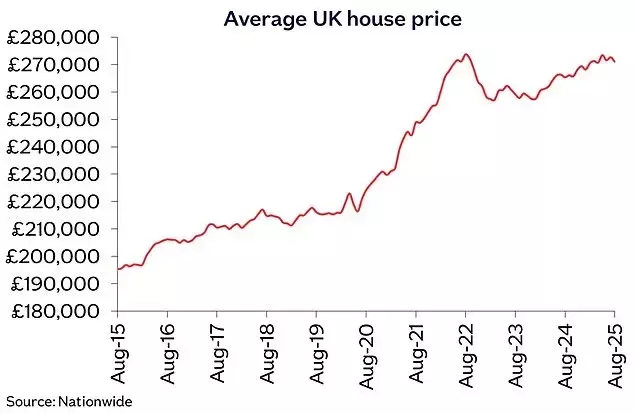

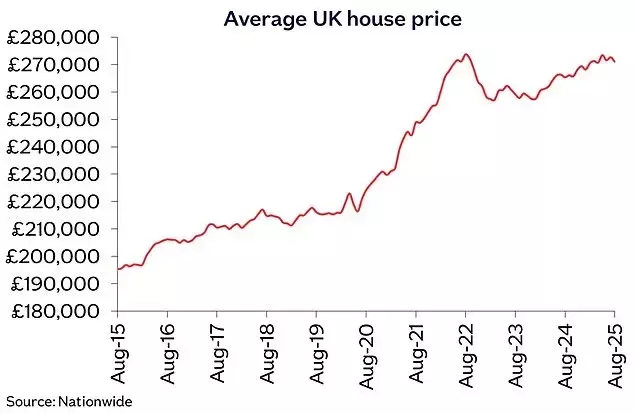

The residential property market in the United Kingdom experienced a downturn in August, as evidenced by recent data from Nationwide Building Society. The average value of homes decreased by 0.1 percent, equating to a reduction of approximately £1,585 within the month. While this still represents a 2.1 percent increase compared to August of the previous year, the current average property value of £271,079 remains below the peak observed in August 2022, which stood at £273,751. Market analysts attribute this stagnation, in part, to widespread rumors concerning potential alterations to property taxation in the upcoming governmental financial statement. These discussions about future fiscal policies are creating a climate of uncertainty, potentially deterring both buyers and sellers and contributing to the downward pressure on prices.

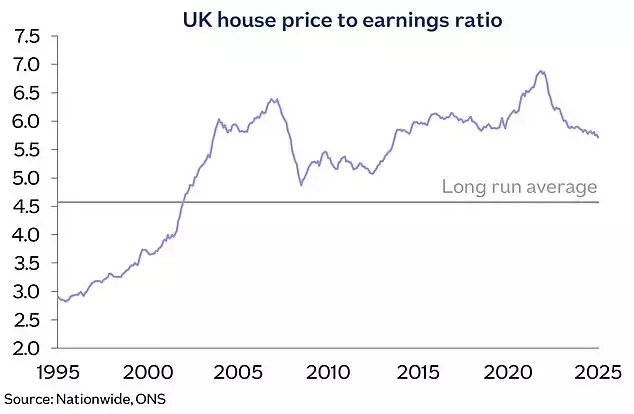

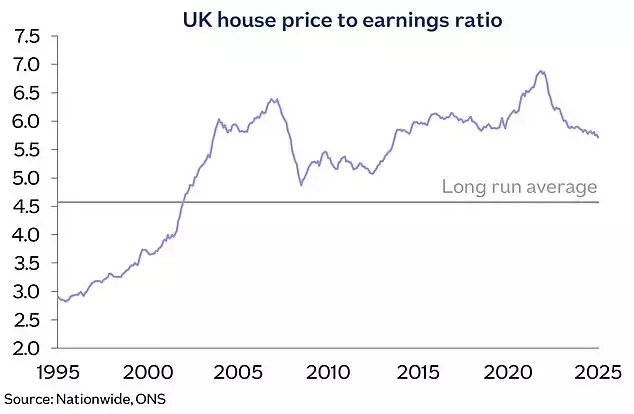

A critical factor contributing to the current housing climate is the ongoing issue of affordability, particularly for new entrants to the market. Robert Gardner, chief economist at Nationwide, emphasizes that housing costs remain disproportionately high relative to average incomes. On average, a UK house is valued at 5.8 times the typical annual full-time salary, significantly exceeding the historical average of 4.8 times. Furthermore, mortgage expenses have escalated dramatically, now more than triple pre-pandemic levels. This presents a considerable obstacle, especially for first-time purchasers, who face monthly mortgage payments representing about 35 percent of their take-home pay, considerably above the long-term average of 30 percent. The confluence of these factors has transformed the market into one where buyers possess greater leverage, leading to increased negotiation on prices and a slower pace of sales.

Looking ahead, the trajectory of the housing market will largely depend on several key economic indicators and policy decisions. A sustained increase in incomes combined with stable or declining house prices could gradually improve affordability. Moreover, any future reductions in interest rates would be beneficial, as they would directly lower mortgage costs and, in turn, stimulate demand. However, the prevailing uncertainty surrounding potential tax reforms, including changes to stamp duty, council tax, and capital gains tax, continues to cast a shadow over the market. These proposed changes, such as replacing stamp duty with an annual property tax for homes over £500,000 or imposing capital gains tax on the sale of high-value primary residences, could significantly reshape the financial landscape for homeowners and investors alike, necessitating careful consideration and adaptation from all market participants.

The current market dynamics underscore the importance of adaptability and informed decision-making for both individuals and policymakers. While economic cycles naturally bring fluctuations, the proactive exploration of financial strategies and thoughtful governmental policies can help mitigate adverse impacts and foster a more equitable and stable housing environment for all. Navigating these challenges with foresight and resilience will be crucial for sustained growth and well-being within the housing sector.