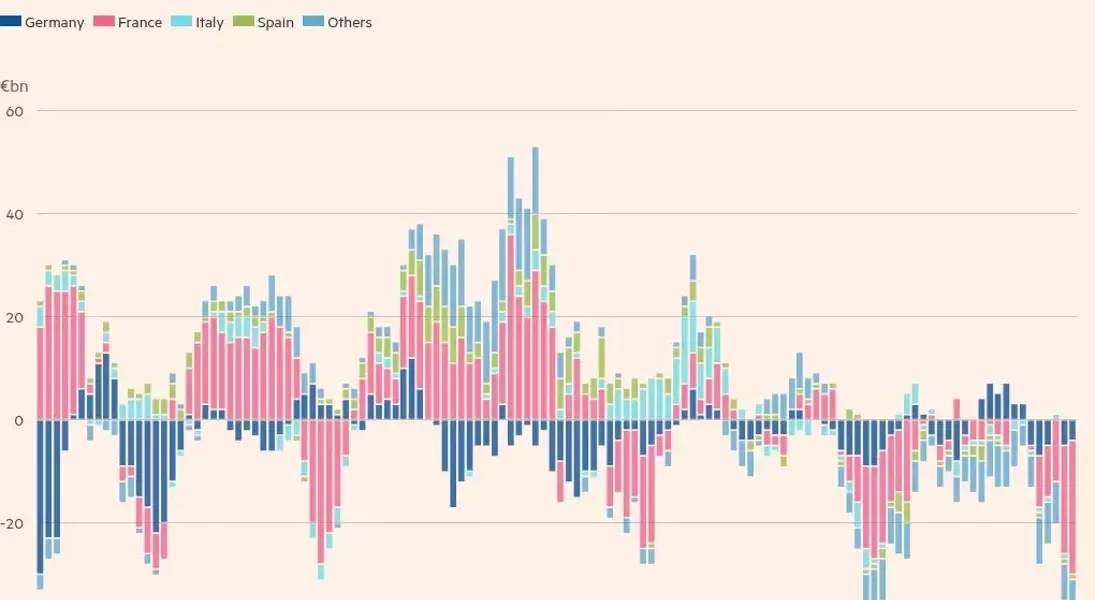

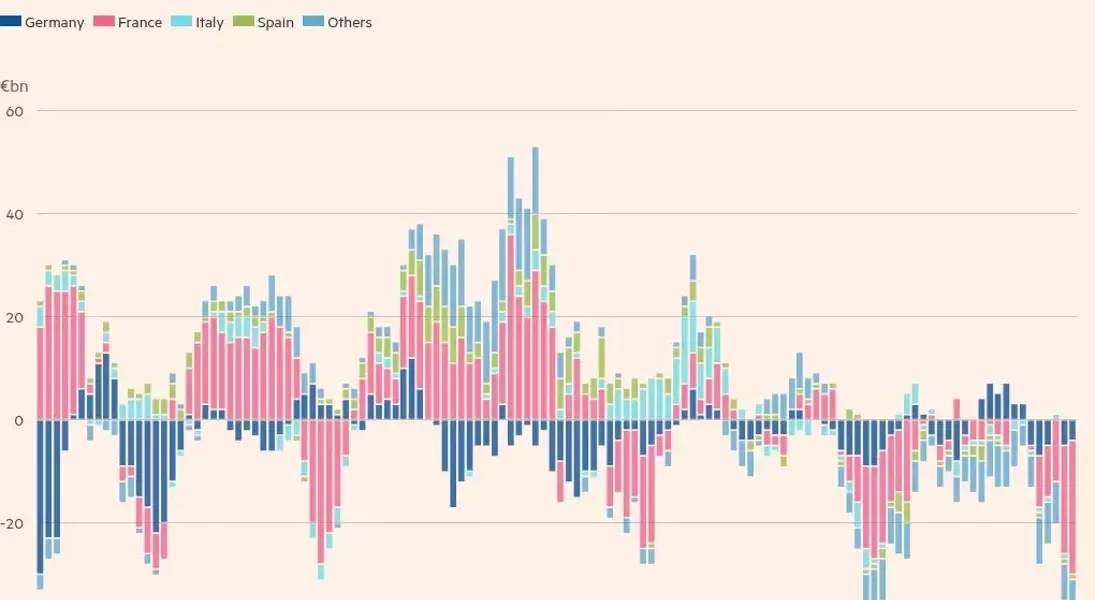

In recent months, Japanese investors have significantly accelerated their divestment from Eurozone government debt, marking the fastest pace of sales in over a decade. This shift has raised concerns among analysts about potential market instability. The net sales by Japanese investors surged to €41 billion in the six months leading up to November. Factors such as rising domestic bond yields and political turbulence in Europe have fueled this trend. French bonds, in particular, have been heavily impacted, with sales reaching €26 billion during this period. This development highlights how changing interest rates in Japan are reshaping global financial markets and putting pressure on European governments already grappling with increased borrowing costs.

