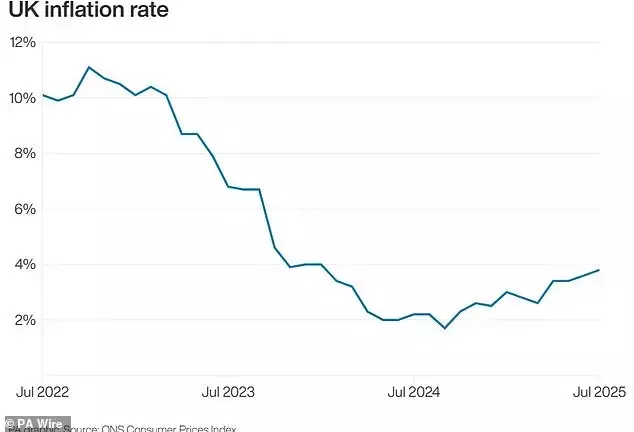

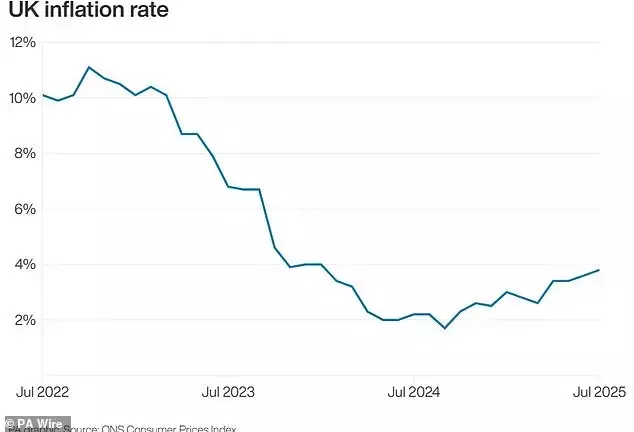

The United Kingdom's economic landscape is experiencing a notable shift as inflation figures unexpectedly climbed in July, signaling potential repercussions for household finances, particularly in the housing market. This upward trajectory in prices, influenced by a unique blend of cultural events and rising travel demands, casts a shadow over the recent relief felt by mortgage holders. Financial experts are now closely monitoring the situation, anticipating a possible reversal in the trend of declining mortgage rates, which could challenge the Bank of England's monetary policy decisions and impact consumer borrowing costs across the nation.

Detailed Report: The Unexpected Drivers Behind Rising UK Inflation and Mortgage Rate Concerns

In mid-August 2025, a significant economic development emerged in the United Kingdom, as the Office for National Statistics reported a surprising increase in the annual inflation rate to 3.8% in July, a notable rise from June's 3.6%. This figure surpassed market forecasts, prompting immediate concerns within financial circles. A key, albeit unconventional, contributor to this inflationary pressure was identified as the highly anticipated reunion tour of the iconic British band, Oasis. The tour, featuring the Gallagher brothers, reportedly spurred a substantial 3.4% increase in hospitality spending—including hotels and restaurants—in cities hosting their concerts. This 'Oasis bump' suggests a significant surge in consumer demand within the entertainment sector. Alongside this cultural phenomenon, a sharp 30.2% jump in airfares between June and July, driven by burgeoning holiday demand, further exacerbated the inflationary trend.

This renewed inflationary surge presents a critical challenge for the Bank of England. The central bank had previously initiated a series of base rate cuts, bringing it down to 4% on August 7th, a substantial decrease from 5.25% in August 2024. These cuts were intended to stimulate the economy by lowering borrowing costs for individuals and businesses. However, with inflation now trending upwards and predicted to hit 4% by September, the prospect of further rate reductions this year appears increasingly uncertain. Katy Eatenton, a mortgage and protection specialist at St Albans-based Lifetime Wealth Management, expressed apprehension, stating that recent mortgage rate cuts might be reversed. Similarly, Peter Stimson, director of mortgages at MPowered, suggested that any additional base rate cuts could be postponed until 2026. Mortgage rates, which had recently seen a welcome decline—with the average two-year fixed rate dipping below 5% for the first time in nearly three years—are now at risk of creeping back up. While some advantageous deals below 4% are still available for borrowers with significant equity or deposits, such as those from Santander and Yorkshire Building Society, the broader market may witness upward adjustments. Experts like David Hollingworth, associate director at L&C Mortgages, advise borrowers to secure rates promptly to mitigate against potential increases, while remaining open to further reviews if market conditions improve. The current economic climate underscores a delicate balance between managing inflation and supporting economic growth, with the Bank of England's decisions having direct implications for millions of British households and their housing costs.

From an observer's viewpoint, this situation highlights the intricate and sometimes unexpected interconnections within a national economy. The 'Oasis bump' serves as a fascinating example of how cultural events, beyond their primary purpose of entertainment, can ripple through the economy, influencing sectors as diverse as hospitality and, ultimately, the financial markets. It underscores the Bank of England's complex task of steering monetary policy in a world where seemingly minor events can contribute to macroeconomic shifts. For the average citizen, this news is a potent reminder of the importance of financial vigilance and proactive planning. In an environment where interest rates are sensitive to a myriad of factors, both conventional and unconventional, staying informed and engaging with financial advisors becomes paramount. This episode also prompts a broader reflection on the nature of inflation itself—not just as a dry economic statistic, but as a dynamic force shaped by consumer behavior, global trends, and even popular culture, constantly challenging policymakers to adapt and respond with agility.