A decade after the United Kingdom's departure from the European Union, the country's luxury market finds itself grappling with profound shifts. A key policy alteration, the discontinuation of VAT-free shopping for international tourists, has significantly undermined the UK's position as a premier global shopping destination. This change has led to a noticeable decline in tourist spending, with major brands like Burberry openly acknowledging the detrimental effects on their domestic market performance. While global economic pressures and changing consumer behaviors contribute to the sector's challenges, the absence of tax incentives has created a structural disadvantage, pushing the UK's luxury retail scene into a less competitive position compared to its European counterparts.

The economic repercussions of this policy extend far beyond the direct sales figures of luxury goods. The UK's luxury sector, traditionally a robust contributor to the national economy and employment, now sees a substantial portion of its potential revenue redirected to countries that still offer VAT refunds. This outflow of spending impacts not only high-end boutiques but also a wide array of related industries, including hospitality, beauty services, and cultural attractions. The British Fashion Council and other industry bodies are actively advocating for the reinstatement of VAT-free shopping, citing analyses that suggest such a move could be economically beneficial, potentially stimulating growth and preserving jobs within the sector and its extensive supply chain.

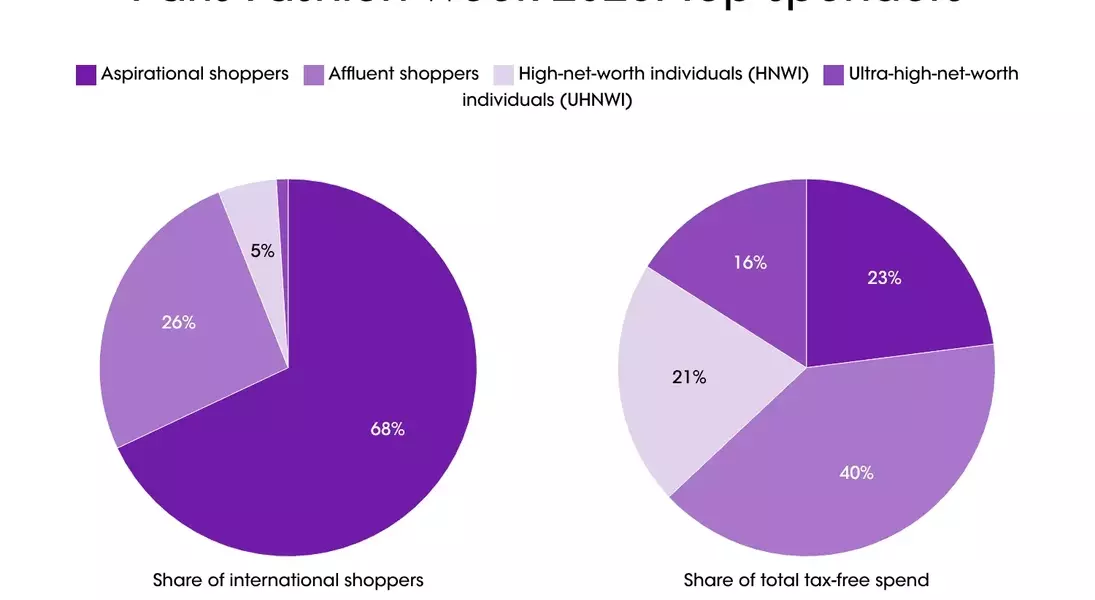

The shift in consumer behavior is evident, with international visitors opting for destinations like Paris and Milan where they can reclaim VAT, and even British shoppers traveling to the EU for tax-advantaged purchases. This trend highlights a psychological element in luxury spending, where the perception of a 'deal' significantly influences purchasing decisions and overall sentiment towards a shopping destination. The ripple effect is observed at major entry points like Heathrow Airport, where luxury sales have seen a sustained decline, leading to reduced investment from brands and an increased focus on defensive retail strategies rather than expansion. For British brands in particular, this situation is compounded by Brexit-related export frictions, making it harder for smaller enterprises without a strong European presence to mitigate losses.

In this complex landscape, the call from the luxury industry is clear: reinstating VAT-free shopping is not merely a subsidy for the wealthy but a crucial tool for national competitiveness and economic growth. As the UK navigates its post-Brexit future, leveraging proven strategies that attract international spending could be pivotal in revitalizing its luxury sector and ensuring its continued vibrancy on the global stage. This move could not only boost retail but also enhance the UK's appeal as a holistic tourist destination, fostering a more prosperous and dynamic economy.