In recent months, investors in emerging markets have adopted a more selective approach towards high-yield dollar bonds, as the broad-based rally that characterized previous years begins to lose momentum. As global market volatility and economic uncertainties increase, portfolio managers are now carefully choosing bonds from developing economies that have underperformed relative to their peers. This shift in strategy reflects a growing awareness of the risks associated with overvalued assets and the need for prudent investment decisions.

The changing dynamics in the bond market have led some fund managers to focus on specific opportunities within distressed debt. Countries like Argentina and Ecuador, which have seen significant gains in recent years, continue to attract interest due to their potential for further appreciation. Meanwhile, nations such as Senegal and Gabon, whose bonds have become relatively inexpensive, offer attractive risk-reward profiles. These investments require thorough analysis and a nuanced understanding of local economic conditions, but they present promising prospects for those willing to take calculated risks.

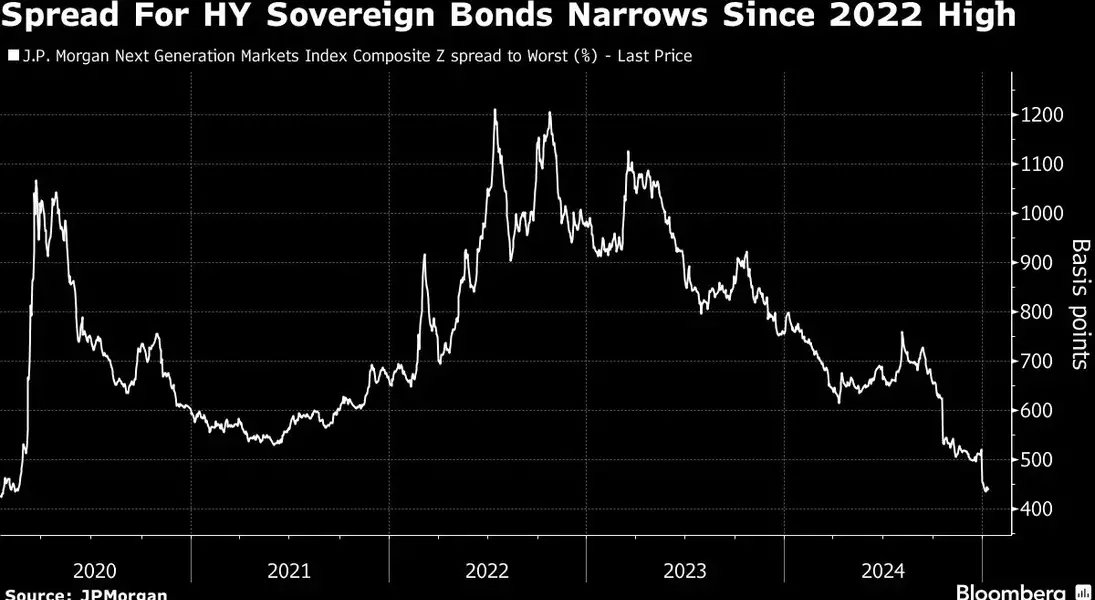

Despite the allure of these selective investments, the broader high-yield rally is showing signs of fatigue. After delivering impressive returns in 2023 and 2024, the asset class now faces challenges from fluctuating global markets, Federal Reserve policies, trade tensions, and concerns about economic growth. The narrowing risk premium for high-yield sovereign bonds has raised questions about whether the rewards still justify the risks. As investors navigate this uncertain landscape, the emphasis on careful selection and diversification becomes increasingly important, underscoring the need for strategic thinking and long-term planning in emerging market investments.