The Federal Reserve finds itself at a critical juncture, grappling with the dual mandate of fostering a robust job market while simultaneously reining in inflation. Recent economic indicators present a perplexing scenario: a decelerating pace of job creation contrasts sharply with persistent inflation levels exceeding the central bank's desired target. This intricate balance has prompted widespread anticipation on Wall Street of an imminent interest rate reduction at the Fed's upcoming September gathering. However, the inherent delay in the impact of monetary policy adjustments raises concerns that any intervention might come too late to avert a potential economic slowdown, suggesting that the stock market could still experience volatility.

Federal Reserve's Policy Dilemma and Market Implications

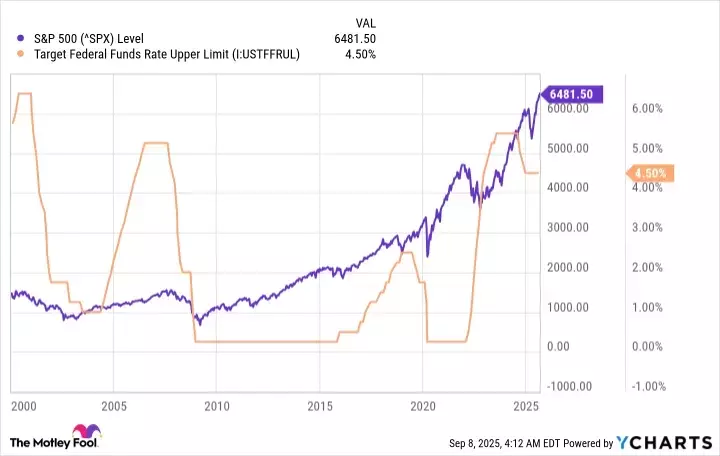

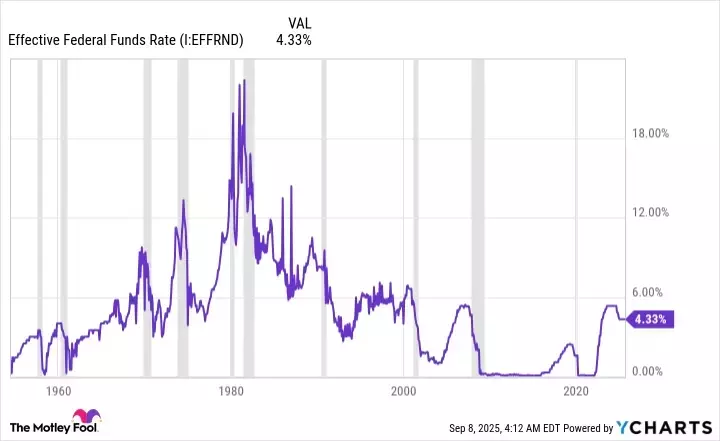

The Federal Reserve is currently navigating a complex economic landscape. On September 16th and 17th, the central bank is scheduled to convene for its next two-day policy meeting, a gathering that has captured the intense focus of financial markets. The prevailing sentiment on Wall Street suggests a near-certainty of an interest rate reduction, driven by recent data indicating a notable softening in the U.S. labor market. This comes despite the Consumer Price Index (CPI) remaining above the Fed's 2% target, presenting a policy quandary. Historically, the Fed has actively adjusted the federal funds rate to manage economic activity, particularly in response to deviations in unemployment and inflation. The aggressive rate hikes implemented between March 2022 and August 2023 successfully tempered inflation, bringing the CPI down from a 40-year peak of 8% in 2022 to an annualized 2.7% in 2025. This progress led to three rate cuts in late 2024, but 2025 has seen no further adjustments until now. However, the current weakness in job creation, with August seeing only 22,000 new jobs against an expectation of 75,000 and a rising unemployment rate reaching a four-year high of 4.3%, compels the Fed to reconsider its stance. Federal Reserve Chair Jerome Powell, in his August 22nd address at the Jackson Hole Economic Policy Symposium, hinted at a potential policy adjustment, reinforcing market expectations. CME Group's FedWatch tool now indicates a 100% probability of a September rate cut, with a significant likelihood of a 25-basis-point reduction. While lower interest rates are conventionally seen as a boon for the stock market, facilitating borrowing and boosting corporate earnings, an underlying economic downturn could negate these benefits. Historical precedents, such as the dot-com crash in 2000, the 2008 financial crisis, and the 2020 pandemic, demonstrate that stock markets can decline even as interest rates fall if broader economic conditions deteriorate. Given the observed lag between policy implementation and economic effects, the current slowdown in the job market suggests the Fed may already be behind the curve. Therefore, while a rate cut is anticipated, its immediate impact on the stock market might not be unilaterally positive if the economic decline continues.

This economic juncture underscores the delicate balance policymakers must maintain. While immediate reactions to rate cuts might be mixed, the historical resilience of the S&P 500 over the long term remains a powerful indicator. Periods of market weakness, driven by economic deceleration, often present strategic buying opportunities for investors focused on sustained growth rather than short-term fluctuations.