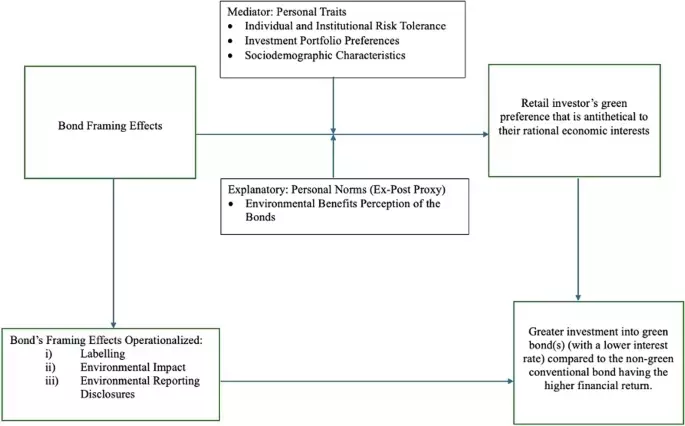

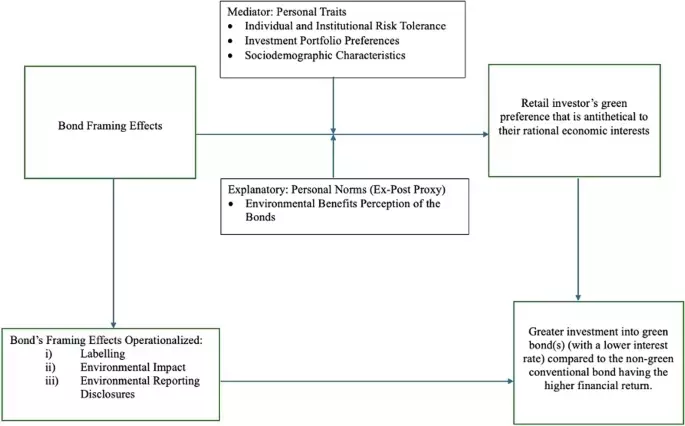

The influence of green labels on retail investors' decision-making is a critical aspect of sustainable finance. This study explores how the presence of a green label can shape investment choices, revealing significant insights into investor behavior and preferences. The research highlights that while most retail investors prioritize the green label over environmental performance or financial returns, a small subset aligns their investments with pro-environmental personal norms.

Retail investors exhibit a notable preference for green-labelled bonds across various scenarios, regardless of additional information about environmental benefits or reporting performance. In the first scenario, where only basic framing information is provided, investors prioritize environmental considerations over financial returns by selecting bonds with lower yields. However, when more detailed information is introduced in subsequent scenarios, they still favor labelled green bonds but place greater emphasis on financial performance over environmental impact. This suggests that the green label effect significantly influences retail investor decisions, even when complex information is presented. Despite this general trend, a small percentage of investors (4.34%) demonstrate a deeper alignment with pro-environmental norms, investing in enhanced performance green bonds despite potential financial drawbacks.

The findings underscore the importance of regulatory oversight to prevent greenwashing and ensure transparency in green bond labelling. Policymakers play a crucial role in establishing robust criteria for what qualifies as a green product, safeguarding investors from misleading claims. Moreover, the study emphasizes the need to balance financial attractiveness with environmental responsibility, suggesting that green bonds should offer competitive returns to appeal broadly to retail investors. For the sustainable finance market to thrive, it is essential to foster awareness and education among retail investors, particularly focusing on demographics that show higher receptivity to green investments. By promoting user-friendly climate-related disclosures and supporting initiatives like tax-free government green bonds, policymakers can encourage wider participation in sustainable finance, ultimately contributing to global climate goals.

This research not only fills a gap in understanding retail investors' perceptions of green bonds but also provides valuable insights for shaping future policies. It highlights the need for creating financially attractive green investment products and improving disclosure practices to protect investors from greenwashing risks. Ultimately, fostering a transparent and trustworthy market environment will empower retail investors to make informed decisions that align with both their financial interests and environmental values, driving the growth of sustainable finance.