Navigating the Fed's Monetary Policy Landscape: Decoding the Signals for Investors

The financial markets are closely watching the Federal Reserve's next policy move, with widespread expectations of another interest rate cut. However, the uncertainty lies in the magnitude of the reduction, with investors divided on whether it will be a 25 or 50 basis point cut. This article delves into the various indicators and models that suggest the central bank's path forward, providing valuable insights for investors navigating the evolving monetary policy landscape.Deciphering the Fed's Next Move: Clues from the Bond Market and Futures Traders

The Federal Reserve's upcoming policy meeting on November 7th, just two days after the election, has captured the attention of market participants. Fed funds futures data suggests a strong likelihood of a 50-basis-point rate cut, with the implied probability currently standing at around 61%. In contrast, the probability of a more modest 25-basis-point reduction is estimated at 39%. Notably, the chance of the Fed leaving rates unchanged is considered virtually negligible.The 2-Year Yield: A Proxy for the Fed's Target Rate

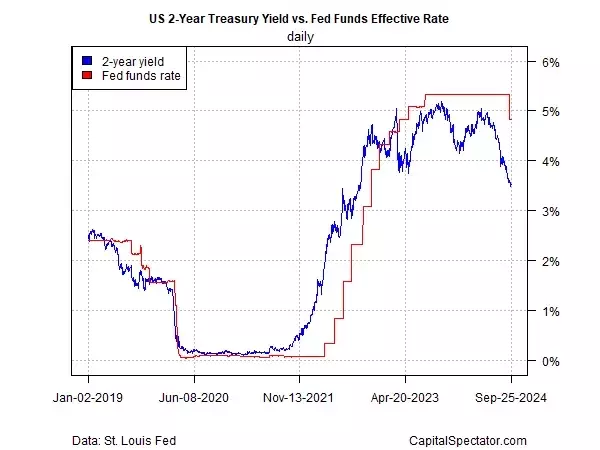

