The Internal Revenue Service (IRS) has recently unveiled the inflation-adjusted tax brackets and standard deductions that will take effect for the 2026 tax year. These adjustments are anticipated to significantly influence the tax obligations of individuals, particularly those in higher income brackets, potentially resulting in reduced tax payments even though the core marginal tax rates are not changing. Understanding these modifications is crucial for effective financial planning in the coming years.

Detailed Report on 2026 Tax Adjustments and Their Implications

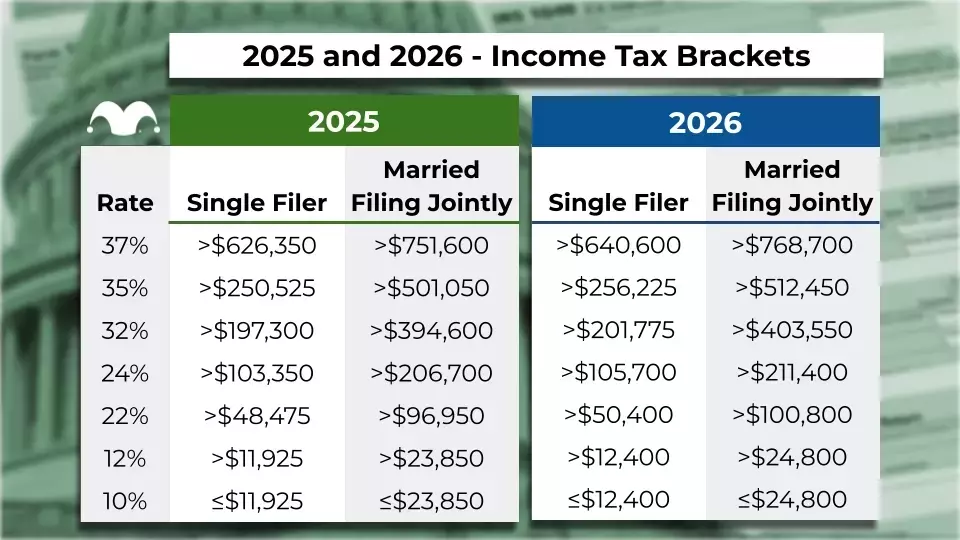

On October 19, 2025, the IRS formally announced the updated tax guidelines for the 2026 fiscal year. These revisions include upward adjustments to income thresholds across all tax brackets, along with increases in standard deduction amounts and other inflation-linked figures. Matt Frankel, a financial expert, highlighted that while the percentage-based marginal tax rates are static, the recalibration of income bands means that a greater portion of income may be taxed at lower rates for many. This structural change primarily benefits top earners, as more of their earnings will fall into comparatively lower tax categories.

For instance, the standard deduction for single taxpayers is set to increase from $15,750 in 2025 to $16,100 in 2026. Similarly, married couples filing jointly will see their standard deduction rise from $31,500 to $32,200. These increases allow taxpayers to shield a larger portion of their income from taxation, thereby reducing their taxable income. To illustrate the effect, consider a hypothetical married couple with an adjusted gross income (AGI) of $1,000,000. Under the 2025 rules, factoring in the $31,500 standard deduction, their taxable income would be $968,500, leading to a tax bill of approximately $282,407.50. However, with the 2026 adjustments, the higher standard deduction of $32,200 reduces their taxable income to $967,800. Applying the new 2026 tax bracket thresholds, their estimated tax liability would drop to around $280,250.50. This represents a saving of $2,157 for the couple, assuming all other financial factors remain constant. It’s important to note that this example simplifies various tax complexities, such as itemized deductions which are often utilized by high-income individuals.

Furthermore, the IRS also anticipates increases in retirement account contribution limits for 2026. This provides an additional avenue for high earners to strategically reduce their taxable income through increased savings. Beyond brackets and standard deductions, various tax credits and other deductions, including those for charitable contributions or self-employed individuals, remain integral components of the overall tax framework. These elements collectively empower taxpayers to optimize their financial strategies and potentially lower their total tax burden.

This announcement from the IRS serves as a critical reminder for all taxpayers, especially high earners, to stay informed about evolving tax laws. The inflation adjustments for 2026 underscore the dynamic nature of tax policy and the continuous need for careful financial planning. Proactive engagement with these changes, such as understanding the new thresholds and leveraging available deductions and credits, can lead to significant savings and a more favorable financial outcome. As a financial reporter, it's clear that these updates provide valuable opportunities for strategic tax management, encouraging individuals to review their financial situations and adapt their strategies accordingly to maximize the benefits of these new provisions.