Navigating the Economic Landscape: A Soft Landing Ahead for the US

The latest economic data suggests that the United States may be heading towards a soft landing, a scenario where the economy slows down without falling into a full-blown recession. The unemployment rate has fallen, and the services sector has shown signs of strength, providing a glimmer of hope for a more stable economic future.Defying Expectations: The Resilience of the US Economy

Unemployment Rate Decline: A Positive Indicator

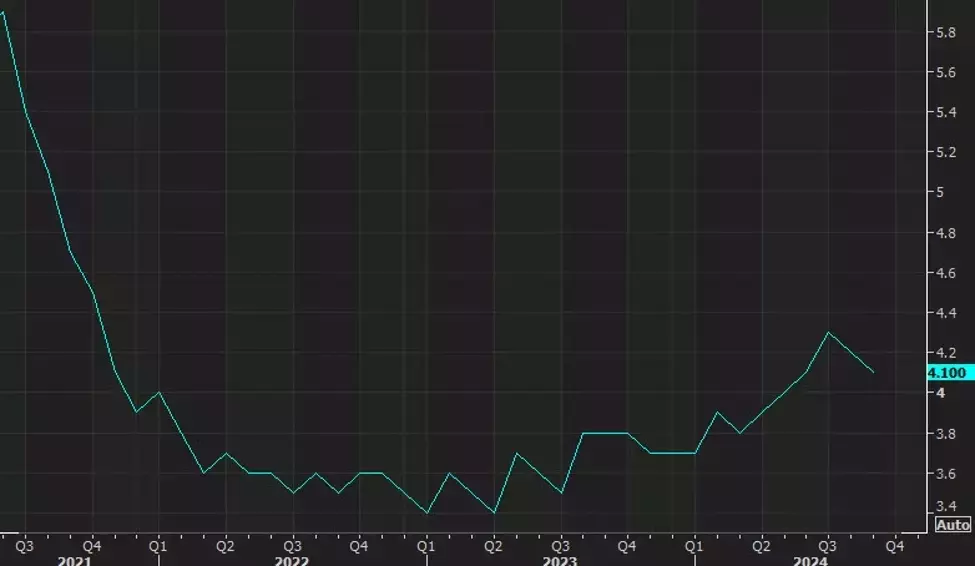

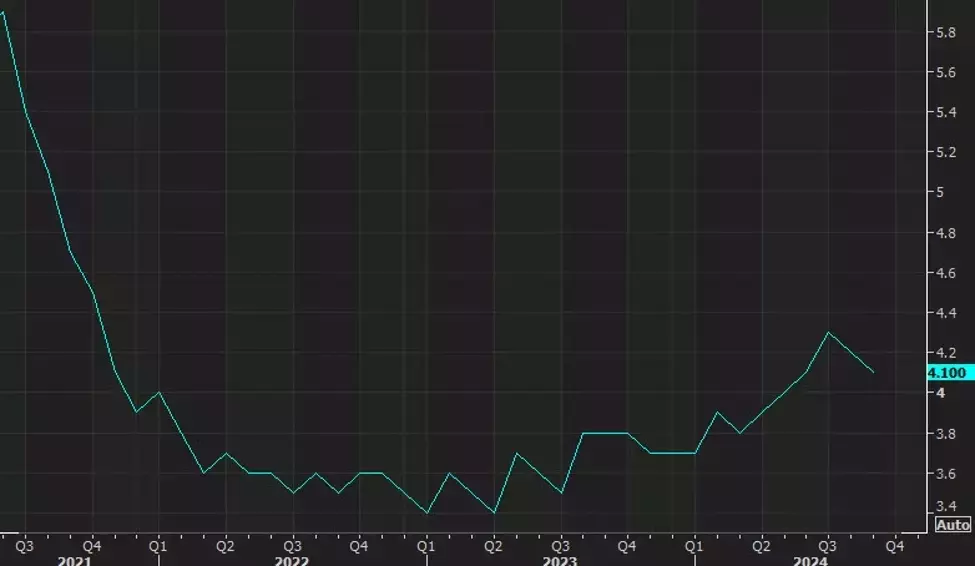

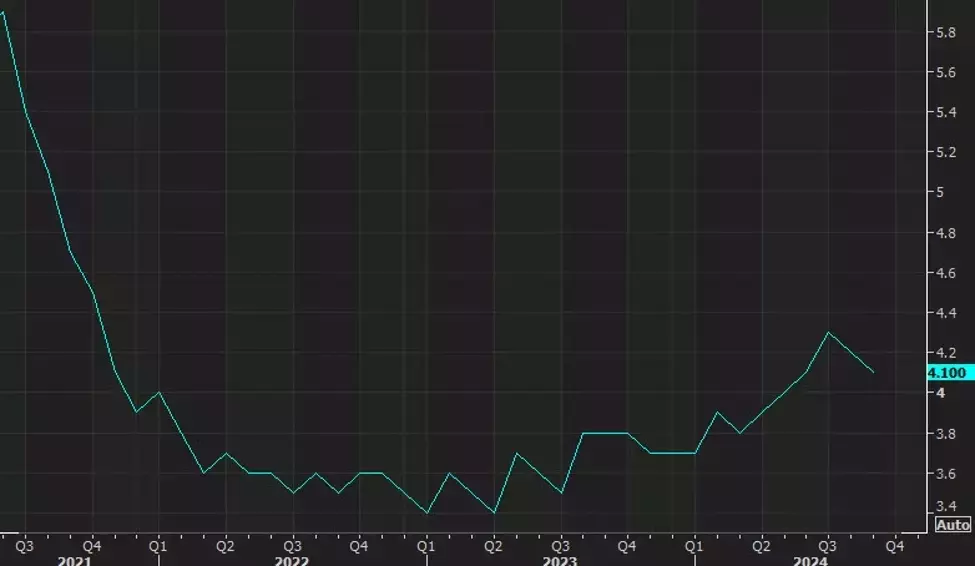

The unemployment rate in the US has fallen to 4.0510%, down from the previous 4.220%. This reversal of the recent upward trend in unemployment rates suggests that the labor market remains resilient, despite concerns about a potential economic slowdown. The lower-than-expected unemployment rate could also impact the Federal Reserve's interest rate decisions, potentially leading to a less aggressive approach to rate hikes.As the labor market continues to show signs of strength, it is crucial to examine the broader implications of this trend. The decline in the unemployment rate not only indicates a healthier job market but also signals the potential for increased consumer spending and economic activity. This, in turn, could have a positive ripple effect on various sectors, contributing to a more stable and sustainable economic recovery.The Fed's Approach: Navigating the Path to Neutral

The Federal Reserve has been clear in its intention to gradually reduce interest rates to a neutral level, a move that the market has been closely monitoring. The current pricing in the rates market suggests a 9% chance of a 50-basis-point cut on November 7th, indicating that the market is not expecting a more aggressive approach from the Fed.This measured approach by the central bank is crucial in maintaining a delicate balance between controlling inflation and fostering economic growth. By slowly cutting rates, the Fed aims to find the sweet spot where the economy can continue to expand without overheating, potentially leading to a soft landing scenario.Positive Signals from the Services Sector

