Ethereum's Resilience Amid Market Volatility: A Closer Look

Ethereum, the second-largest cryptocurrency by market capitalization, has been making headlines for its recent price movements. Despite facing rejection around the $2,700 level, the digital asset has demonstrated remarkable resilience, showcasing its potential to navigate the volatile crypto landscape. This article delves into the factors influencing Ethereum's current trajectory, exploring the implications of the rising Estimated Leverage Ratio and the institutional flow trends, while also providing a comprehensive Ethereum price forecast.Ethereum's Resilience Amid Market Volatility: Navigating the Challenges

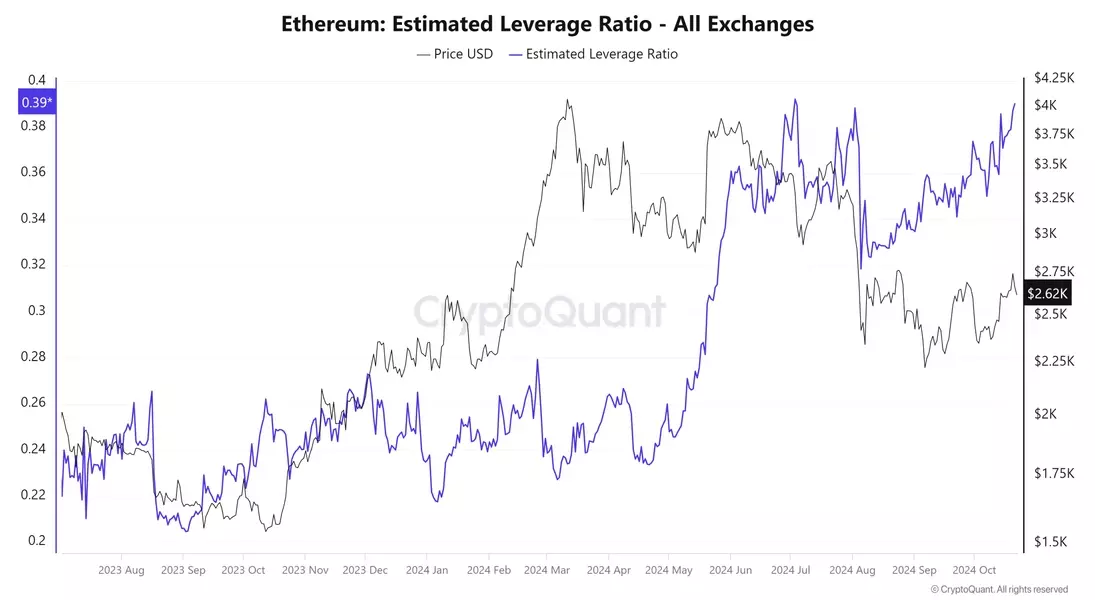

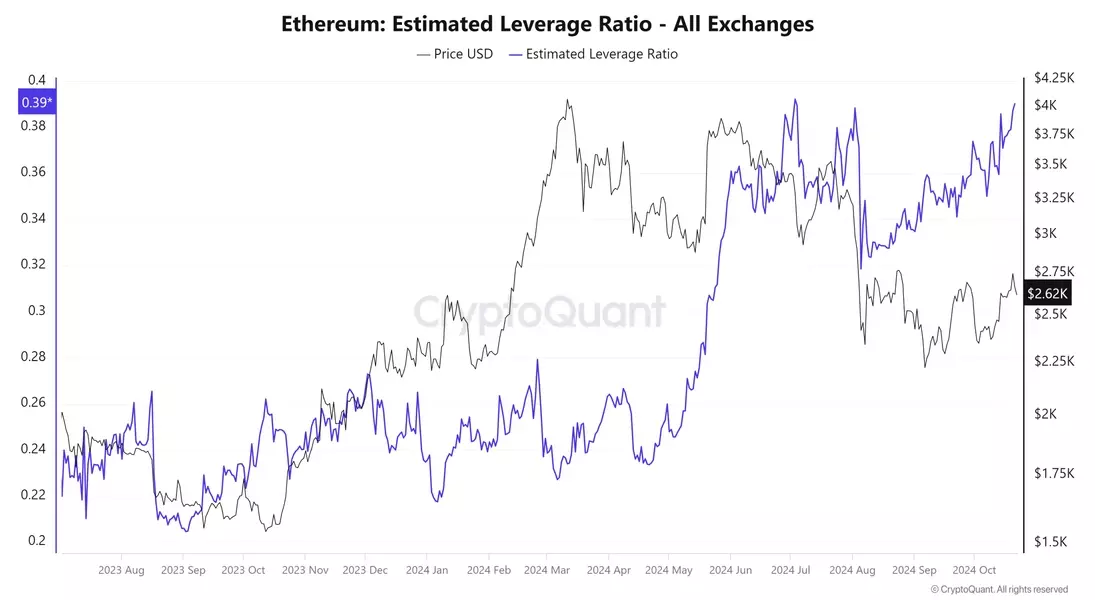

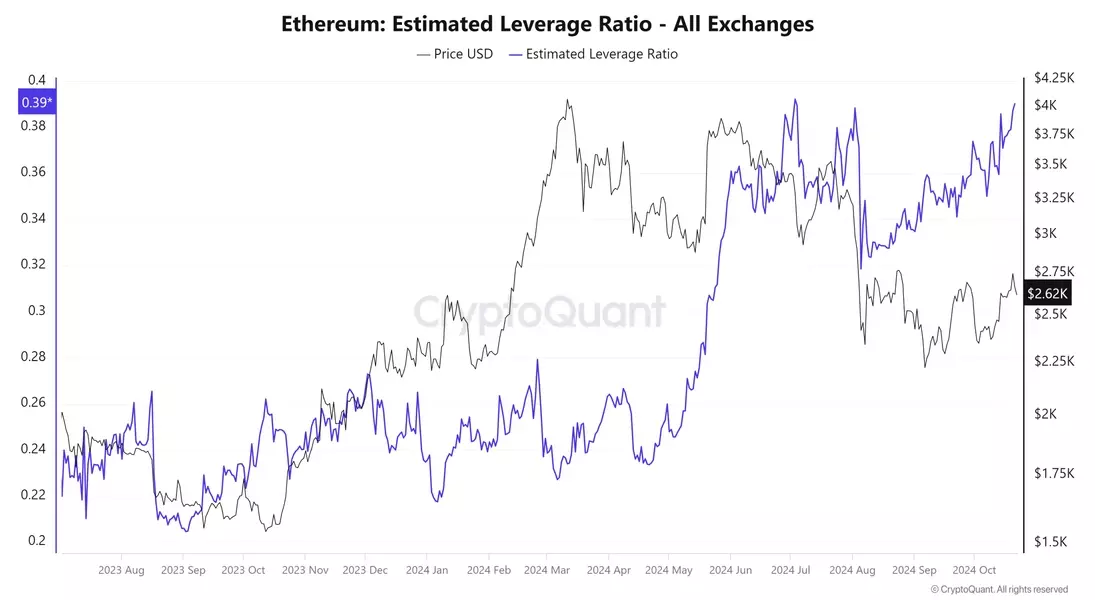

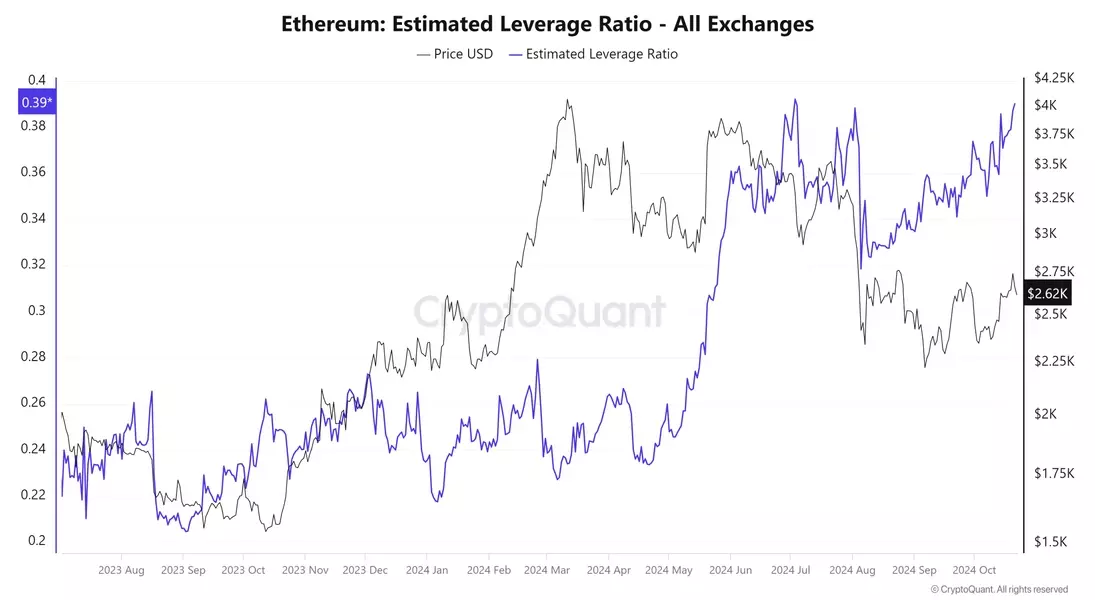

Ethereum's Estimated Leverage Ratio: A Double-Edged Sword

Ethereum's Estimated Leverage Ratio (ELR) has been a topic of keen interest among market analysts. According to CryptoQuant data, the ELR has increased to its highest level since early July, reaching 0.39. This rise in the metric indicates that more traders are opening high-leverage short positions, driven by a bearish sentiment. While this may seem concerning, it also presents a potential opportunity for a short-squeeze scenario.A short-squeeze event occurs when a sudden and unexpected rise in the asset's price forces traders with short positions to close their positions, leading to a surge in buying pressure and further price appreciation. This dynamic can significantly drive up Ethereum's price, as traders scramble to cover their over-leveraged short positions. The high ELR suggests that the futures market is overheated, making Ethereum vulnerable to such a short-squeeze event, which could trigger impulsive buying and propel the digital asset's value higher.Institutional Flow: A Mixed Bag for Ethereum

