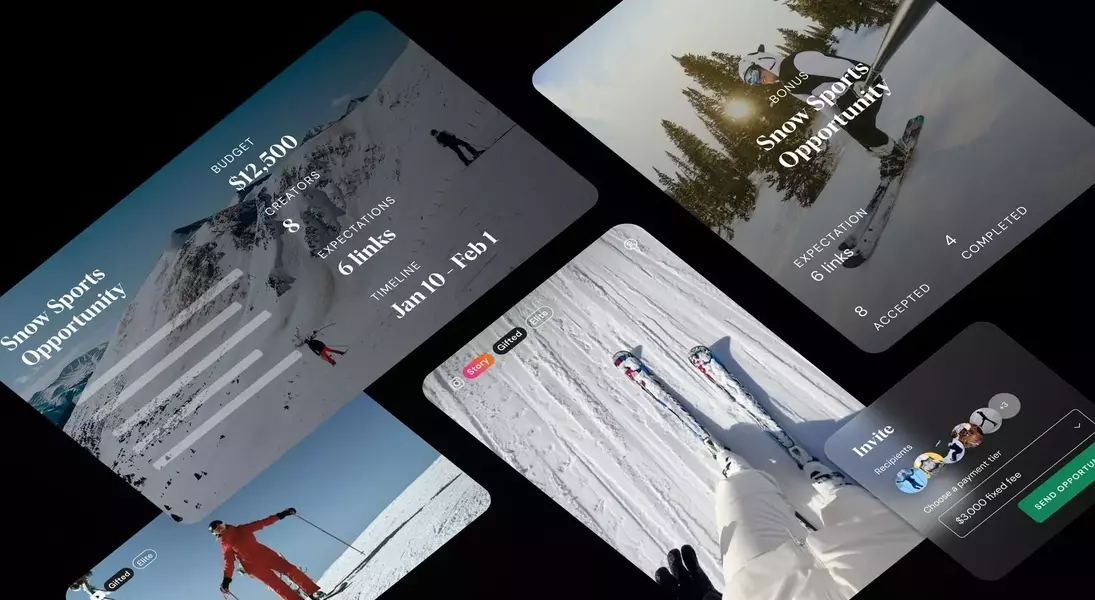

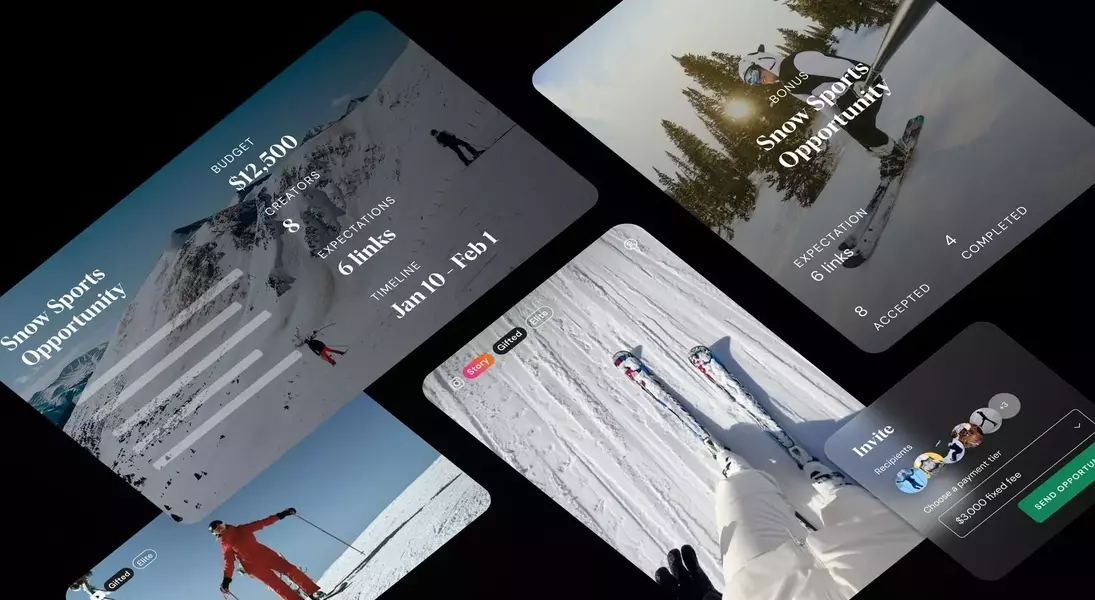

In the past months, the fashion, beauty, and tech industries have witnessed a flurry of investment and acquisition activities, underscoring a period of dynamic growth and strategic realignment. From November 2025, Skims, co-founded by Kim Kardashian, secured a substantial $225 million funding round, boosting its valuation to $5 billion. This investment is earmarked for expanding its physical retail footprint internationally and fostering product innovation. The brand aims to transition into a predominantly physical business, with plans for more owned retail stores and category diversification. Similarly, ShopMy, an affiliate and influencer marketing platform, successfully raised $70 million in its Series B round, pushing its valuation to $1.5 billion. The platform, which connects brands like Gucci with content creators, experienced a 200% revenue growth in the past year, indicating a strong demand for streamlined creator commerce solutions. This surge reflects a broader industry trend towards leveraging digital platforms and influencer networks for market penetration and brand engagement.

