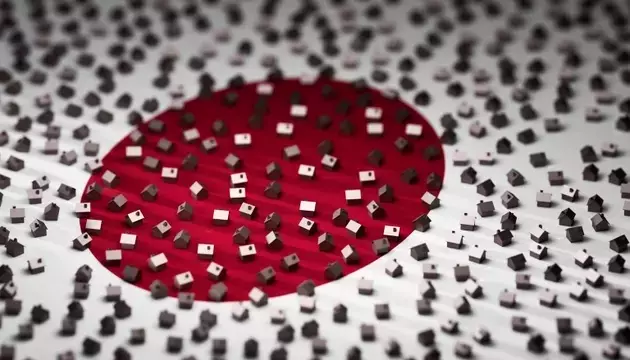

In 2025, Japanese equities have demonstrated remarkable strength, surpassing both U.S. and global market performances. This impressive surge is largely attributed to widespread earnings growth across various sectors, with the MSCI Japan trailing Earnings Per Share (EPS) having increased by 66% since 2019. This robust financial health, coupled with a significant equity risk premium, positions Japan as a compelling area for investors seeking growth opportunities.

Despite the backdrop of political shifts and rising bond yields, Japan's stock market maintains a distinct advantage. The equity risk premium in Japan is currently more than double that of the S&P 500, indicating that investors are being compensated more generously for the risks taken in the Japanese market. This sustained attractiveness persists even as the yen weakens and political uncertainties emerge, challenging traditional investment paradigms.

A deeper analysis reveals that Japanese companies are not only delivering strong current performance but also promise significant future growth. With lower valuation ratios compared to many developed markets and analyst forecasts predicting robust forward earnings growth through 2027, the investment case for Japan remains strong. This outlook suggests a continued upward trajectory for Japanese equities, offering diversification and potential capital appreciation for global portfolios.

The comprehensive earnings growth observed in Japan is not confined to a few dominant sectors but is broadly distributed, showcasing the fundamental strength of the Japanese economy. This broad-based improvement in corporate profitability provides a solid foundation for sustained market performance, distinguishing it from regions where growth might be more concentrated in specific industries like technology.

The current market environment, characterized by rising Japanese bond yields and a depreciating yen, presents a complex yet potentially rewarding landscape for investors. While these factors could introduce volatility, the underlying strength in corporate earnings and the attractive equity risk premium suggest that Japanese equities are well-positioned for continued outperformance. Investors looking for opportunities in undervalued markets with strong growth potential may find Japan particularly appealing.

The confluence of lower valuations, promising forward earnings growth, and a high equity risk premium underscores the unique appeal of Japanese equities. Investment vehicles focusing on this region, such as the WisdomTree Japan Hedged Equity Fund and the WisdomTree Japan Opportunities Fund, offer strategic exposure to these dynamics. These funds provide a means for investors to capitalize on Japan's economic resurgence and the ongoing transformation of its corporate landscape.