Institutional Investors Flock to Cash-Margined Bitcoin Futures

The cryptocurrency market has witnessed a significant shift in the derivatives landscape, with cash-margined bitcoin (BTC) futures contracts gaining unprecedented popularity. As open interest in these contracts reaches new highs, the data suggests a growing preference among institutional investors for more stable and regulated trading instruments.Unlocking the Potential of Cash-Margined Bitcoin Futures

Reaching New Milestones in Open Interest

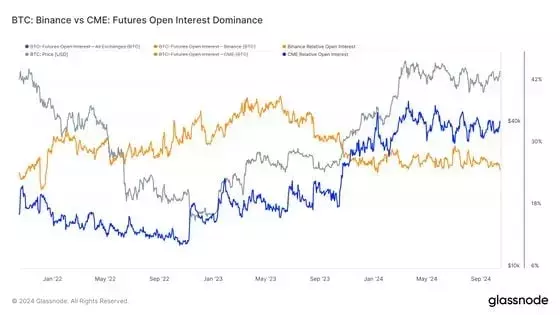

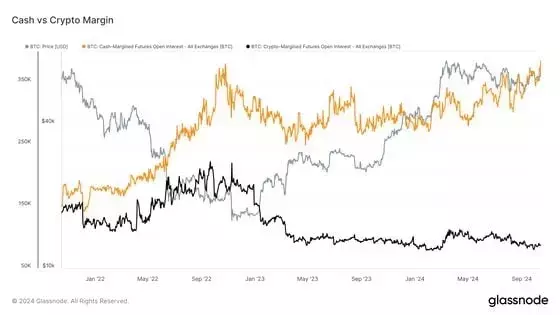

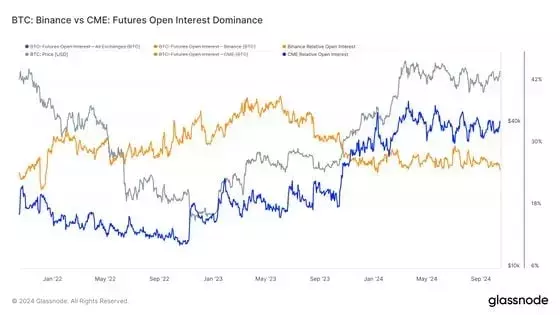

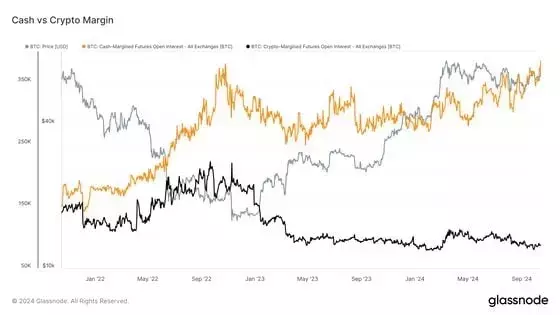

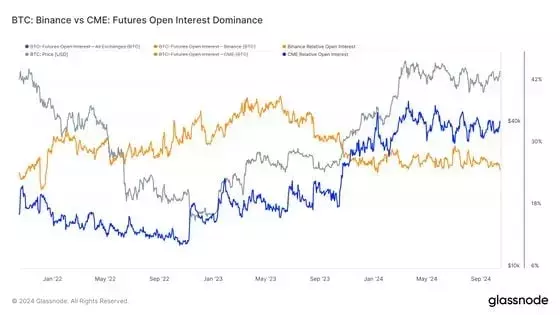

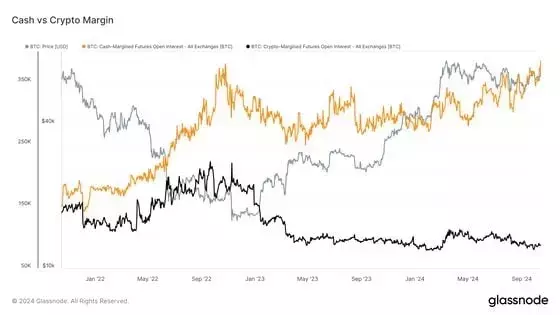

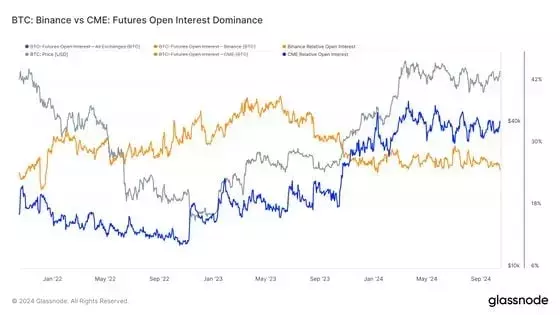

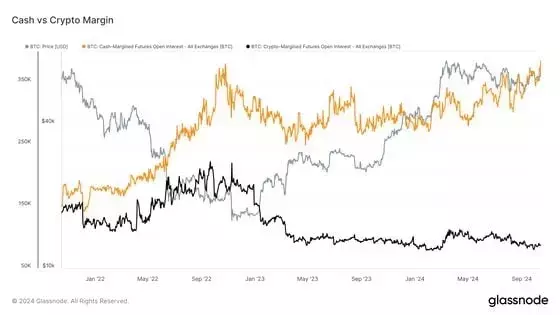

The open interest in cash-margined bitcoin futures has reached an all-time high of 384,000 BTC ($25.5 billion), surpassing the previous peak recorded in November 2022 when bitcoin traded near $16,000. This surge in open interest is primarily driven by increased institutional activity on the Chicago Mercantile Exchange (CME), which now accounts for 40% of the cash-margined tally.The rise in cash-margined open interest has been a steady trend over the past two years, while the open interest in crypto-margined futures has steadily declined from 210,000 BTC to 87,000 BTC. As a result, crypto-margin now accounts for only 18.2% of the total open interest of 478,000 BTC.Institutional Investors Embrace Cash-Margined Contracts

The growing preference for cash-margined bitcoin futures suggests a shift in the investment landscape, with sophisticated investors increasingly turning to more stable and regulated trading instruments. The CME's leadership in the cash-margined segment indicates a significant influx of institutional activity in the derivatives market.Institutional investors may be using CME futures to hedge their directional plays or set up market-neutral basis trades, seeking to mitigate the volatility inherent in the cryptocurrency market. The stability and regulatory oversight provided by cash-margined contracts offer a more sustainable approach to navigating the market's fluctuations.Reducing Volatility and Promoting Stability

