The French tech ecosystem has experienced a remarkable transformation in 2024, with venture capital investment trends reflecting both challenges and opportunities. This report delves into the nuanced dynamics driving France's startup landscape, highlighting pivotal sectors like artificial intelligence (AI) and exploring key players poised for significant growth.

Discover How France Is Becoming Europe's Next AI Powerhouse

Shifting Tides in Venture Capital Investment

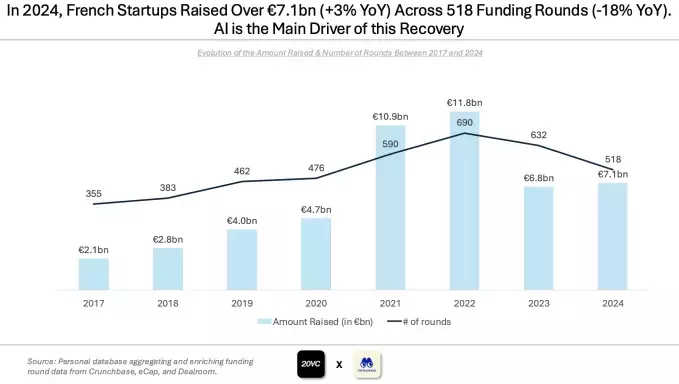

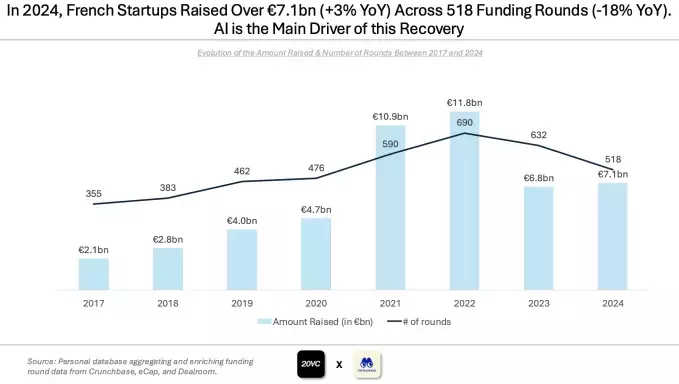

The year 2024 marked a period of stability in venture capital funding for French startups, despite fluctuations from previous years. According to recent data, €7.1 billion was injected into the French tech sector, a marginal increase from the €6.8 billion recorded in 2023. However, this figure pales in comparison to the €11.8 billion raised in 2022, signaling a potential slowdown in overall investment momentum.While discrepancies exist between different sources—such as EY’s report indicating a slight downturn from €8.3 billion in 2023 to €7.8 billion in 2024—the overarching narrative remains consistent. The stability in venture funding underscores a cautious yet resilient market, with AI emerging as a dominant force. AI startups secured 27% of total funding, marking an 82% surge compared to 2023. This trend suggests that AI is not only a burgeoning sector but also a beacon of hope for future innovation.Artificial Intelligence: A Catalyst for Growth

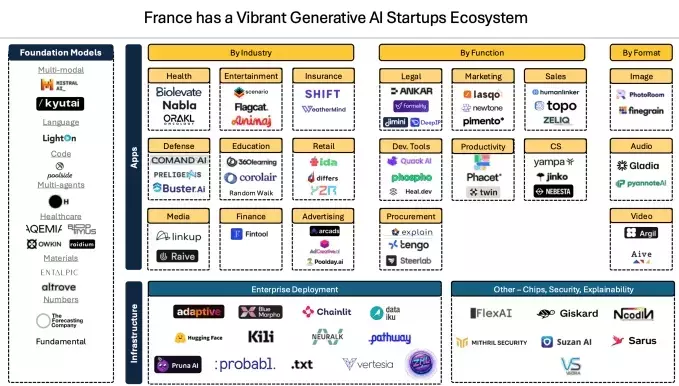

Artificial intelligence has undeniably become the cornerstone of France's tech ecosystem. The substantial increase in AI funding reflects its growing importance. Some may view this as a silver lining amidst a broader funding slowdown, while others see it as a strategic shift towards high-potential verticals. AI startups like Mistral AI, Owkin, and PhotoRoom are leading the charge, attracting substantial investments and demonstrating the sector's robustness.This focus on AI can be attributed to its versatility and transformative potential across various industries. Investors are increasingly recognizing the value of AI-driven solutions, which promise efficiency gains and innovative applications. For instance, AI-powered software development tools like Poolside are revolutionizing how developers create and deploy applications, offering faster and more reliable outcomes. Moreover, AI's role in drug discovery, exemplified by companies like Aqemia, showcases its capacity to address critical global challenges.Facing the Challenges: Bankruptcies and Market RealitiesDespite the positive outlook for AI, the tech ecosystem is not without its challenges. Several notable startups faced financial difficulties in 2024, including Ynsect, Cubyn, Masteos, Luko, and Cityscoot. These bankruptcies highlight the evolving macroeconomic landscape, where securing growth rounds requires robust financial performance and strategic planning.The changing market dynamics have made it increasingly difficult for startups to secure funding without demonstrating strong revenue streams and profitability. This shift underscores the importance of sustainable business models and disciplined financial management. Startups must now prioritize long-term viability over rapid expansion, ensuring they can weather economic uncertainties and continue innovating.Unicorns and IPO Prospects: A Glimpse into the Future

France's tech ecosystem boasts 45 unicorns, though some may face valuation pressures in the coming years. Three new additions to this elite group include Pennylane, Pigment, and Poolside. These startups represent diverse sectors, from accounting software to business planning platforms, illustrating the breadth of innovation within the French tech community.Looking ahead, several late-stage companies are well-positioned for public listings. Companies like Back Market, Dataiku, Doctolib, Qonto, and Content Square are generating substantial annual recurring revenue and showing promising growth rates. However, the path to an Initial Public Offering (IPO) remains challenging, particularly for those lacking a significant U.S. customer base. The tepid IPO market in France further complicates these prospects, with many companies considering U.S. listings to access broader investor pools.Exit Strategies and International Investments

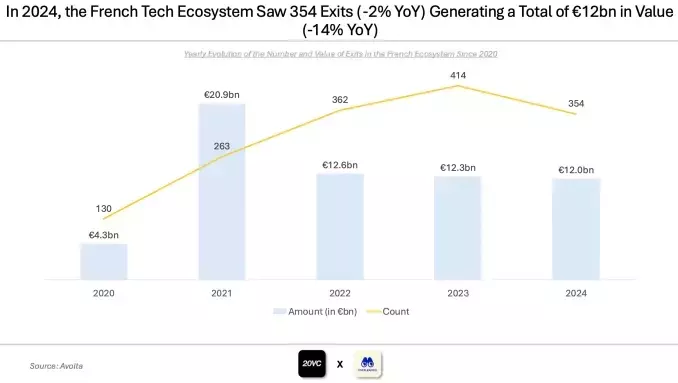

While the number of exits decreased by 14% year over year, the total exit value remained stable at around €12 billion. This consistency indicates that despite fewer transactions, the quality and scale of exits remain robust. Strategic acquisitions and mergers continue to play a crucial role in shaping the tech ecosystem, providing valuable exit pathways for startups.Moreover, the declining pace of U.K. funds investing in French startups raises concerns about the ecosystem's future health. This trend could impact the availability of capital and limit growth opportunities for emerging founders. It will be essential to monitor how this dynamic evolves and whether it influences the overall vibrancy of France's tech landscape.