In a remarkable display of the music industry's ever-evolving landscape, YG Entertainment, the renowned South Korean entertainment company, has seen its shares surge by an impressive 4.3% this week. This surge can be attributed to the continued success of "APT," a collaborative track featuring ROSÉ, a member of the popular K-pop group BLACKPINK, and the acclaimed artist Bruno Mars.

Riding the Wave of Global Dominance

A Blockbuster Start on Streaming Services

Just a week after YG's stock gained 6.1% following the track's impressive debut on streaming platforms, "APT" has now topped both the Billboard Global 200 and Billboard Global Excl. U.S. charts. This remarkable achievement underscores the growing global appeal of K-pop and the power of strategic collaborations within the industry.The THEBLACKLABEL Connection

ROSÉ's solo venture, "APT," was released through Atlantic Records in partnership with THEBLACKLABEL, a YG sub-label co-founded in 2015 by BLACKPINK producer Teddy Park. This strategic move highlights YG's commitment to nurturing and supporting its artists' individual pursuits, while maintaining its strong grip on the management of BLACKPINK.Diversifying the Portfolio

The success of "APT" not only bolsters YG Entertainment's financial performance but also underscores the company's ability to adapt and diversify its offerings. By empowering its artists to explore solo projects, YG is demonstrating its willingness to embrace the evolving music landscape and capitalize on emerging trends.Weathering the Storm

Despite the broader market volatility, YG Entertainment's resilience and ability to capitalize on the global popularity of K-pop have positioned the company as a standout performer in the industry. As the music world continues to evolve, YG's strategic approach and its commitment to nurturing its artists' individual talents are likely to keep the company at the forefront of the global music scene.Diversified Investments, Diversified Rewards

While YG Entertainment's shares have been the primary beneficiary of the "APT" success, the broader music industry has also seen its fair share of ups and downs. Universal Music Group (UMG), the industry giant, has experienced a mixed week, with its shares falling 0.7% overall but gaining 1.6% on Friday following its third-quarter earnings report.Analysts Remain Bullish on UMG

Despite the slight dip, Morgan Stanley has raised its price target for UMG shares, citing its continued confidence in the company's prospects. Guggenheim, another prominent financial institution, has also maintained a "neutral" rating on UMG shares, describing the company's third-quarter results as "encouraging."Navigating the Streaming Landscape

