A new analysis underscores a stark financial divergence between those who own their homes and those who rent in England. Over three decades, individuals who choose to rent could find themselves at a substantial disadvantage, potentially missing out on hundreds of thousands of pounds in accumulated wealth compared to their home-owning counterparts. This comprehensive research, conducted by a prominent mortgage advisory firm, meticulously compared the long-term financial implications of both housing paths.

The study’s findings reveal that the financial benefits of homeownership become apparent surprisingly quickly, with homeowners typically beginning to accrue advantages within just two years. This accelerated gain is primarily attributed to the stability of mortgage payments, which tend to remain consistent over time, contrasting sharply with the upward trajectory of rental costs. Furthermore, the analysis considers the potential for homeowners to invest the money they save on housing expenses, which can lead to significant additional wealth generation. For example, within 14 years, these invested savings could amount to enough to cover a typical first-time buyer's deposit, and by 16 years, they could even pay off an average student loan debt. Across a full 30-year span, the estimated difference in housing costs alone is over £200,000, and when combined with the returns from investing these savings, the total financial opportunity missed by renters could exceed £338,000.

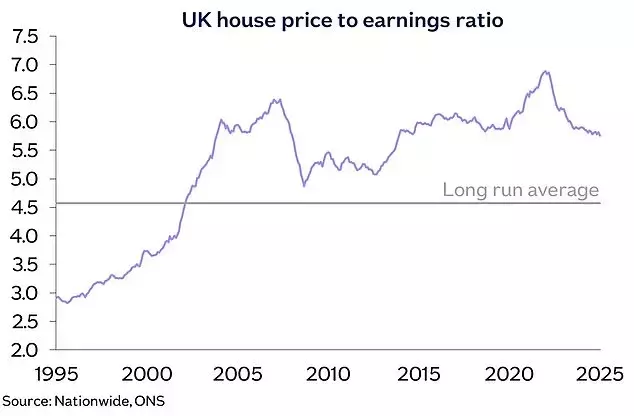

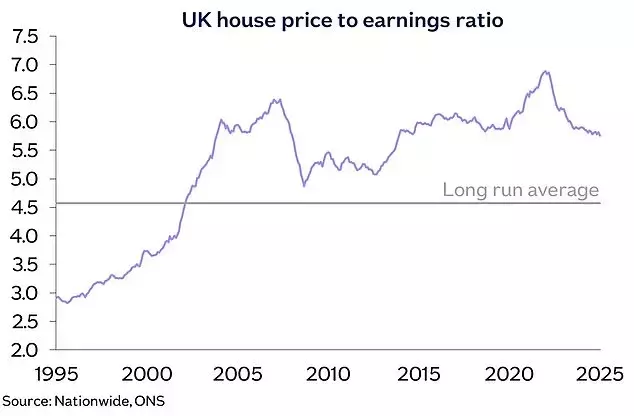

Geographical variations play a significant role in this wealth disparity. Certain urban centers, such as Bristol and London, exhibit even wider gaps, with renters in these areas facing a potential loss of over £500,000 over 30 years. The research also delves into the affordability of homeownership, noting that despite persistent challenges like saving for a down payment and mortgage eligibility concerns, conditions have improved recently. House prices have stabilized, while average incomes have risen, making homeownership more accessible than in previous years. Lenders are also easing mortgage affordability rules, allowing some individuals to borrow more and offering lower deposit options, which could help more renters transition to homeownership sooner than they anticipate.

Embracing homeownership offers a pathway not only to financial stability but also to substantial long-term wealth creation. The journey towards owning a home, while it may seem challenging, is often more attainable than many believe, fostering a sense of security and providing a solid foundation for future prosperity.