A critical window is closing for Americans looking to capitalize on federal tax incentives for sustainable technologies, including residential solar power systems, electric vehicles, and various energy-efficient home upgrades. With recent legislative action, these valuable financial inducements are slated for discontinuation in the near future. This abrupt policy change is creating a significant rush in the market, as consumers endeavor to complete their installations or purchases before the benefits are no longer available. Industry experts are advising prompt action, highlighting a 'now or never' scenario for those hoping to take advantage of these expiring government programs, which were originally designed to accelerate the adoption of cleaner energy solutions and reduce household utility expenses across the nation.

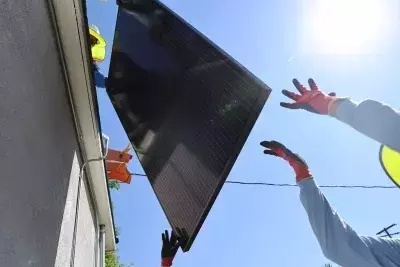

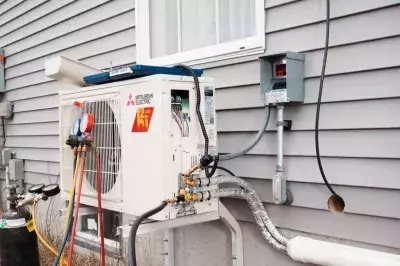

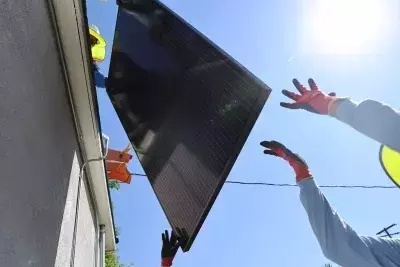

For homeowners considering the transition to renewable energy sources, the federal tax credit for rooftop solar panels, solar water heaters, and geothermal heat pumps is set to expire on December 31 of the current year. This incentive previously allowed homeowners to claim up to a 30% reduction on the cost of installation and equipment. This policy, a cornerstone of earlier climate initiatives, significantly lowered the financial barrier to adopting solar technology. Similarly, the Energy Efficient Home Improvement Credit, which provided up to $2,000 off for heat pumps, water heaters, and biomass systems, along with up to $1,200 for insulation, doors, and windows, also concludes on December 31. To qualify, equipment must be installed and operational before this deadline, emphasizing the urgency for prospective buyers to engage contractors and finalize projects without delay, as installation timelines can often extend over several months.

The landscape for electric vehicle (EV) purchasers is also undergoing a rapid transformation. Federal tax credits, offering up to $7,500 for new EVs and $4,000 for used models, are slated to end on September 30. These incentives, which could be utilized as cash rebates at the point of sale, have been a significant driver of EV adoption. The impending cessation of these credits has prompted a rush among auto dealerships to sell qualifying vehicles before the deadline. While some analysts suggest this might present a unique buying opportunity in the short term, there are concerns that the removal of these financial supports could slow the pace of EV market growth in the U.S. and prolong reliance on fossil fuel vehicles, potentially increasing future carbon emissions. Furthermore, a tax credit for installing EV charging infrastructure, particularly in underserved areas, will expire on June 30, 2026, with current administration actions already freezing certain federal funding for high-speed charging networks.

Despite the winding down of these federal programs, some localized financial assistance remains available. Homeowners and prospective EV buyers are encouraged to consult their local utility providers, as many offer incentives for energy-efficient upgrades such as heat pumps, residential solar, and insulation. Additionally, substantial funds allocated to states through the 2022 climate legislation, totaling over $8.5 billion for rebate programs, are still largely untapped. Non-profit organizations like Rewiring America and The Switch is On provide online tools to help individuals identify eligible federal, state, local, and utility incentives based on their location and income. Although these state-level programs offer a crucial lifeline, their long-term viability is uncertain, particularly as federal support diminishes. Experts warn that while many states may not exhaust their rebate funds this year, the eventual depletion of these resources, coupled with the absence of further federal aid, will mark a definitive end to this era of widespread green technology incentives.

The discontinuation of these federal incentives signals a pivotal moment for the clean energy and electric vehicle sectors. Consumers are faced with a limited timeframe to benefit from existing subsidies, creating a surge in demand for solar installations, energy-efficient appliances, and electric vehicles. This shift underscores the importance of prompt decision-making for those aiming to reduce their environmental footprint and energy costs with governmental financial assistance. While state and local initiatives may provide some continued support, the broader landscape for green technology adoption is poised for change as these significant federal catalysts are phased out.