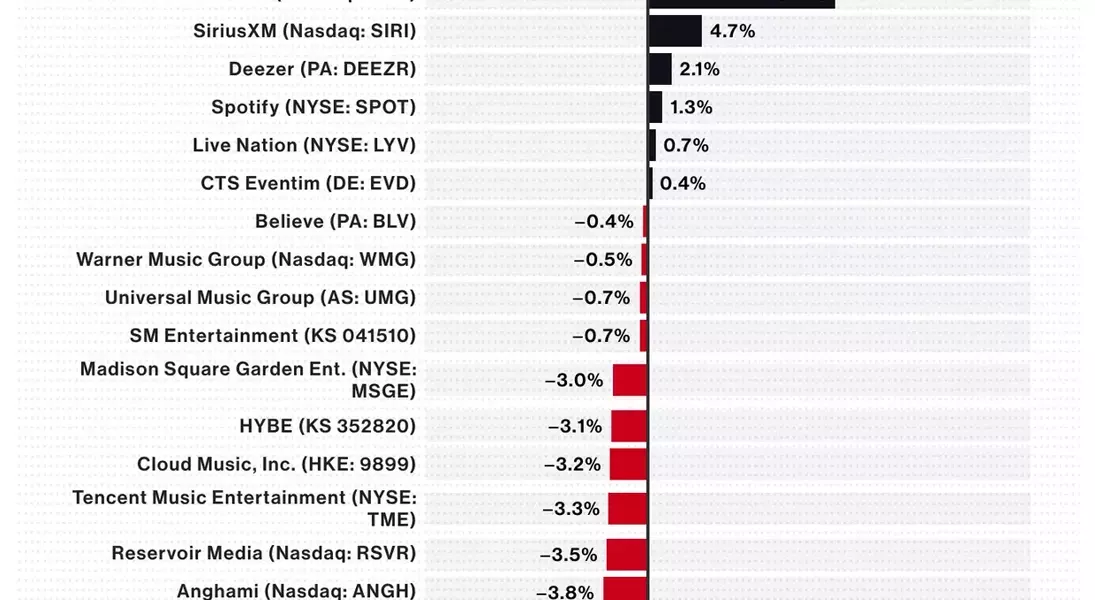

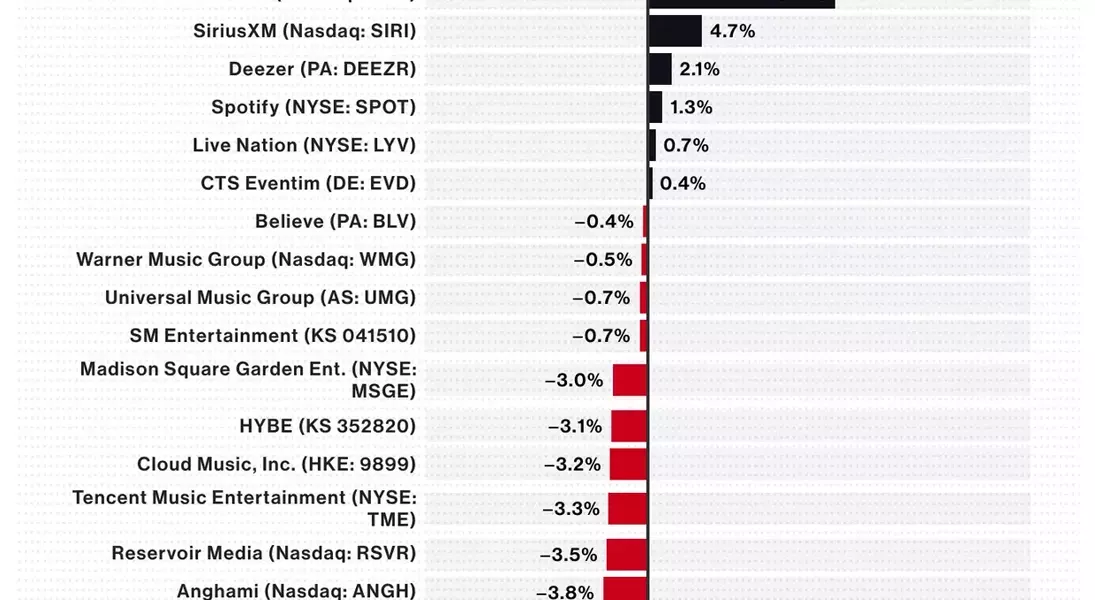

The music industry's transformation has not been limited to the success of individual artists and companies. Streaming platforms, such as SiriusXM and Deezer, have also been making waves in the market. SiriusXM's shares gained 4.7% after reporting a net gain of 14,000 self-pay subscribers in the third quarter, while Deezer's shares rose 2.1% on the back of an 11% revenue growth and a 9% increase in subscribers.Diversification Strategies Paying Off

The performance of these streaming platforms underscores the industry's ongoing shift towards digital consumption and the importance of adapting to changing consumer preferences. Companies that have successfully diversified their offerings and embraced the streaming revolution are poised to reap the rewards of this evolving landscape.Navigating the Challenges

Not all music industry players have been immune to the market's volatility, however. Reservoir Media, a music publishing and entertainment company, saw its shares fall 3.5% despite reporting solid 6% revenue growth and an increase in its price target by B. Riley.The Billboard Global Music Index: A Barometer of Industry Trends

