The memory market is facing unprecedented demand, with Kioxia, a prominent Japanese memory producer, revealing that its complete NAND flash output for 2026 has been pre-allocated. This situation, primarily driven by the escalating needs of the artificial intelligence sector, indicates that consumers and businesses should brace for ongoing supply constraints and potential price increases in the coming years.

Shunsuke Nakato, the managing director of Kioxia's memory division, shared this critical information in an interview with the Korean publication Digital Daily. He emphasized that the AI industry's persistent growth is creating a challenging supply-demand dynamic. Nakato anticipates that this trend will likely extend into 2027 and possibly beyond, as companies continue to heavily invest in AI technologies to maintain competitive advantage.

Despite the tight supply, Kioxia is upholding its commitments through what Nakato described as a 'gentleman's agreement' with existing clients. This approach prioritizes fulfilling current contracts over maximizing profits through bidding wars. Nevertheless, even long-standing customers are experiencing significant year-on-year price hikes, reportedly up to 30%.

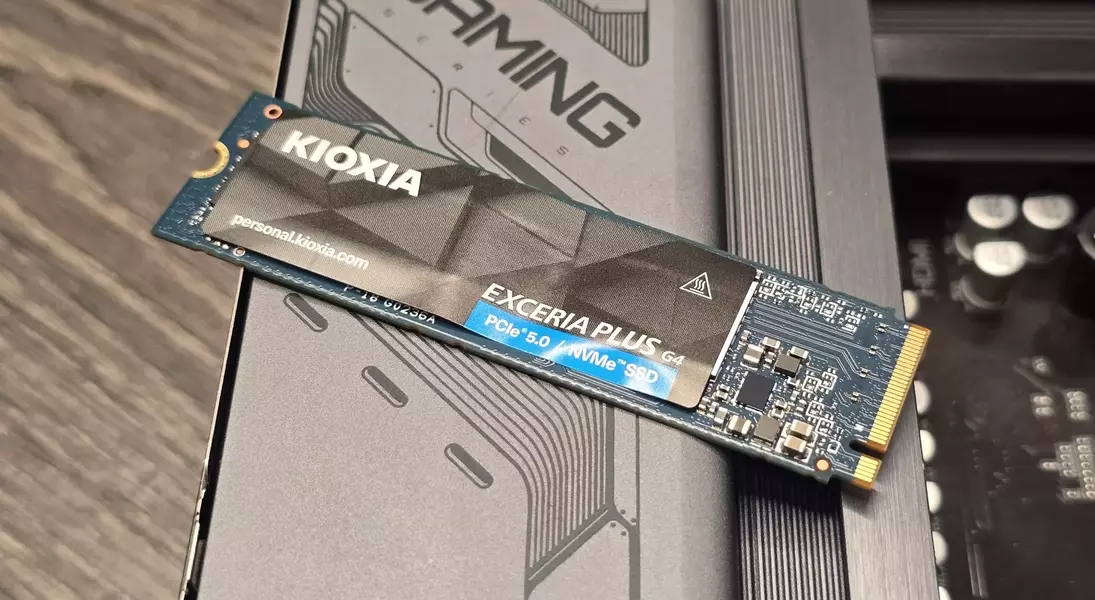

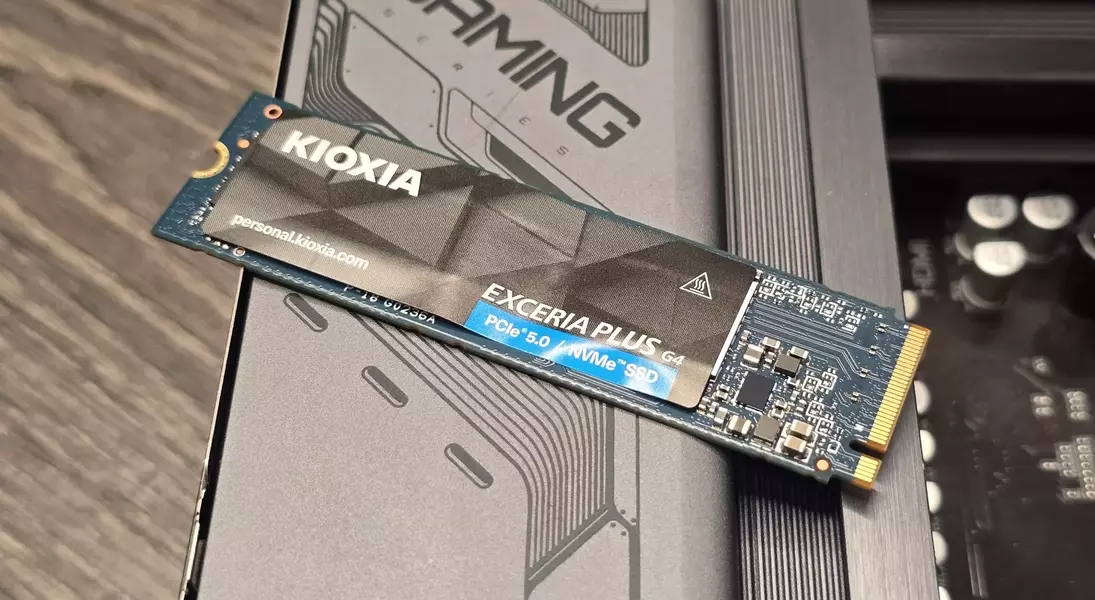

Nakato also expressed reservations about Quad-Level Cell (QLC) technology, which has been gaining traction with competitors like SK Hynix and Micron. While these companies have introduced advanced QLC flash memory chips and NVMe SSDs, Nakato raised concerns regarding QLC's longevity and performance. He believes that eighth-generation NAND flash, with its superior structural integrity, offers a more robust solution to these issues.

The current memory supply crisis aligns with broader industry observations, with some experts predicting that the scarcity and high prices for DRAM could persist beyond 2028. This long-term outlook is partly influenced by major memory manufacturers like Samsung and SK Hynix deliberately managing production to prevent oversupply in the future.

However, the future is not entirely bleak. Kioxia is preparing to launch a range of new products throughout 2026, signaling ongoing innovation. Furthermore, the company is actively working to alleviate supply pressures by boosting the operational efficiency of its Yokkaichi and Kitakami manufacturing facilities. The Yokkaichi plant is already a global leader in flash memory production, and a second fabrication plant at the Kitakami site is expected to reach full operational capacity later this year. While these expansions may not offer immediate relief, they represent a strategic effort to meet the surging global demand for memory. Other major players, such as SK Hynix, are also accelerating their fab expansion plans to address the immense needs of AI customers, suggesting that while the path to equilibrium may be long, concerted efforts are underway to stabilize the market.

The semiconductor industry continues to grapple with the immense pressure from the burgeoning artificial intelligence sector, leading to a critical shortage in memory supply. Kioxia's announcement underscores the severity of this issue, with all production for the upcoming year already reserved. This scenario highlights the rapid technological advancements and the corresponding strain on manufacturing capabilities, prompting manufacturers to re-evaluate production strategies and product roadmaps to navigate this challenging landscape.