The Gemini Trust Company, a prominent player in the cryptocurrency exchange sector established by the Winklevoss twins, has entered into an agreement to pay a $5 million civil penalty. This settlement resolves allegations made by the Commodity Futures Trading Commission (CFTC) regarding misleading statements to regulators. The settlement allows Gemini to avoid a trial scheduled for January 21, without admitting or denying any wrongdoing. The controversy centers around Gemini's efforts to gain approval for its Bitcoin futures product, where it allegedly provided false or misleading information concerning the susceptibility of these contracts to market manipulation. In the complex world of financial derivatives, such actions can have significant implications for both investors and regulatory bodies.

Resolving Regulatory Allegations Without Trial

The settlement between Gemini and the CFTC signifies a strategic move to address the accusations while avoiding the uncertainties of a courtroom battle. By agreeing to this financial penalty, Gemini demonstrates a willingness to cooperate with regulatory authorities without conceding fault. The CFTC had initially accused Gemini of making material misrepresentations during its application process for a Bitcoin futures contract. These alleged misstatements pertained to the potential vulnerabilities of the proposed contract to market manipulation, raising concerns about the integrity of the futures market. The settlement not only helps Gemini evade the legal complexities of a trial but also signals a broader shift in how crypto companies interact with regulatory bodies.

When the CFTC first brought charges against Gemini in 2022, it highlighted the company's role in providing misleading information that could influence the approval of its Bitcoin futures product. The lawsuit emphasized that Gemini should have been aware of the inaccuracies in its submissions. This case underscores the challenges faced by crypto firms when navigating the regulatory landscape, especially as they seek to introduce innovative financial instruments like Bitcoin futures. By resolving the matter out of court, Gemini may be positioning itself to focus on rebuilding trust with regulators and stakeholders moving forward.

Navigating the Crypto Regulatory Landscape

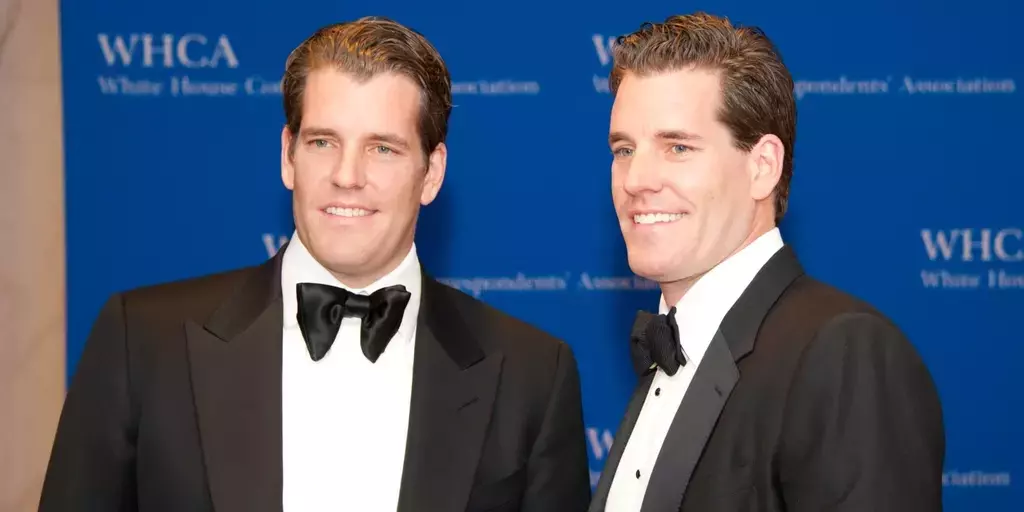

In the rapidly evolving world of cryptocurrency, regulatory scrutiny has intensified, particularly under the Biden administration. Gemini's settlement with the CFTC reflects the broader trend of increased oversight in the crypto industry. The Winklevoss twins, known for their influential presence in the digital asset space, have also been vocal about their views on crypto regulation. Their recent political contributions highlight the ongoing debate over how best to regulate cryptocurrencies while fostering innovation. As regulators continue to impose stricter rules, crypto firms must adapt to ensure compliance and maintain operational stability.

The crypto industry's relationship with regulators has become increasingly complex, especially as new products like Bitcoin futures enter the market. The introduction of Bitcoin futures on platforms like the Cboe Futures Exchange in 2017 marked a significant milestone, with Gemini playing a crucial role by supplying price data. However, this involvement also exposed the company to greater regulatory scrutiny. Under the Biden administration, numerous lawsuits have been filed against crypto exchanges and related businesses, signaling a more aggressive stance from regulators. For Gemini, this settlement may serve as a pivotal moment, allowing the firm to refocus on its core operations while addressing past issues. The future of the crypto industry will likely depend on how effectively companies can navigate these regulatory challenges.