The dominance of cash-margined contracts over crypto-margined ones has important implications for the overall market dynamics. In cash-margined contracts, the underlying collateral is stablecoins and/or dollars, which are more stable than the tokens used as margin in crypto-collaterized futures.This stability in the underlying collateral translates to a lower risk of forced liquidations, which can often exacerbate market volatility. By reducing the likelihood of such disruptive events, cash-margined contracts can contribute to a more sustainable bull run in the cryptocurrency market, potentially paving the way for a more stable and mature ecosystem.The Rise of the CME and the Anticipation of Spot ETFs

The surge in cash-margined open interest has also coincided with the CME's rise to prominence in the futures market. In October 2023, the CME became the largest futures exchange, capturing over 30% of the market share and overtaking Binance.This growth was likely driven by traders positioning themselves for the expected debut of U.S.-based spot bitcoin exchange-traded funds (ETFs), which went live in January. The anticipation of these spot ETFs has fueled increased institutional interest and activity in the derivatives market, as investors seek to gain exposure to the cryptocurrency through regulated and liquid instruments.Implications for the Cryptocurrency Market

The dominance of cash-margined bitcoin futures contracts has far-reaching implications for the cryptocurrency market. The increased institutional participation and the preference for more stable trading instruments suggest a maturing and professionalizing of the market.As cash-margined contracts become the preferred choice for sophisticated investors, the market may experience reduced volatility and more sustainable price movements. This could pave the way for a more stable and attractive investment environment, potentially drawing in a wider range of institutional and retail investors.Furthermore, the rise of the CME and the anticipation of spot bitcoin ETFs indicate a growing integration of the cryptocurrency market with the traditional financial system. This convergence could lead to greater regulatory oversight, improved transparency, and enhanced liquidity, ultimately contributing to the long-term viability and mainstream adoption of digital assets.You May Like