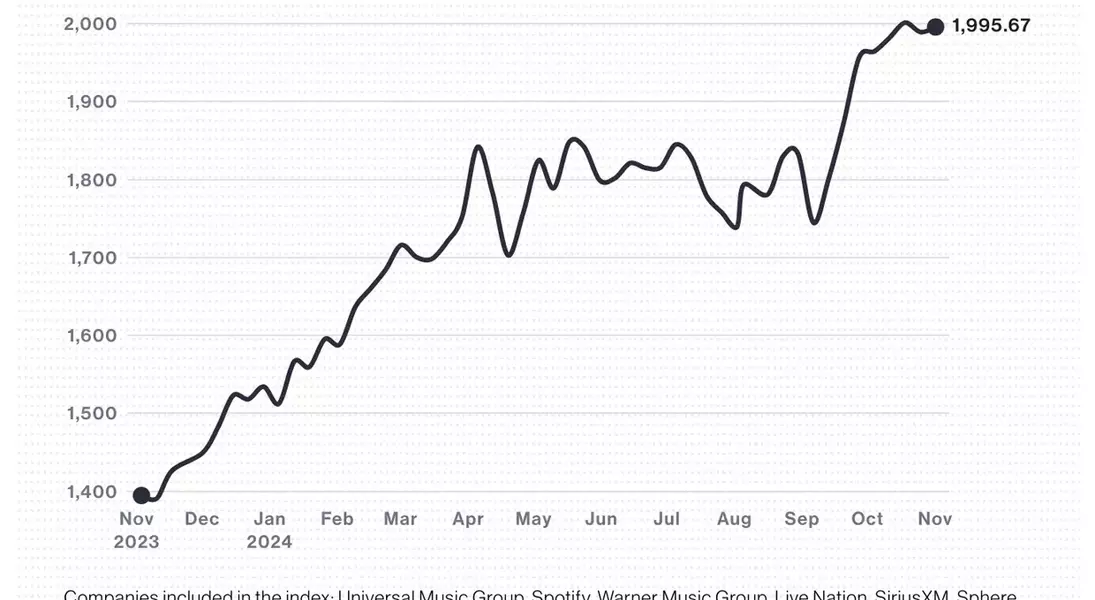

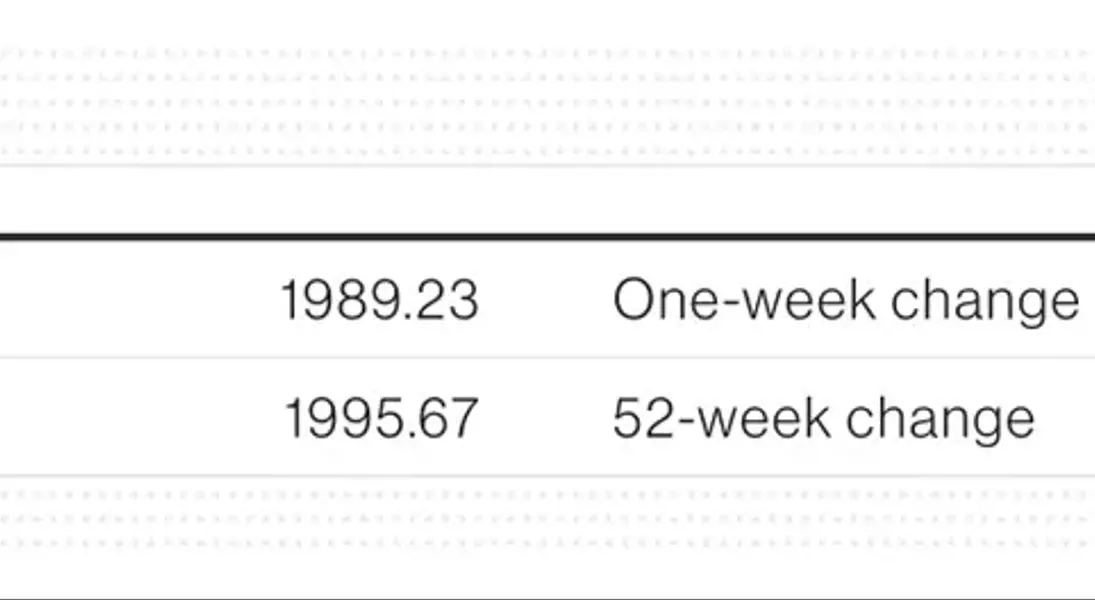

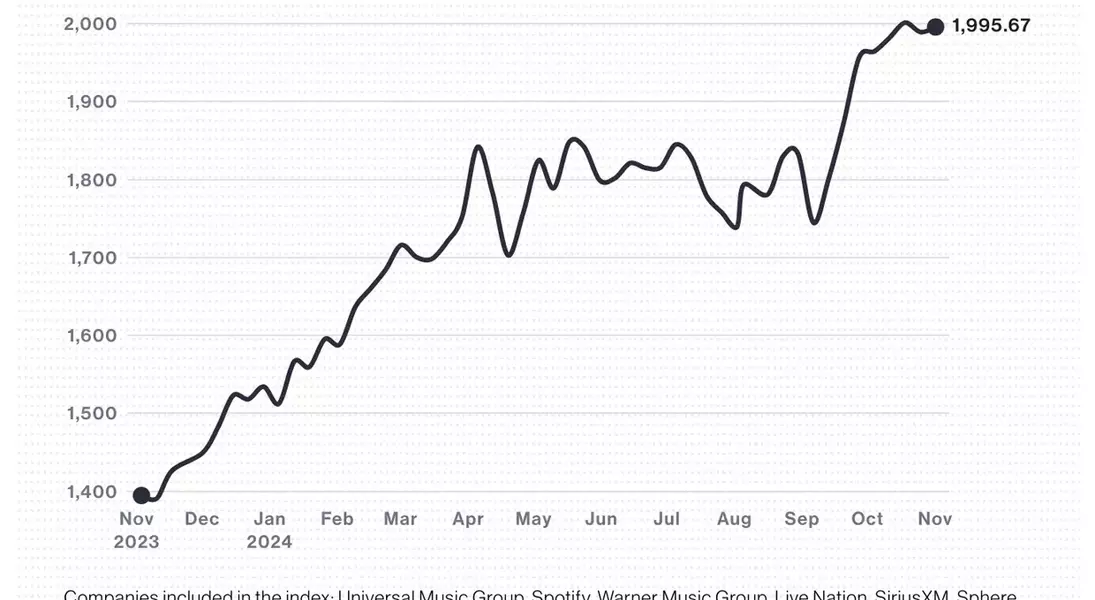

The performance of the broader music industry can be gauged through the Billboard Global Music Index (BGMI), which tracks the stock prices of 20 leading companies in the sector. Despite a small 0.3% gain for the week, the index's year-to-date increase of 30.1% underscores the resilience and growth potential of the global music industry.Weathering the Broader Market Turbulence

The music industry's performance has not been immune to the broader market fluctuations, with major indexes like the Nasdaq Composite and S&P 500 experiencing declines of 1.5% and 1.4%, respectively, for the week. However, the music industry's ability to navigate these challenges and maintain its upward trajectory is a testament to the sector's adaptability and the enduring appeal of music in the global marketplace.Podcast Powerhouse LiveOne Soars

Within the music industry, one standout performer was LiveOne, a music streaming and podcast platform, which saw its shares jump an impressive 32.8% to $0.77. This surge was driven by the company's announcement that it has engaged MZ Group to increase the visibility of its PodcastOne division within the investment community.The K-Pop Landscape: A Mixed Bag

While YG Entertainment's shares have been the star of the show, the broader K-pop industry has experienced a more mixed performance. HYBE, JYP Entertainment, and SM Entertainment all saw their share prices decline, with a collective year-to-date loss of 28.6%.Radio Sector Sees Divergent Fortunes

The music industry's performance has also been reflected in the radio sector, with iHeartMedia's shares jumping 16.1% a week before the company's third-quarter earnings report, while Cumulus Media's shares dropped 19.0% following its release of third-quarter results, which saw a decline in revenue and a net loss.