A new report reveals a growing apprehension among American workers regarding their employment stability, leading many to postpone or forgo significant investments such as acquiring property or vehicles. This caution is particularly evident within lower-income brackets and among those who rent their residences, indicating a stratified impact of economic uncertainties. Furthermore, the findings highlight a widespread deficit in emergency financial reserves, suggesting that a considerable number of individuals are ill-prepared to manage unexpected periods of unemployment or financial hardship, emphasizing the fragility of household finances for a substantial segment of the population.

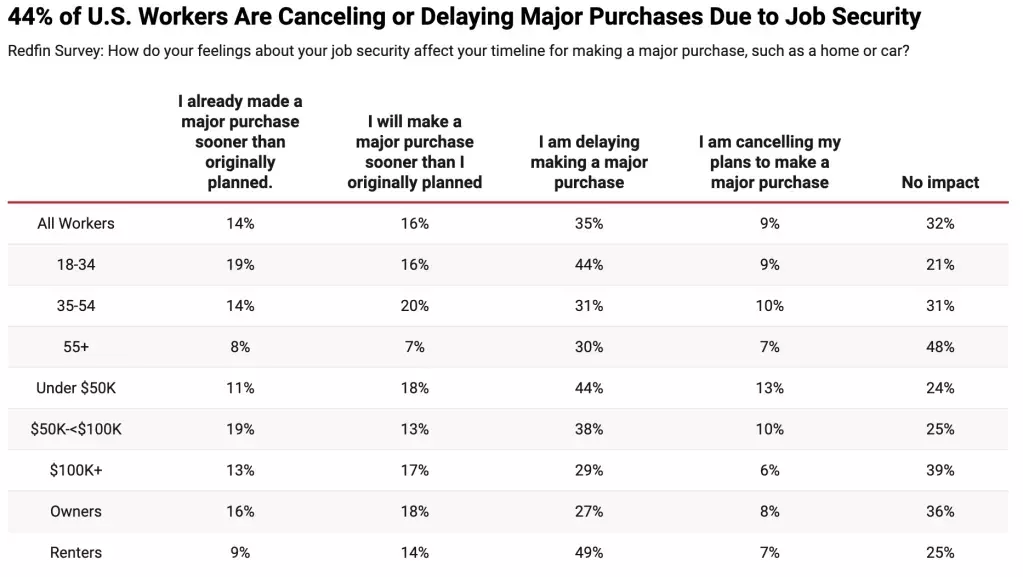

A recent poll, commissioned by Redfin, brought to light that approximately 44% of employed individuals across the United States have either deferred or abandoned plans for major acquisitions. This reluctance is primarily driven by concerns over the security of their current employment. Conversely, about 30% of respondents indicated that they had either accelerated such purchases or intended to do so, suggesting a diverse range of responses to the prevailing economic climate. The survey encompassed 1,142 working adults, comprising both full-time and part-time employees, offering a comprehensive look at employment-related anxieties.

The study further unveiled notable disparities across various income levels. Nearly 57% of workers residing in households with annual incomes below $50,000 reported having put off or canceled a significant purchase. This figure stands in contrast to 48% of households earning between $50,000 and $100,000, and 35% of those with incomes exceeding $100,000. Among renters, almost half, or 49%, indicated a delay in major purchases, a stark difference compared to 27% of homeowners. Intriguingly, roughly one-third (32%) of those surveyed stated that their job security had no bearing on their purchasing decisions whatsoever.

Overall, two out of three workers express a degree of confidence in their job stability, aligning with prior research from the Pew Research Center. However, a significant portion, 31%, harbor considerable worry regarding their employment future. Chen Zhao, the head of economic research at Redfin, noted that this apprehension is influencing the housing market, keeping potential homebuyers on the sidelines. He also pointed out that those with greater financial confidence are encountering less competition, granting them increased bargaining power. Zhao advised sellers to recognize this cautious buyer sentiment and consider competitive pricing and flexibility to facilitate transactions.

Moreover, the survey highlighted that nearly two in five workers feel more anxious about their job prospects now than they did six months ago. Conversely, only 20% reported increased confidence. For those already concerned, a staggering 77% reported heightened anxiety. When probed about the reasons behind their job insecurity, 32% attributed it to their company’s performance, 17% cited tariffs, and 16% pointed to the growing influence of artificial intelligence. These findings underscore a multifaceted economic environment contributing to widespread unease.

The survey also shed light on the alarming lack of emergency savings among the workforce. A substantial 36% of workers revealed they do not possess an emergency fund sufficient to cover housing costs in the event of job loss or a financial crisis. Households with higher incomes (over $100,000) and homeowners were more likely to have a financial safety net, with 68% and 65% respectively reporting such reserves. In contrast, only 37% of lower-income households (under $50,000) and 40% of renters reported having emergency savings. Younger adults, aged 18 to 34, were particularly vulnerable, with fewer than half (44%) possessing backup funds. Financial experts typically suggest maintaining three to six months of expenses in an emergency fund. However, only 20% of those with savings indicated they could cover more than a year of housing costs, while 32% reported having less than three months' worth. The youngest demographic was least prepared for extended periods without income, as merely 9% of individuals aged 18 to 34 had enough savings for a year of housing expenses, compared to 38% of workers aged 55 and above. This comprehensive study was conducted between August 7-8 and August 13-14, offering a snapshot of current economic sentiment.

The findings from this survey highlight a crucial interplay between labor market anxieties and consumer spending habits, particularly in high-value sectors like real estate. The pervasive concern over job stability is not merely an abstract worry but a tangible factor directly influencing significant financial decisions, leading to a palpable slowdown in the housing market. Addressing these underlying economic anxieties and bolstering financial resilience among the workforce will be essential for stimulating broader economic activity and fostering a more secure financial future for all Americans.