Details of the Market Shift

In the midst of a golden autumn, Japanese investors have been withdrawing from Eurozone government bonds at an unprecedented rate. According to data compiled by Goldman Sachs from Japan's finance ministry and the Bank of Japan, net sales soared to €41 billion between June and November. Analysts attribute this surge to several factors: the anticipation of higher yields within Japan and the political instability across Europe. Germany's coalition collapse and France's emergency budget law have exacerbated the situation. French bonds, traditionally favored for their higher yield compared to German bonds, saw massive outflows totaling €26 billion.

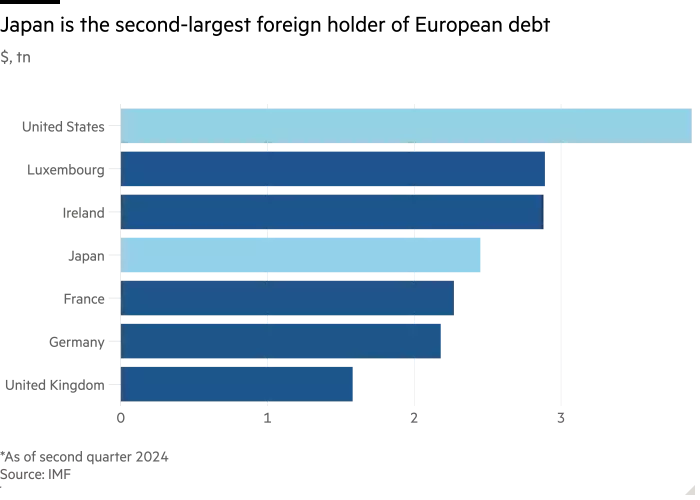

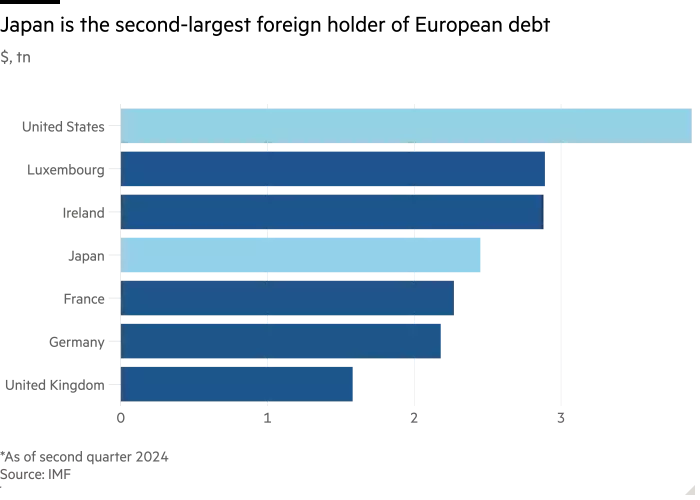

The retreat of Japanese investors is particularly significant because they have long been a reliable source of demand for European government bonds. However, soaring hedging costs against yen fluctuations have made foreign debt less appealing. For instance, the 10-year Italian government bond yield, when adjusted for hedging costs, stands at just over 1%, comparable to Japanese yields. Regional banks in Japan have emerged as major sellers of European debt. Norinchukin, one of Japan’s largest institutional investors, plans to offload more than ¥10 trillion of foreign bonds this year, recording a $3 billion loss in the second quarter due to these sales.

This withdrawal has put upward pressure on bond yields that have already risen since the European Central Bank began reducing its balance sheet following the pandemic-era bond-buying program. France, a traditional favorite among Japanese investors, has witnessed substantial outflows, especially as political crises deepen. Between June and November, Japanese funds sold €26 billion worth of French bonds, compared to €4 billion in the same period last year. This shift signals a fundamental change in the buyer base for French debt.

Over the past two decades, Japanese investors have played a crucial role in various bond markets, driven by ultra-low yields at home. At their peak in late 2020, total holdings of foreign bonds by Japanese institutional investors reached $3 trillion. However, as domestic bonds become more attractive, their net buying of global debt securities has dwindled to just $15 billion over the past five years, down from approximately $500 billion in the previous five-year period. This structural change underscores a new era in global financial markets.

From a journalist's perspective, this trend underscores the interconnectedness of global financial markets. The retreat of Japanese investors from Eurozone bonds serves as a stark reminder of how shifts in one region can ripple through others, impacting everything from bond yields to political stability. It also highlights the importance of diversification and adaptability in investment strategies, especially in times of economic uncertainty. As we move forward, it will be crucial to monitor how these changes unfold and what implications they may have for both investors and policymakers alike.