The Fed's Delicate Dance: Navigating Market Pressures and Economic Data

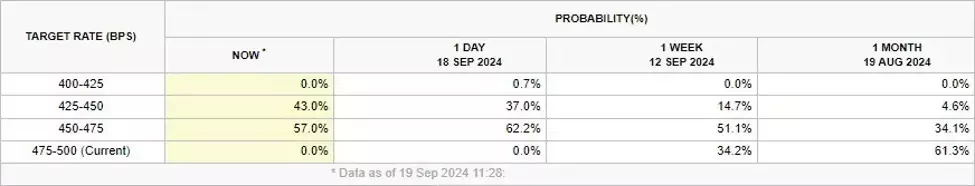

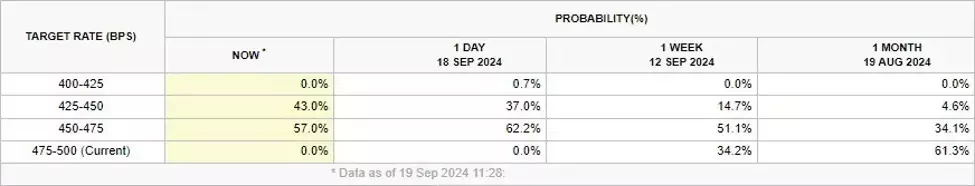

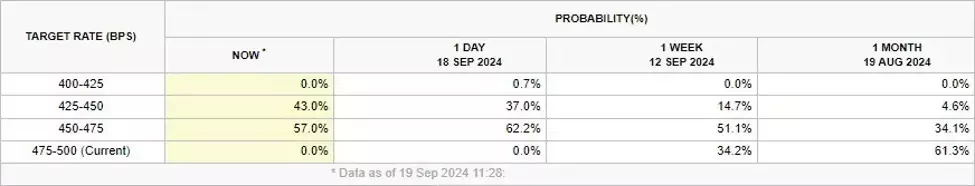

The Federal Reserve's upcoming policy decisions have become a subject of intense scrutiny, as market participants and economic analysts closely monitor the central bank's signals. The recent developments suggest that the Fed might be considering a more gradual approach to interest rate adjustments, potentially signaling a 25-basis-point cut in both November and December. However, the central bank's ability to maintain its course has been tested, as markets have shown a willingness to exert pressure on the Fed's decision-making process.Balancing Act: The Fed's Dilemma

Navigating Market Expectations

The Fed's recent actions have demonstrated its willingness to respond to market pressures, raising concerns about the central bank's ability to maintain its independent stance. While the Fed has traditionally aimed to make decisions based on its assessment of economic conditions, the current environment has highlighted the influence that market sentiment can have on its policy decisions. This dynamic poses a delicate challenge for the Fed, as it must balance its commitment to data-driven policymaking with the need to maintain market confidence and stability.The Labor Market's Influence

The labor market has emerged as a critical factor in the Fed's decision-making process. As the central bank seeks to maintain its outlook, the performance of the job market in the weeks ahead will be closely watched. Weaker-than-expected data, particularly in the labor market, could potentially prompt market participants to believe that the Fed can be swayed into implementing a more aggressive 50-basis-point rate cut in the future. This scenario would have significant implications for the dollar and broader financial markets, as it could signal a shift in the Fed's policy stance and its ability to maintain its independence.Vindication or Capitulation?

The onus now lies on the upcoming economic data to either vindicate the Fed's current outlook or compel the central bank to reconsider its approach. If the data, especially in the labor market, deteriorates, it could potentially embolden market players to exert further pressure on the Fed, potentially leading to a more aggressive policy response. However, if the data supports the Fed's assessment, it would strengthen the central bank's position and its ability to maintain its intended course of action.Navigating the Delicate Balance

The Fed's challenge in the coming weeks and months will be to navigate this delicate balance between market expectations and its own data-driven policy decisions. The central bank must demonstrate its commitment to its mandate while also maintaining market confidence and stability. This will require a deft touch and a clear communication strategy to ensure that the Fed's actions are understood and supported by market participants and the broader public.Implications for the Dollar and Financial Markets

The outcome of the Fed's policy decisions and its ability to maintain its independence will have significant implications for the dollar and broader financial markets. If the central bank is perceived as being overly influenced by market pressures, it could undermine confidence in the dollar and lead to increased volatility in financial markets. Conversely, if the Fed is able to stay the course and make decisions based on its assessment of economic conditions, it could bolster the dollar's standing and provide a measure of stability in the markets.You May Like