Greed's Perilous Grip: A Cautionary Tale of Unchecked Ambition

In the realm of finance, greed is often portrayed as a double-edged sword – a trait that can propel individuals to dizzying heights of wealth, but also lead them down a treacherous path of ruin. This captivating narrative explores the cautionary tale of an investor who rode the wave of Tesla's meteoric rise, only to have his fortunes crumble in a spectacular fashion, serving as a stark reminder of the perils of unchecked greed and the importance of prudent risk management.Uncovering the Perils of Greed: A Cautionary Tale for Investors

The Meteoric Rise and Catastrophic Fall

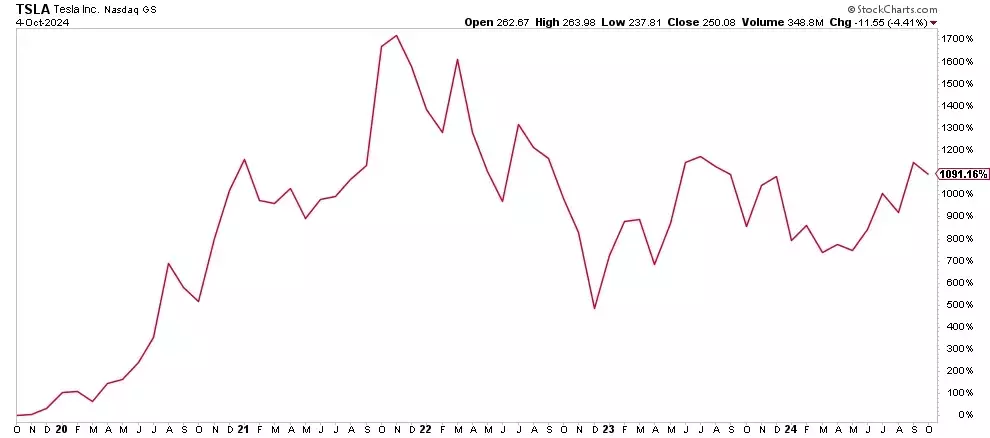

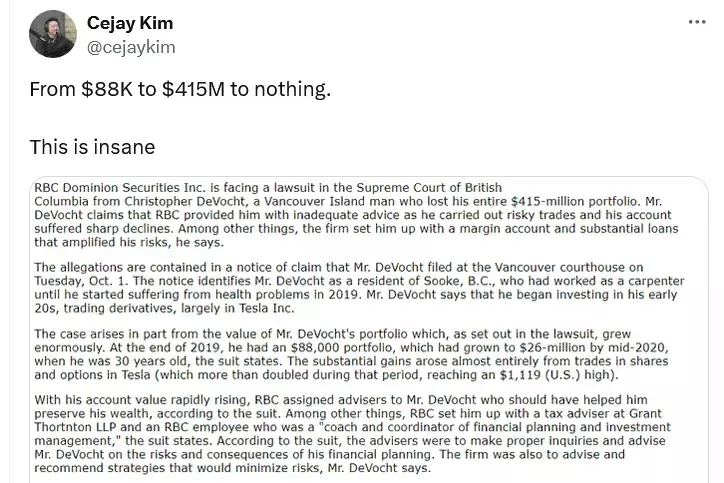

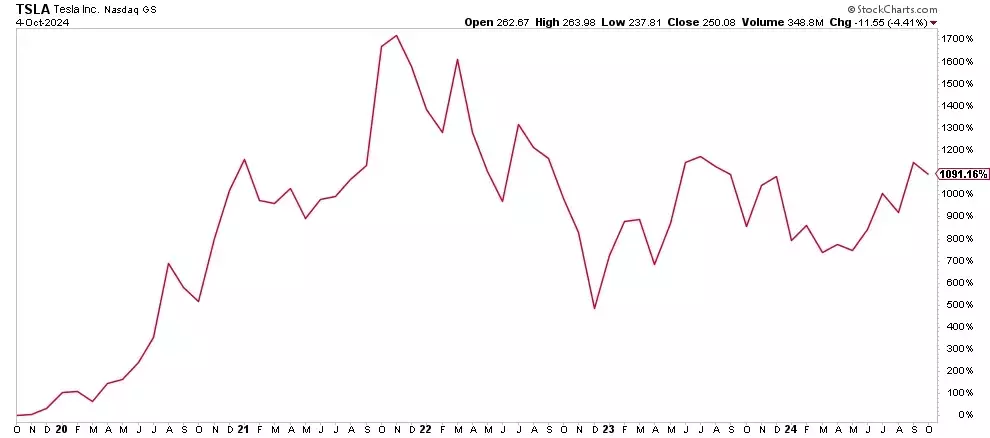

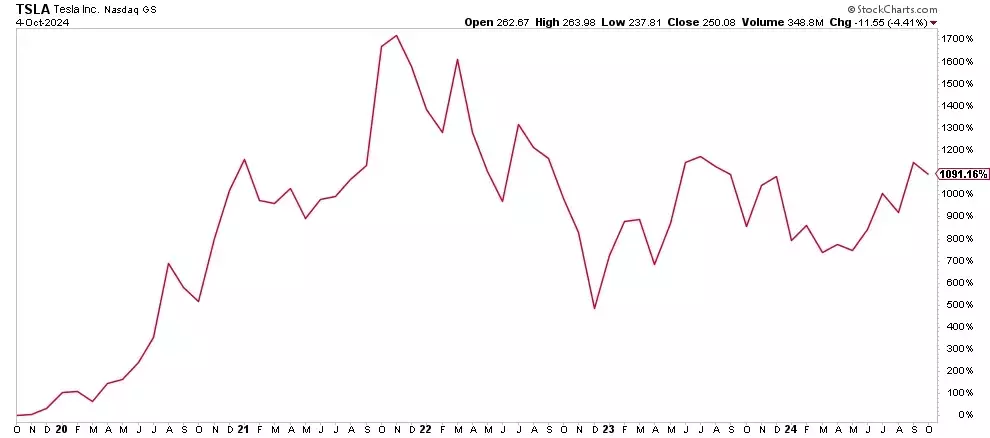

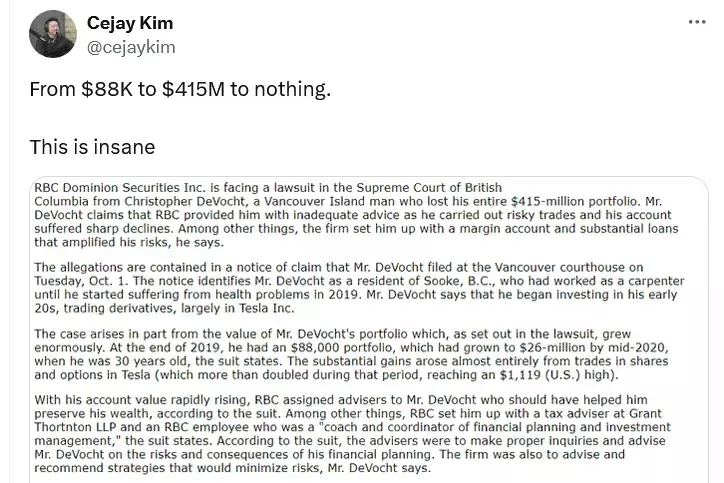

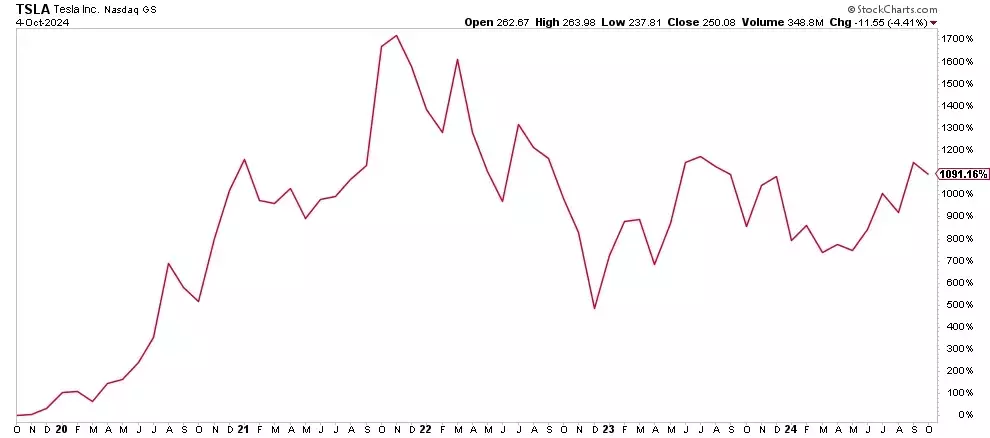

The story begins with an investor, Christopher DeVocht, who turned an initial $88,000 investment into a staggering $415 million through his savvy trading of Tesla options. This remarkable feat was fueled by the speculative frenzy that gripped the markets during the pandemic-driven economic upheaval of 2020. As Tesla's stock price skyrocketed, Christopher's leveraged positions grew exponentially, propelling his portfolio to dizzying heights.However, the allure of even greater returns proved too tempting for Christopher to resist. Despite the inherent risks of his highly concentrated position, he chose to stay the course, unwilling to cash out or diversify his holdings. This decision would ultimately prove to be his undoing, as the market turned against him in 2022 when the Federal Reserve's aggressive rate-hiking campaign and the waning of pandemic-era stimulus measures led to a significant correction in Tesla's share price.The Anatomy of a Financial Catastrophe

