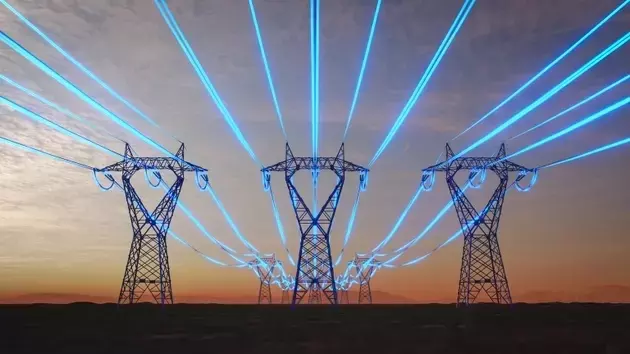

The Kayne Anderson Energy Infrastructure Fund (KYN) presents a compelling investment opportunity, primarily due to its strategic focus on energy infrastructure amidst the escalating power demands fueled by artificial intelligence. With a robust 7.4% yield, KYN offers investors a direct pathway into a sector on the cusp of significant growth. The fund's portfolio is predominantly composed of midstream energy equities, positioning it to capture value from the ongoing expansion of AI data center infrastructure. While it currently trades at a notable discount to its Net Asset Value, its distribution coverage's reliance on realized gains highlights a potential for earnings variability, underscoring the importance of enhanced net investment income for sustained stability.

Insightful Analysis of KYN's Market Position and Future Prospects

The Kayne Anderson Energy Infrastructure Fund (KYN) is currently positioned as a 'buy' due to its attractive 7.4% dividend yield and its strategic investment in energy infrastructure, a sector expected to thrive from the increasing power demands of AI technologies. The fund's portfolio is heavily concentrated, with 95% of its holdings in midstream energy equities, indicating a targeted approach to capitalizing on the growth driven by AI data centers. Key companies within its top holdings are set to benefit directly from this trend. KYN currently trades at a 12.14% discount to its Net Asset Value (NAV), presenting an appealing entry point for investors. However, a significant portion of its distribution coverage relies on net realized gains, which can introduce variability in earnings and may limit long-term price appreciation. For investors, particularly those considering tax implications, KYN is ideally suited for tax-advantaged accounts due to its less tax-efficient distributions. An increase in net investment income would bolster the fund's stability, reducing its dependence on fluctuating market momentum and strengthening its overall investment profile.

As a financial observer, the KYN fund's current valuation at a discount to NAV, combined with its high yield and exposure to the burgeoning AI-driven energy demand, presents a fascinating case. However, the reliance on net realized gains for distribution coverage serves as a critical point of consideration. This structure can lead to a less predictable income stream for investors and underscores the importance of a thorough understanding of the fund's operational nuances. Future performance will likely hinge on the fund's ability to generate consistent net investment income, thereby stabilizing its distributions and mitigating risks associated with market volatility. This situation highlights a broader trend in specialized funds: while they offer targeted growth opportunities, detailed scrutiny of their financial mechanisms is paramount for informed decision-making.