The artificial intelligence revolution is opening up significant investment opportunities. This analysis identifies two prominent companies, Taiwan Semiconductor Manufacturing (TSMC) and Meta Platforms, as excellent AI stock choices with sensible valuations. Both organizations are well-positioned to leverage the increasing demand for AI-driven technologies, indicating the potential for substantial investor returns in the foreseeable future.

Tech Titans Eye AI Future: TSMC and Meta Platforms Poised for Growth

In the vibrant landscape of artificial intelligence, two industry leaders, Taiwan Semiconductor Manufacturing (TSMC) and Meta Platforms, are capturing the attention of investors. These companies are strategically aligning themselves to capitalize on the burgeoning AI market, offering compelling prospects for growth.

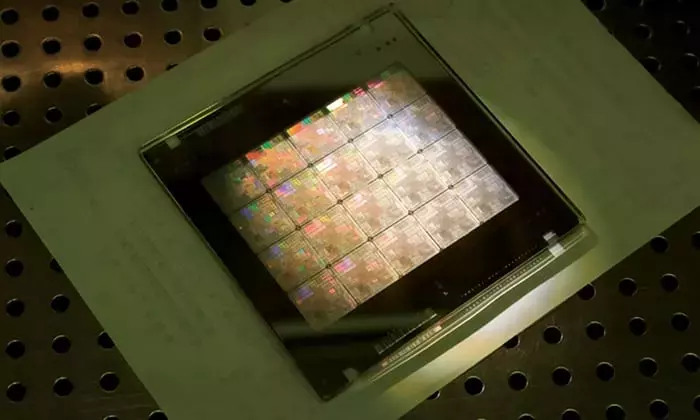

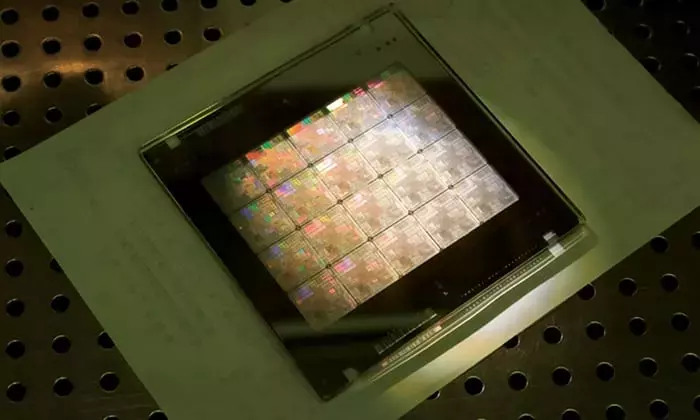

As of October 20, 2025, TSMC, a pivotal player in chip manufacturing, has seen its stock soar by 50% year-to-date. This surge reflects the company's established track record of delivering impressive returns to its shareholders. TSMC's business model involves manufacturing advanced chips for major designers such as Nvidia and Advanced Micro Devices. The company absorbs the significant costs associated with cutting-edge chipmaking equipment, thereby enabling its partners to concentrate on designing superior chips. TSMC's management anticipates a 20% compound annual growth in revenue through 2029, with AI chips specifically projected to drive over 40% annualized revenue growth in the coming years. During their second-quarter earnings call, CEO C.C. Wei underscored the escalating demand for AI models, emphasizing that the rapid increase in 'token volume' necessitates more computation, thus fueling the demand for advanced silicon.

Concurrently, Meta Platforms has emerged as a formidable contender in the AI race. The company has made extensive investments in AI infrastructure to bolster its diverse product and service offerings, encompassing social media platforms, AI-powered advertising technology, and collaborative ventures like AI-enhanced smart glasses with Ray-Ban. Meta's inherent advantage lies in its vast user base, with half the global population engaging with its platforms like Facebook and Instagram. This robust engagement translates into significant advertising revenue and profits, which Meta judiciously reinvests in data centers and chips to foster an AI-centric future. Analysts forecast Meta's revenue to climb by 19% this year, reaching $196 billion, with earnings per share expected to increase by 18% to $28.19. The company's full-year capital expenditures are projected to reach $72 billion, earmarked for AI initiatives and operational enhancements. A key strategic focus for CEO Mark Zuckerberg in 2026 is to expand the company's AI development team, accelerating the establishment of Meta Superintelligence Labs. These labs are crucial for guiding Meta's efforts in AI model development and product innovation, potentially expanding the company's market reach through new services and products.

Both TSMC and Meta Platforms, despite their strong market performance, currently trade at reasonable forward price-to-earnings (P/E) multiples around 24 based on 2026 earnings estimates. This suggests that their current stock valuations may not fully capture their substantial future growth potential driven by the AI revolution.

The ongoing AI revolution underscores the importance of strategic investment in companies that are not only adapting but also actively shaping this transformative technological wave. The cases of Taiwan Semiconductor Manufacturing and Meta Platforms highlight how fundamental strengths, coupled with forward-thinking investments in AI infrastructure and talent, can create significant value. For investors, this means looking beyond immediate returns and focusing on companies with clear long-term visions and the capacity to execute them, especially in disruptive technological fields. The continuous evolution of AI demands constant vigilance and a readiness to embrace change, reminding us that tomorrow's market leaders are those investing wisely today.