The beginning of the year has seen a surge in emerging-market bond sales, but this momentum is at risk as higher US Treasury rates pose challenges for weaker credits. While some countries and companies have managed to tap into international capital markets, the trend favors higher-rated borrowers. This shift highlights the vulnerability of high-yield borrowers to changes in global financial conditions, leaving them with limited options. The situation is further complicated by expectations of inflationary policies from the incoming US administration, which could exacerbate borrowing costs.

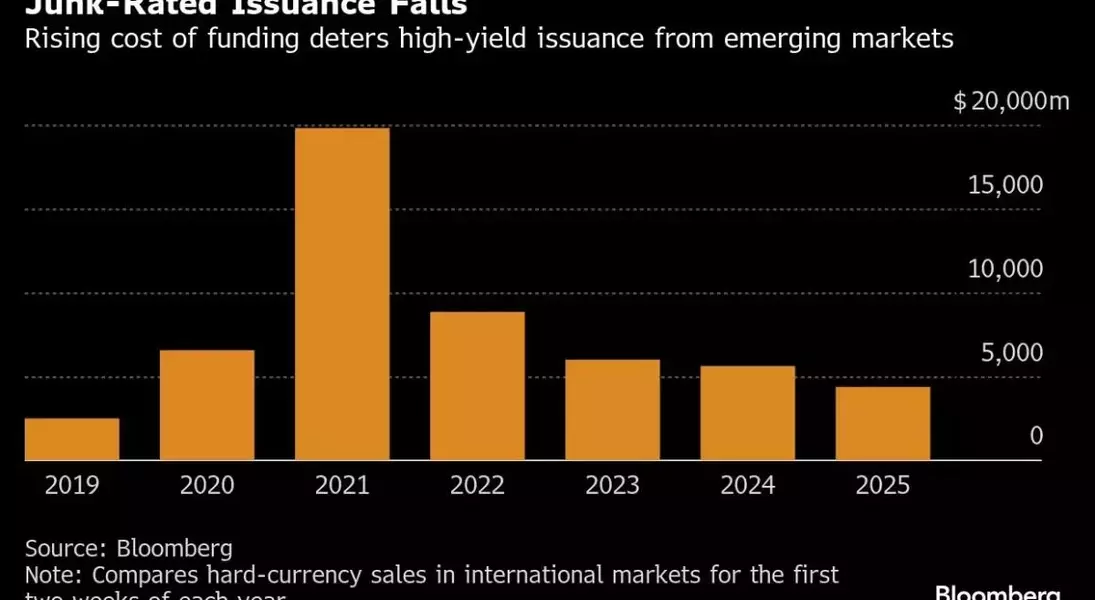

In recent weeks, several emerging-market sovereigns have rushed to issue bonds, taking advantage of a brief lull in rising US yields. By early 2025, the total value of Eurobond sales had reached approximately $34 billion, marking a 12% increase compared to the same period in 2024. However, most of these issuers boast investment-grade credit ratings, including nations like Saudi Arabia, Mexico, and Slovenia. Benin stands out as an exception, successfully placing a $500 million bond despite its lower rating. Meanwhile, corporate and government-linked borrowers with junk ratings have struggled, with debt sales totaling around $6 billion so far in 2025—a decline of 7% from the previous year.

The preference for higher-quality credits reflects broader market concerns about future interest rate movements. Investors are wary that US Treasury yields may rise again after President-elect Donald Trump takes office, given his support for policies that could fuel inflation. In response, many high-yield borrowers are exploring alternative funding sources, such as private markets or bridge loans, to navigate the challenging environment. For instance, Angola recently secured $1 billion in financing through repo operations, while Pakistan is preparing to debut yuan-denominated bonds. These unconventional approaches offer flexibility in terms of size and duration, making them attractive options for borrowers facing tight public market conditions.

Despite the current challenges, there are signs of stabilization in US Treasury yields, which have retreated to around 4.6% in recent days. This has reassured some investors, who now anticipate potential Federal Reserve interest-rate cuts. Additionally, historical data shows that high-yield bond sales have experienced slow starts in the past three years, following a boom in January 2021. Analysts believe that once the uncertainty surrounding the Trump inauguration subsides, issuance activity will likely resume, with investment-grade borrowers leading the way. High-yield borrowers may follow suit once market conditions improve further.

As the year progresses, emerging-market borrowers will need to carefully monitor global financial trends and adapt their strategies accordingly. The ability to secure financing in a changing economic landscape will be crucial for maintaining stability and growth in these regions. With various factors at play, including policy shifts and market dynamics, the coming months will test the resilience of emerging-market economies and their access to capital.