Hamster Kombat's Airdrop: A Risky Gamble in the Volatile Crypto Landscape

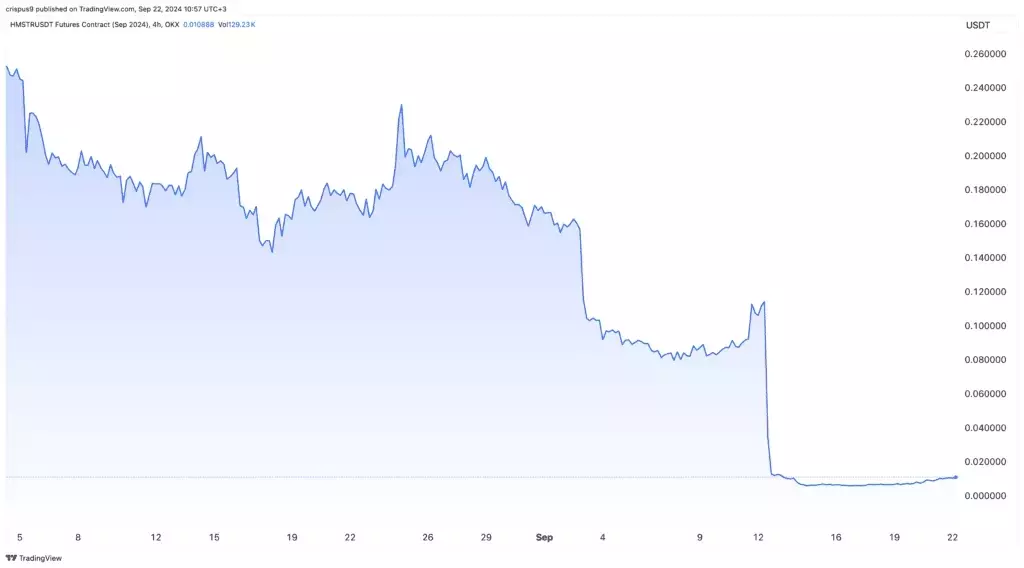

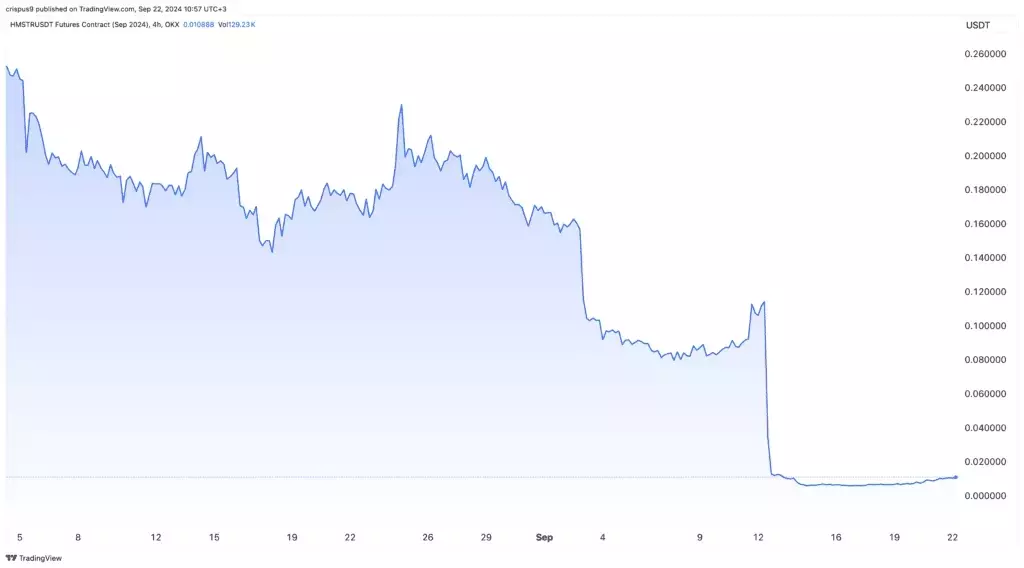

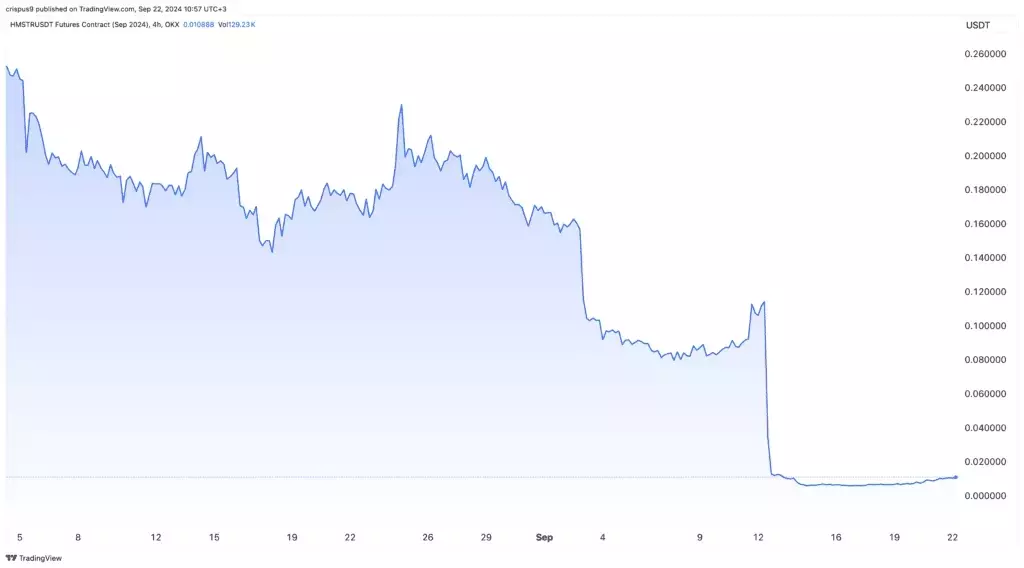

As the crypto world eagerly awaits the upcoming airdrop and exchange listings of the Hamster Kombat (HMSTR) token, the pre-market futures have been trading within a narrow band, reflecting the cautious optimism surrounding this highly anticipated event. The token, which has seen a significant decline of over 96% from its highest point this year, now stands at a crucial juncture, poised to either soar or plummet in the aftermath of the airdrop.Navigating the Volatile Crypto Terrain: Hamster Kombat's Airdrop Dilemma

The Allure of Hamster Kombat's Airdrop

The Hamster Kombat airdrop, scheduled for September 26th, has generated significant buzz within the crypto community. Analysts believe that this event could be one of the biggest airdrops of the year, owing to the platform's growing popularity. With over 300 million global users and a thriving YouTube channel boasting over 37.6 million subscribers, Hamster Kombat has managed to captivate the attention of a vast audience. The platform's active engagement on various social media platforms, including its X and Telegram accounts, further underscores its widespread appeal.The Risks of Tap-to-Earn Tokens

However, the success of Hamster Kombat's airdrop is not without its challenges. Historically, tap-to-earn tokens have often experienced a pattern of initial price surges followed by significant retreats. Notcoin (NOT), a platform with over 40 million users, saw its token jump to a high of $0.02925 before plummeting by over 80% to the current $0.0078. Similarly, Pixelverse's token soared to $0.1745 shortly after its airdrop and has since crashed by over 90% to a record low of $0.0070. More recently, Catizen (CATI) surged to a record high of $1.20 but has since pulled back by over 26% to the current $0.87.The Struggle to Maintain User Engagement