As Tesla's stock value plummeted by nearly 70%, Christopher's highly leveraged position crumbled. The forced liquidation of his Tesla shares to repay margin loans, coupled with the expiration of his options contracts, resulted in the complete decimation of his $415 million portfolio. This staggering loss serves as a stark reminder that unchecked greed and poor risk management can be the architects of financial ruin.Lessons from the Downfall

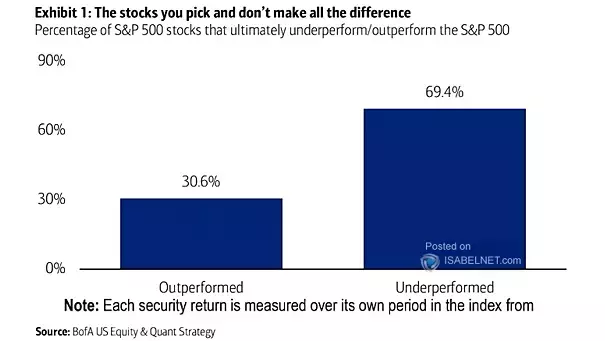

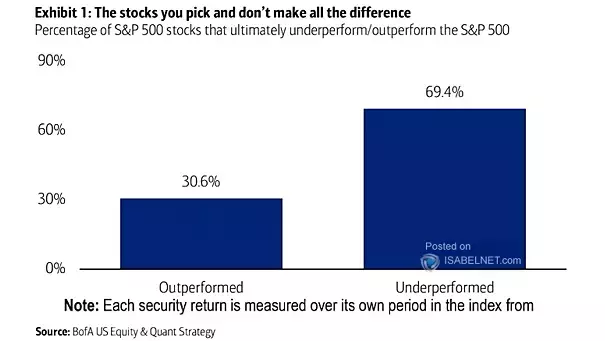

The cautionary tale of Christopher DeVocht highlights several crucial lessons for investors. Firstly, it underscores the importance of diversification – a fundamental principle of prudent wealth management. By concentrating his entire portfolio in a single stock, Christopher exposed himself to an unacceptable level of risk, leaving him vulnerable to the market's inevitable fluctuations.Secondly, the story emphasizes the value of implementing risk management strategies, such as stop-loss orders and profit-taking mechanisms. These tools could have helped Christopher lock in his substantial gains and protect his wealth, even as the market turned against him.The Role of the Financial Advisor

While Christopher bears the ultimate responsibility for his decisions, the financial advisor also plays a critical role in guiding clients towards sound investment strategies. In this case, the advisor should have proactively encouraged diversification, insisted on the implementation of risk management tools, and maintained clear communication about the portfolio's risk exposure. Failure to do so may have contributed to the disastrous outcome, and the advisor could face legal consequences as a result.The Pervasive Grip of Greed

Greed, in its various forms, is a powerful emotion that can cloud judgment and lead investors down a perilous path. Whether it's the insatiable desire for greater returns, the reluctance to let go of a winning position, or the unwillingness to pay taxes on gains, greed can be a formidable adversary in the pursuit of financial success.Safeguarding Wealth: A Disciplined Approach

To avoid a fate similar to Christopher's, investors must adopt a disciplined approach to wealth management. This includes diversifying their portfolios, implementing robust risk management strategies, and maintaining a clear understanding of their risk tolerance and long-term financial goals. By prioritizing prudent decision-making over the allure of outsized returns, investors can navigate the volatile markets with greater confidence and protect their hard-earned wealth.At RIA Advisors, we specialize in helping investors navigate these complex challenges. Our experienced team of financial advisors is dedicated to guiding clients towards a balanced and responsible investment strategy, ensuring that their wealth is safeguarded and positioned for sustainable growth. If you find yourself in a situation similar to Christopher's, or simply seek to optimize your investment approach, we encourage you to schedule an appointment with us today. Together, we can help you avoid the pitfalls of greed and secure your financial future.