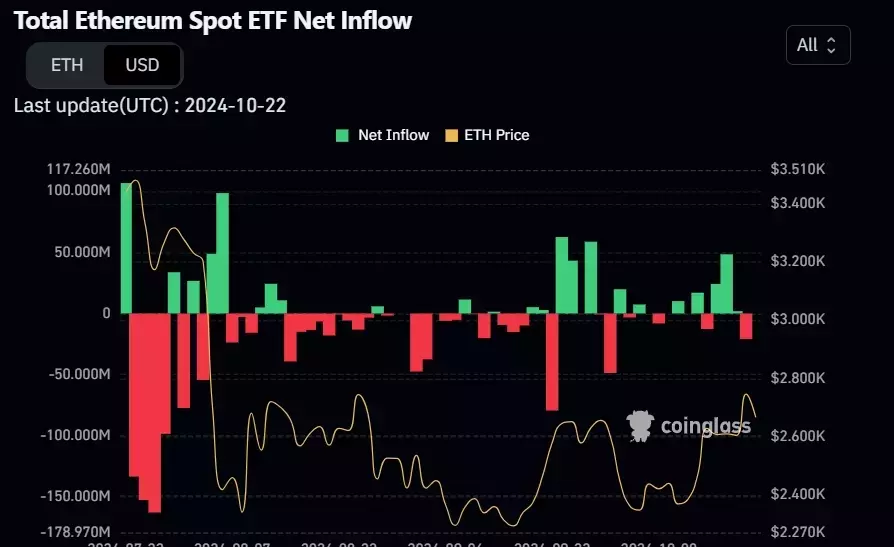

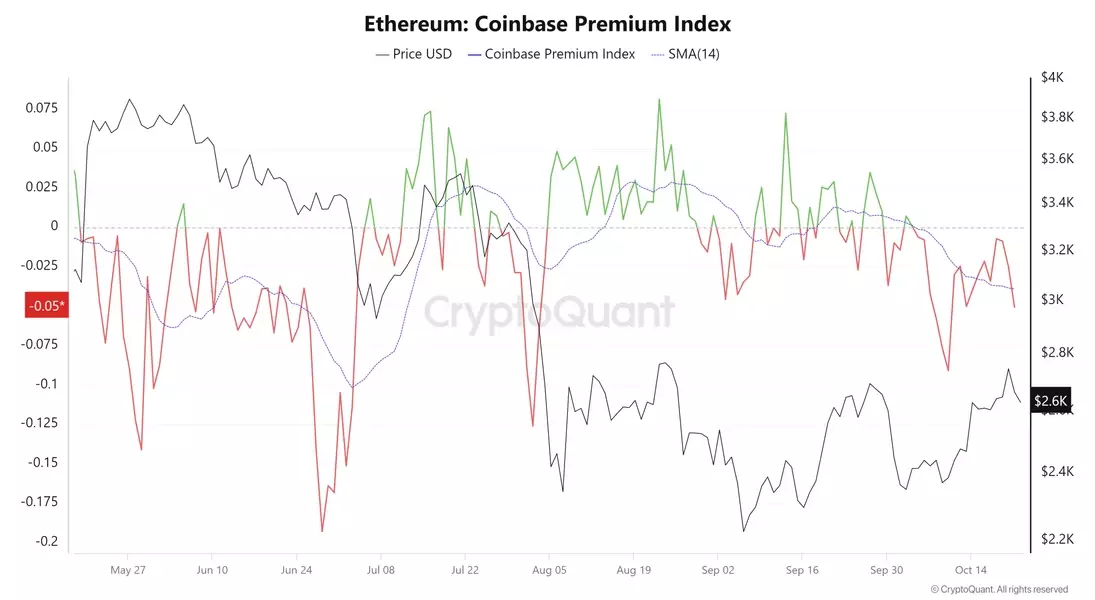

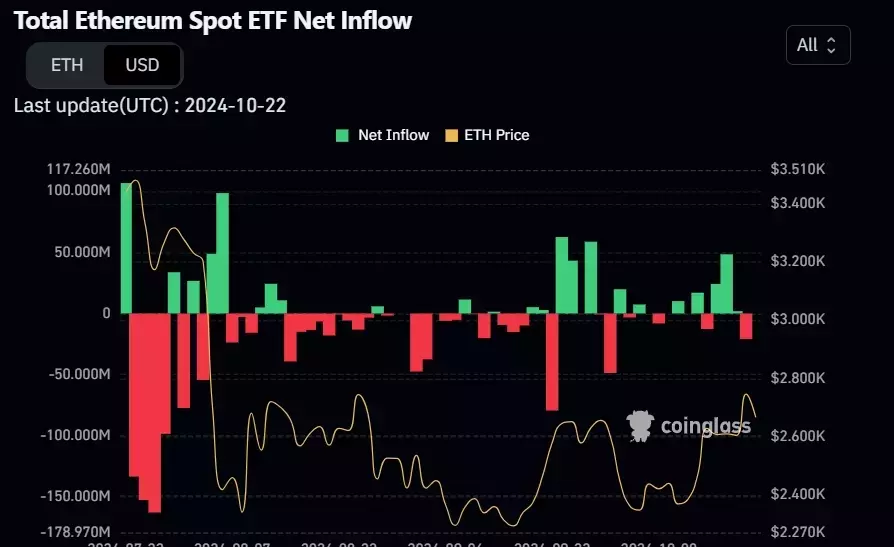

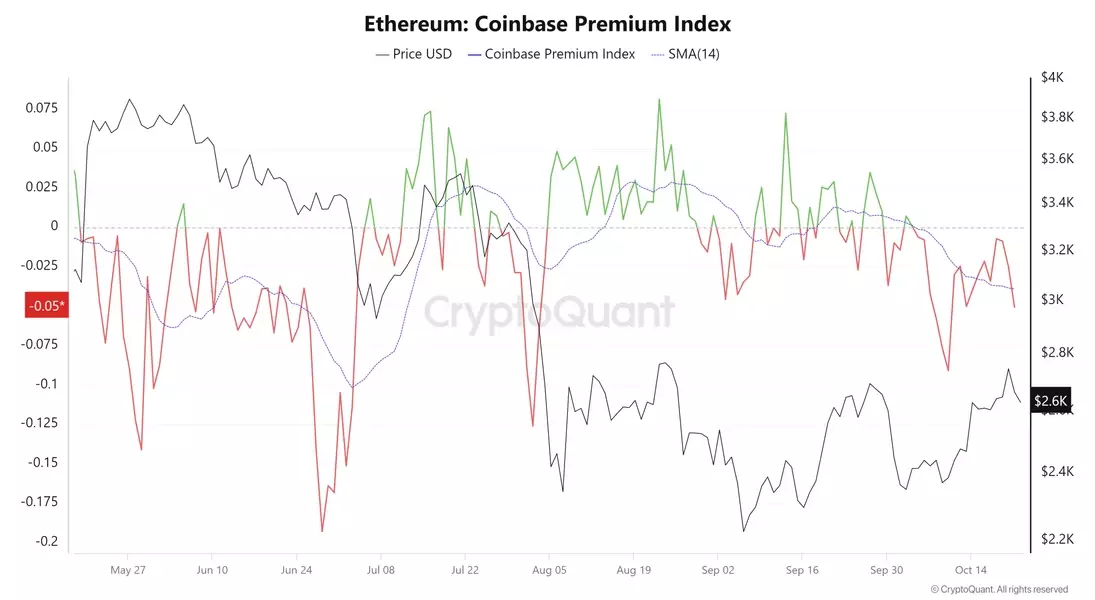

The institutional flow of Ethereum has been a mixed bag, with the US spot Ethereum Exchange Traded Funds (ETFs) recording a mild outflow of $20.80 million on Monday. This outflow, while relatively small, could be an indication of a temporary shift in institutional sentiment towards Ethereum.However, it's important to note that the institutional flow is not the sole determinant of Ethereum's price trajectory. The CryptoQuant Ethereum Coinbase Premium Index, which measures the price gap between Coinbase Pro (USD pair) and Binance (USDT pair), provides valuable insights into the behavior of large-wallet investors. This metric currently stands at -0.039, below its neutral level of zero, suggesting signs of weakness in the market.For Ethereum's price to rally, the Coinbase Premium Index must rise above its neutral value of zero, indicating increased whale accumulation and a more favorable sentiment among institutional investors. This metric serves as a crucial indicator for assessing the overall health of the Ethereum market and the potential for future price appreciation.Ethereum Price Forecast: Navigating the Volatility

Ethereum's price action has been closely monitored by traders and investors alike. The digital asset faced resistance around its descending trendline, drawn by joining multiple highs from the end of May, and declined 2.9% on Monday. As of Tuesday, Ethereum continues its retracement, trading around the $2,600 level.If Ethereum's downward trend persists, the digital asset could decline further to retest its daily support level of around $2,461. The Relative Strength Index (RSI) momentum indicator, currently reading 56 and pointing downwards on the daily chart, suggests a weakening in bullish momentum. If the RSI continues to decline and closes below its neutral level of 50, it could lead to a more pronounced decline in Ethereum's price.On the other hand, if Ethereum manages to break the descending trendline and close above $2,820, the digital asset's price could rally to retest its next daily resistance at $2,927. This scenario would indicate a potential reversal in the current downward trend and a renewed surge in buying pressure.Ethereum's price forecast remains a delicate balance, with the digital asset navigating the volatile crypto landscape. The interplay between the Estimated Leverage Ratio, institutional flow, and technical indicators will continue to shape Ethereum's future price movements, making it crucial for investors and traders to closely monitor the evolving market dynamics.