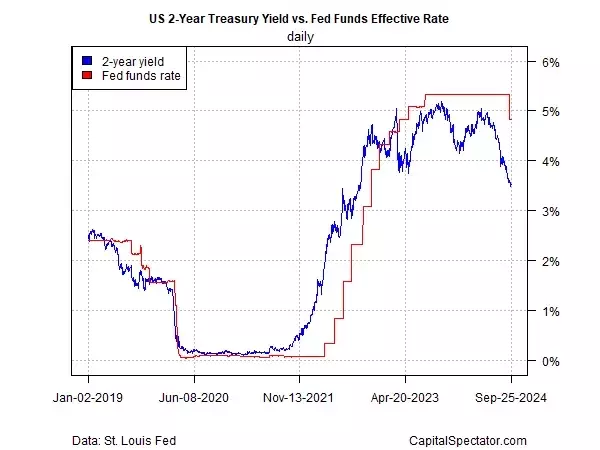

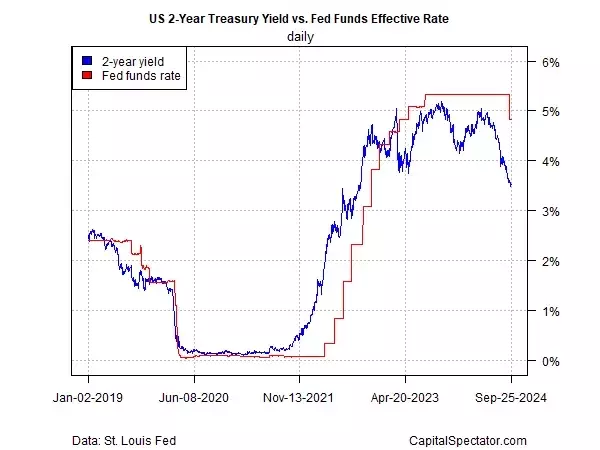

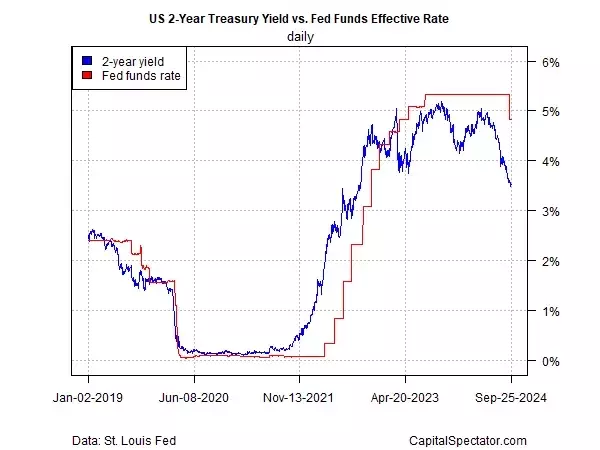

The policy-sensitive 2-year US Treasury yield provides valuable insights into the market's expectations for the Fed's target rate. Currently trading at 3.56% (as of September 25th), the 2-year yield continues to trade significantly below the Fed's current target range of 4.75% to 5.00%, which was reduced by 50 basis points just last week. This divergence suggests that the market anticipates further interest rate cuts in the near future, as the 2-year yield is often viewed as a proxy for the Fed's target rate.Modeling the "Optimal" Fed Funds Rate

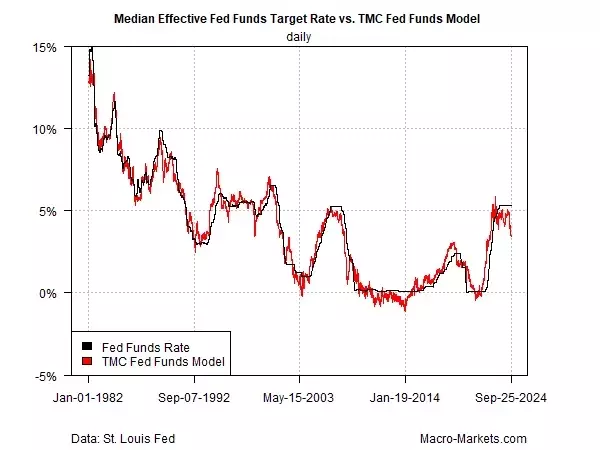

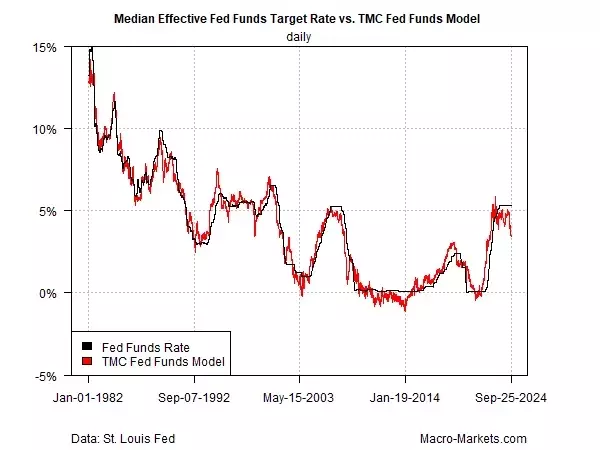

A multi-factor model developed by TMC Research offers an alternative perspective on the appropriate level of the Fed funds rate. This model, which incorporates various economic indicators, estimates the "optimal" Fed funds rate to be around 3.4% - significantly lower than the current target range. This analysis provides further support for the case of additional monetary policy easing by the central bank.Inflation, Unemployment, and the Fed Funds Rate

