The global financial markets are experiencing volatility as investors prepare for crucial economic data releases and a wave of corporate earnings reports. Futures for major U.S. indices, including the Nasdaq-100, Dow Jones Industrial Average, and S&P 500, are showing premarket losses, driven by declines in tech stocks. Meanwhile, the 10-year Treasury yield is approaching the significant 5% mark. Notable movements in individual stocks include Sage Therapeutics' surge following a takeover bid from Biogen, while Moderna faces sharp declines due to reduced sales forecasts. Retailer Lululemon has seen a modest gain after revising its revenue projections upward.

International markets are also feeling the pressure. Asian markets closed lower on Monday, influenced by the previous week's U.S. jobs report, which dampened hopes for near-term interest rate cuts. European stocks followed suit, with bond yields playing a significant role in market sentiment. The U.K.'s 10-year yield reached its highest level since 2008, adding to the region's economic concerns.

U.S. Market Dynamics: Tech Stocks and Corporate Announcements Drive Volatility

The premarket activity in the U.S. reflects a cautious investor mood as they brace for upcoming inflation figures and bank earnings. Major indices like the Nasdaq-100, Dow Jones, and S&P 500 are all indicating potential losses at the opening bell. The decline in tech stocks has been particularly notable, contributing to the overall bearish sentiment. Additionally, the 10-year Treasury yield is edging closer to the psychologically important 5% level, signaling rising borrowing costs and impacting investor confidence.

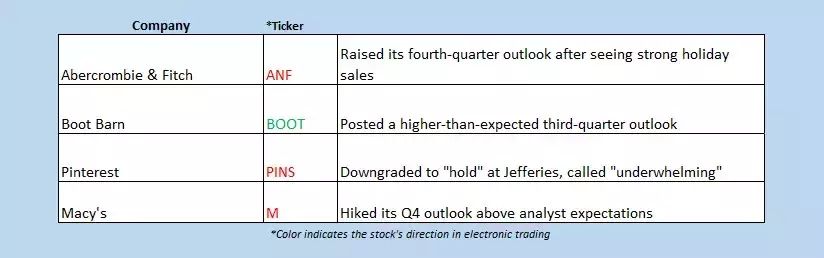

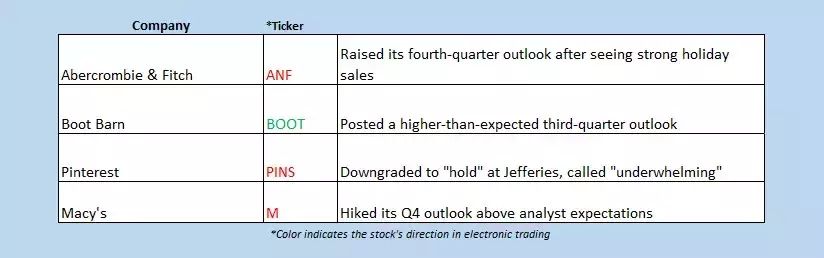

In the corporate sector, several companies have made headlines. Sage Therapeutics has surged significantly after receiving an unsolicited takeover offer from Biogen, marking a substantial shift in its year-over-year performance. Conversely, Moderna is facing steep losses as it revised downward its 2025 sales forecast due to waning demand for its Covid vaccine. On a more positive note, Lululemon has seen a slight uptick in its stock price following strong holiday sales, leading to improved revenue outlooks for both the current quarter and full year. These divergent performances highlight the mixed signals in the market, where some sectors show resilience while others struggle.

International Markets React to Economic Data and Policy Signals

Across the globe, financial markets are responding to a mix of economic indicators and policy announcements. In Asia, markets ended the day lower, influenced by the U.S. jobs report that tempered expectations for interest rate cuts. Despite better-than-expected export and import figures in China, the Shanghai Composite and Hong Kong’s Hang Seng both declined. Chinese regulators have pledged support to stabilize the yuan, but this has not yet translated into immediate market stability. South Korea’s Kospi also saw losses, while Japanese markets were closed for a holiday.

In Europe, the afternoon trading session showed continued weakness, with bond yields playing a pivotal role. Higher borrowing costs in the U.K. have pushed up gilt yields to levels not seen since 2008, affecting market sentiment. France’s CAC 40, Germany’s DAX, and London’s FTSE 100 all posted modest declines. The focus on bond yields underscores the broader concern about rising interest rates and their impact on economic growth. Investors remain vigilant as they monitor these developments, anticipating further volatility in the coming days.