The key challenge for tap-to-earn and play-to-earn platforms lies in their ability to keep users engaged within their ecosystems, especially when the tokens are not performing well. This is a concern that has plagued even the most popular play-to-earn tokens, such as Decentraland, Sandbox, Gala, and Axie Infinity, which have all experienced significant drops from their all-time highs as the number of users in their networks declined. Decentraland's market cap, for instance, has plummeted from around $7 billion in 2021 to just $576 million, while Axie Infinity has seen a similar decline from over $10 billion to $749 million.The Cautionary Tale of Move-to-Earn Platforms

The challenges faced by tap-to-earn and play-to-earn platforms are not limited to the crypto space alone. Move-to-earn platforms, such as Sweatcoin and StepN, which were highly popular before their airdrops, have also experienced sharp declines. Their market caps have dropped to $58 million and $348 million, respectively, as activity in their networks has waned. This trend highlights the difficulty in maintaining user engagement when the token's performance is not meeting expectations.The Uncertain Future of Hamster Kombat's Token

Given the historical precedents, there is a significant risk that Hamster Kombat's token may follow a similar trajectory, rising initially due to the hype surrounding the airdrop and then retreating as the excitement fades. The challenge for the Hamster Kombat team will be to find ways to keep their users engaged and invested in the platform, even when the token's performance is not meeting their expectations. Failure to do so could result in a sharp decline in the token's value, leaving investors and users alike disappointed and disillusioned.