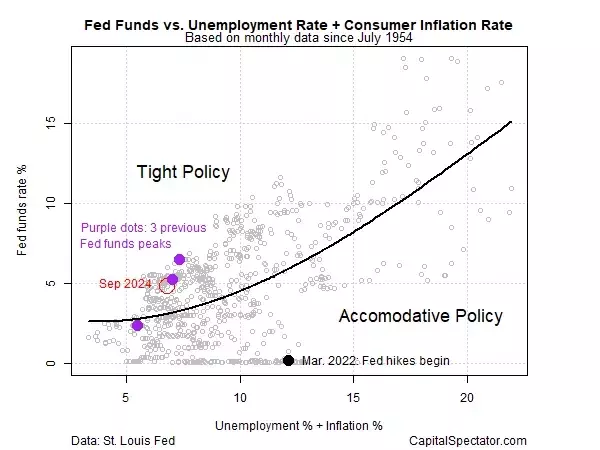

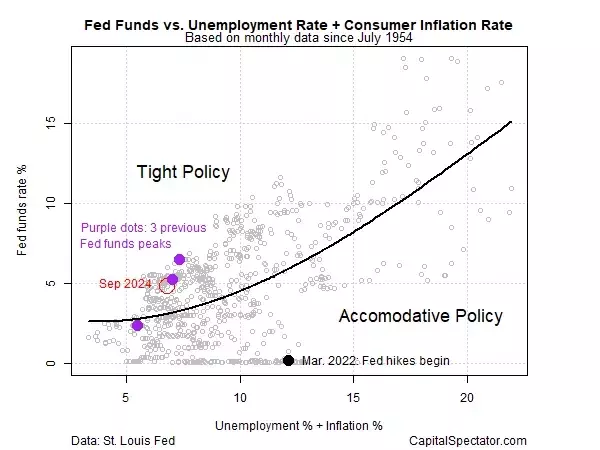

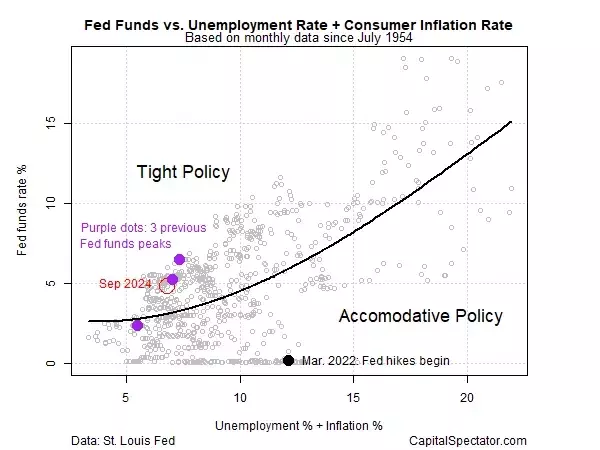

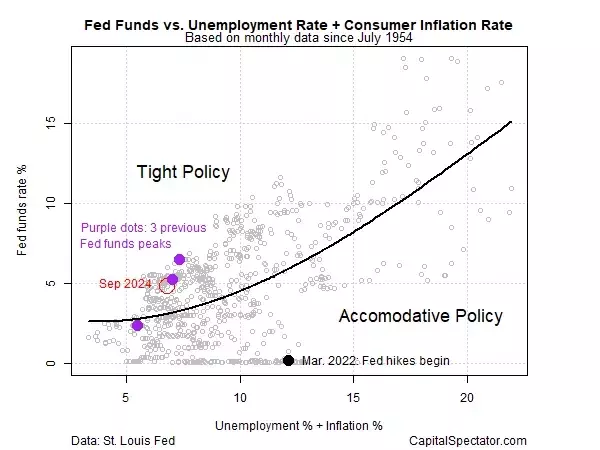

Another model that considers the relationship between consumer inflation, the unemployment rate, and the Fed funds rate also points to the need for further policy easing. This analysis suggests that the current Fed funds rate remains elevated relative to the level implied by the combination of inflation and unemployment, indicating that monetary policy is still relatively tight from this perspective.Implications for Investors: Navigating the Evolving Landscape

The various indicators and models examined in this article paint a consistent picture of the Federal Reserve's likely path forward. The strong market consensus, the divergence between the 2-year yield and the current target range, and the model-based assessments all point to the probability of a more aggressive 50-basis-point rate cut at the upcoming policy meeting.For investors, this evolving monetary policy landscape presents both challenges and opportunities. Closely monitoring the Fed's actions and the market's response will be crucial in positioning investment portfolios to capitalize on the changing interest rate environment. By staying informed and adapting their strategies accordingly, investors can navigate the complexities of the current market and potentially unlock new avenues for growth and risk management.You May Like