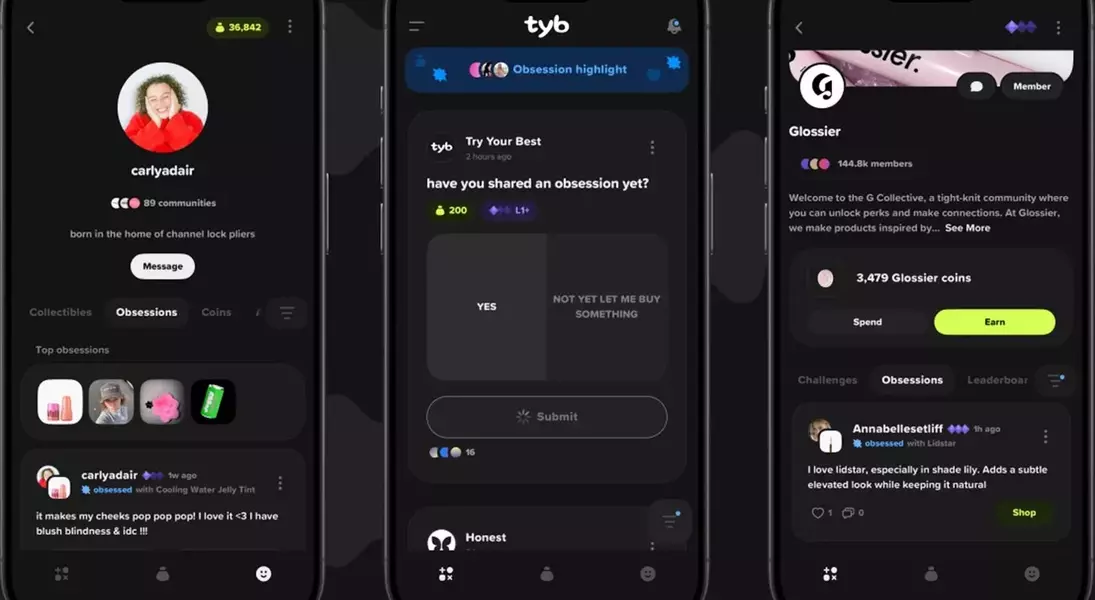

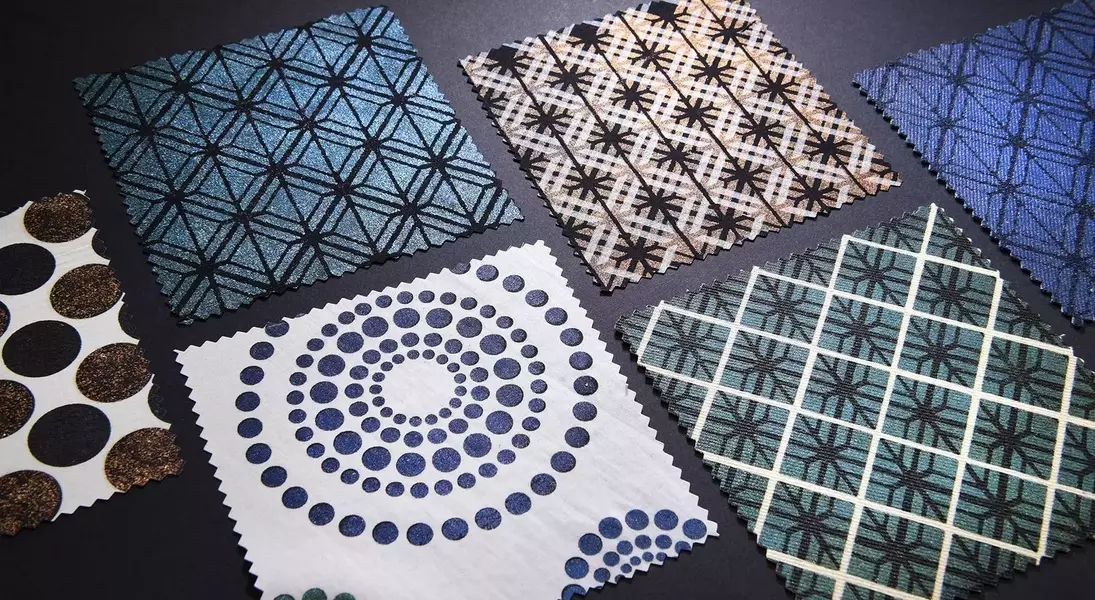

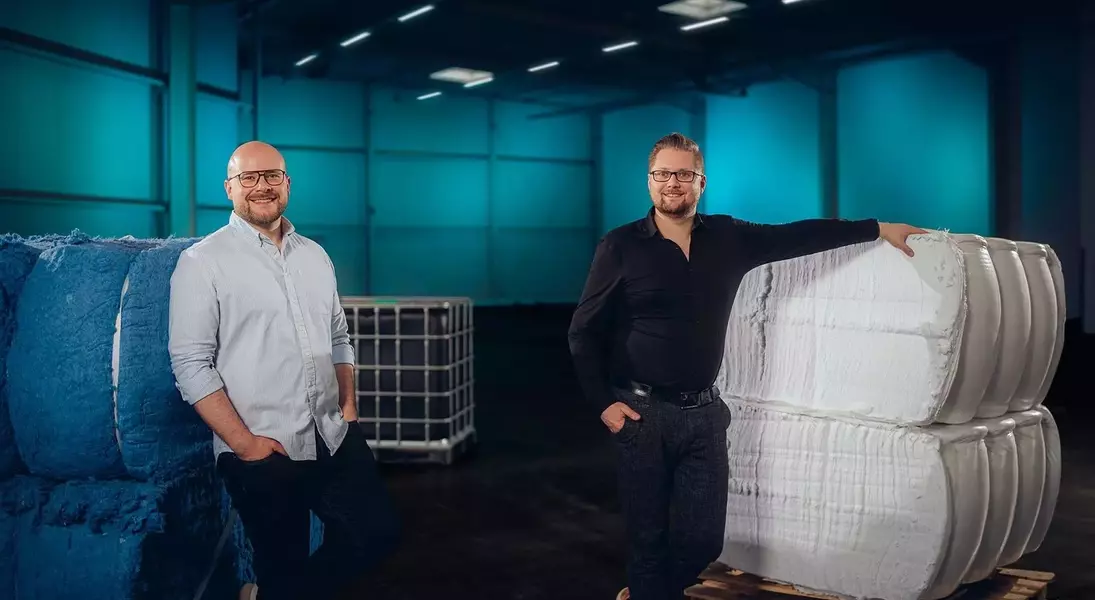

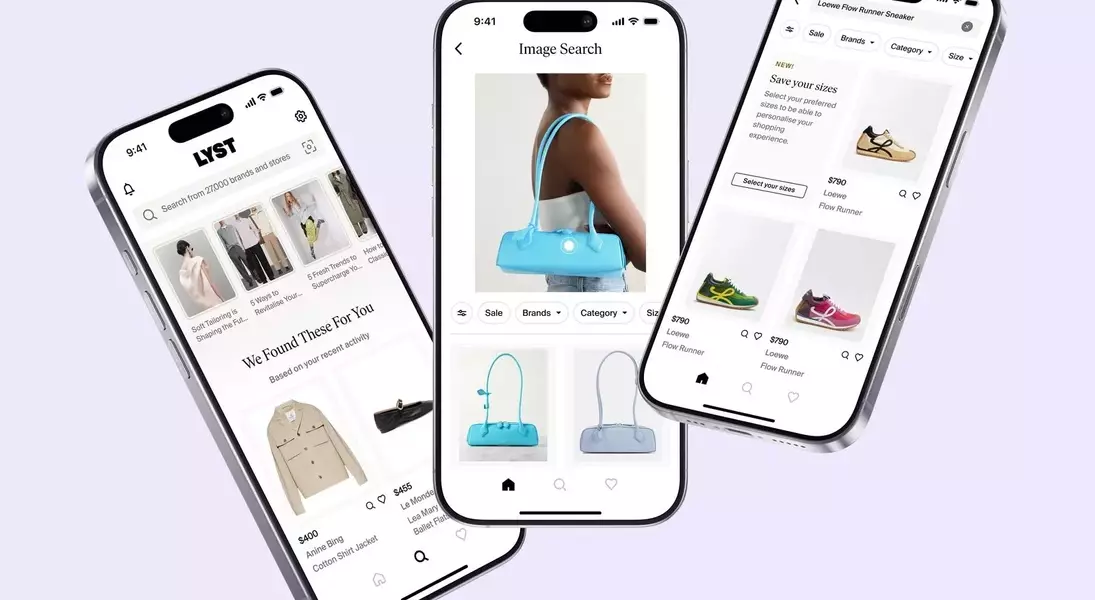

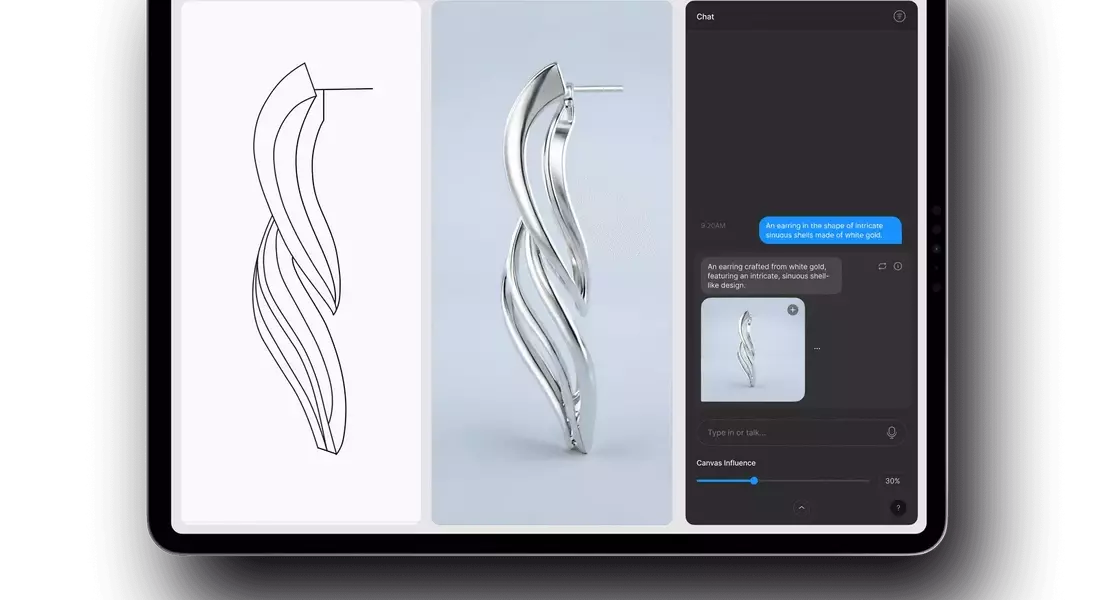

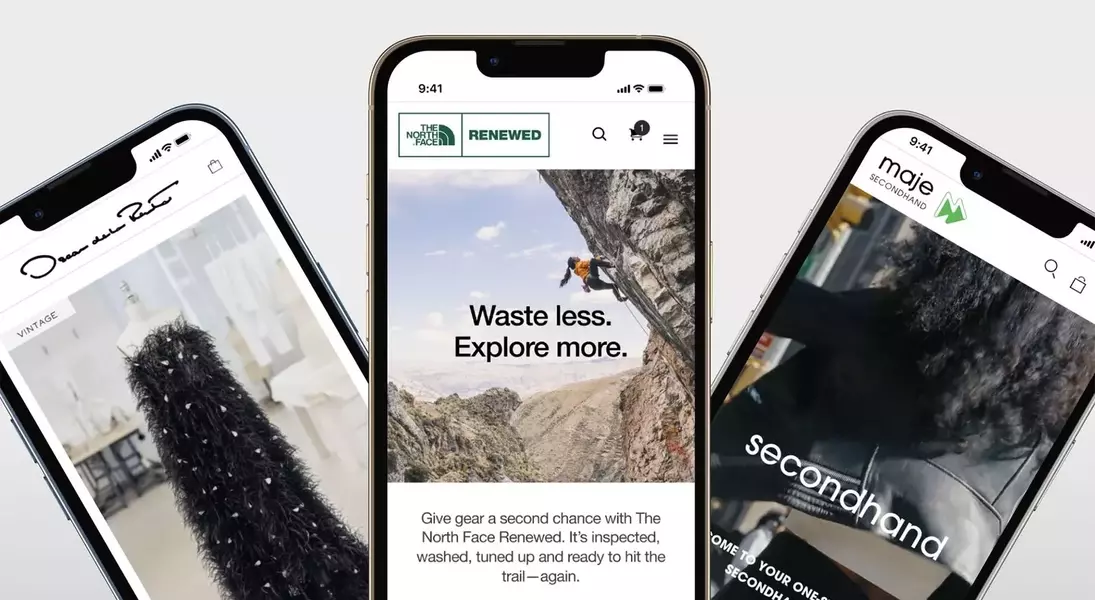

Looking ahead, the commitment to innovation, sustainability, and market expansion continues to drive investment decisions. The industry is seeing a shift towards integrating AI and advanced technologies to personalize consumer experiences, optimize supply chains, and foster circularity. Companies like Faircraft, a lab-grown leather startup, and Circ, a textile-to-textile recycling platform, are receiving significant funding to scale their sustainable initiatives, reflecting a growing consumer and investor appetite for environmentally conscious solutions. Moreover, brands are increasingly focusing on building strong community engagement and leveraging digital tools to connect with consumers, as seen with platforms like Try Your Best (TYB) and social commerce platforms like Whatnot. The emphasis on personalized experiences, ethical production, and technological advancement underscores a forward-looking vision for the fashion and beauty industries, poised for continued evolution and growth in the global marketplace.