In addition to the positive employment data, the recent ISM services survey also provided encouraging news. The survey showed that the services sector in the US has risen to its best levels since February 2023, further reinforcing the notion of a resilient economy.The services sector, which accounts for a significant portion of the US economy, is a crucial indicator of overall economic health. The improvement in this sector suggests that consumer demand remains strong, and businesses are continuing to invest and expand their operations. This, in turn, could lead to increased job creation and a more stable economic environment.The Stock Market's Response: Reaching New Heights

The positive economic data has had a tangible impact on the stock market, with the S&P 500 jumping by 50 points, or 0.8%, following the release of the latest figures. This surge in the stock market brings the cash market within 25 points of a fresh record high, further bolstering the optimism surrounding the US economy.The stock market's reaction is a testament to the market's confidence in the underlying strength of the economy. Investors are likely interpreting the data as a sign of a more stable and sustainable economic trajectory, leading them to increase their exposure to equities and driving the market to new highs.Navigating the Path Ahead: Cautious Optimism

While the recent economic data paints a relatively positive picture, it is essential to maintain a cautious optimism. The path ahead may still be fraught with challenges, and the potential for unexpected economic shocks remains ever-present.As the Federal Reserve continues to navigate the delicate balance between controlling inflation and fostering growth, it will be crucial for policymakers to closely monitor the evolving economic landscape and make data-driven decisions. Similarly, businesses and consumers will need to remain vigilant, adapting to the changing conditions and seizing opportunities as they arise.By staying informed, making prudent decisions, and maintaining a flexible approach, the US economy can continue to navigate the path towards a soft landing, ultimately emerging stronger and more resilient in the face of future challenges.