The financial landscape of Gabon has encountered a significant setback following a downgrade by Fitch Ratings, casting doubt on the country's economic stability and investor confidence. The nation's dollar bonds have experienced a decline, raising concerns about liquidity strains and the potential impact on upcoming presidential elections.

Prepare for Economic Shifts: Gabon’s Financial Future Hangs in the Balance

Market Reactions to Rating Adjustments

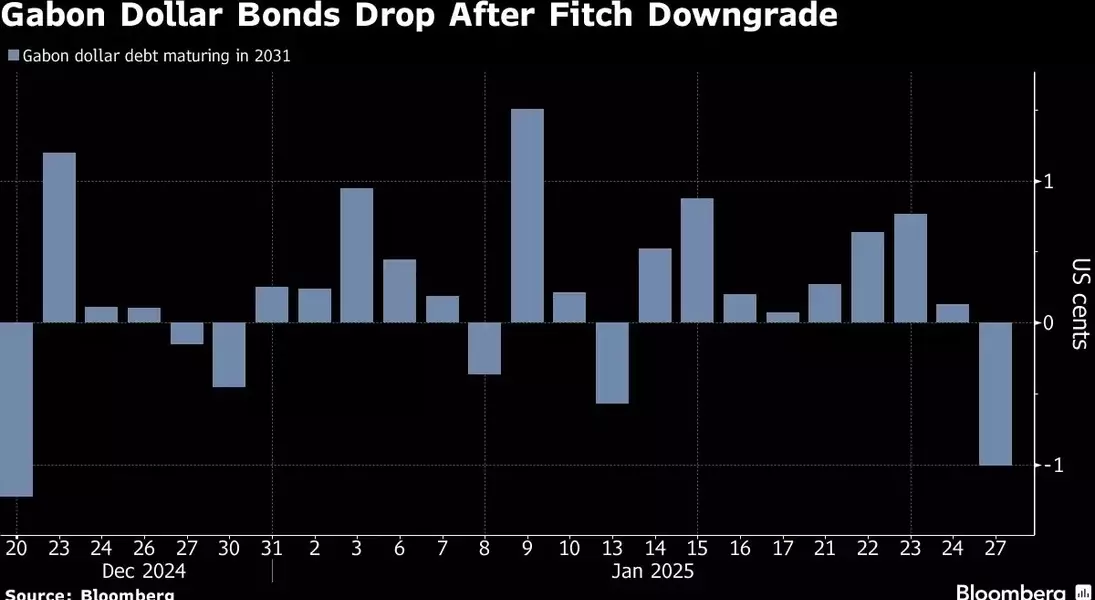

The recent downgrade of Gabon’s long-term foreign-debt rating from CCC+ to CCC by Fitch Ratings has sent ripples through the financial markets. Investors are now demanding higher yields to compensate for the increased risk associated with holding Gabon’s dollar-denominated debt. According to JPMorgan Chase & Co. data, the extra yield investors require to own Gabon’s dollar debt instead of Treasuries widened significantly. On Monday, this spread surged by 36 basis points to reach 735 basis points. This increase highlights the growing perception of risk among market participants.The interest rate on Gabon’s 2031 bonds also saw a notable jump, rising 21 basis points to 11.35%, marking its highest level since December 20th. Such movements underscore the volatility in investor sentiment and the challenges facing Gabon’s financial instruments. Analysts suggest that this could further deter international investors, potentially leading to capital flight and exacerbating liquidity issues within the country.Economic Prospects Amid Political Transitions

Amidst these financial challenges, Gabon is preparing for a pivotal presidential election scheduled for April 12th. While this event may serve as a catalyst for economic reforms, it also introduces an element of uncertainty into the financial outlook. The junta’s commitment to holding elections is seen as a positive step towards political normalization, but delays in securing an International Monetary Fund (IMF) program due to political factors could heighten liquidity pressures.Fitch Ratings highlighted the risks associated with prolonged negotiations for an IMF program, which are likely to commence only after the elections. The agency expects Gabon’s debt-to-GDP ratio to rise to 71% by 2025, up from 67% last year, driven by lower nominal oil GDP and broader budget deficits. These projections paint a concerning picture of the country’s fiscal health and the challenges it faces in managing public finances effectively.Impact of Fiscal Policies on Economic Stability

Since the military coup led by Brice Oligui Nguema two years ago, Gabon’s fiscal policies have undergone substantial changes. The junta’s focus on addressing social demands has resulted in increased government spending and hiring more civil servants. This shift has loosened the country’s fiscal stance, with Fitch estimating that the wage bill will rise by 7% in both 2024 and 2025. While these measures aim to address immediate social concerns, they pose long-term risks to economic stability. The accumulation of arrears to official creditors, increasing by 0.9% of GDP between January and November, adds another layer of complexity to Gabon’s financial management. The junta’s approach to fiscal policy will be closely scrutinized as the country navigates these challenging times, seeking a balance between social welfare and sustainable economic growth.Future Challenges and Opportunities

Looking ahead, Gabon faces a critical juncture in its economic trajectory. The combination of financial downgrades, liquidity concerns, and impending elections creates a complex environment for policymakers and investors alike. Securing an IMF program remains a priority, but achieving this will depend on navigating the political landscape post-election.Despite these challenges, there are opportunities for reform and restructuring that could stabilize the economy. Engaging in transparent dialogue with international partners, implementing prudent fiscal policies, and fostering a conducive environment for investment can pave the way for a more resilient economic future. As Gabon moves forward, the coming months will be crucial in determining the path toward sustained growth and financial recovery.You May Like