In today's ever-evolving housing market, marked by fluctuating conditions and shifting mortgage rates, the ability of mortgage professionals to consistently secure new clients is paramount. Sustained growth and profitability within the mortgage industry hinge on a proactive and multifaceted approach to lead generation. By strategically implementing various outreach and engagement methods, professionals can establish a strong pipeline of interested individuals, ensuring a continuous stream of business opportunities even amidst market challenges.

Developing an effective lead generation strategy involves more than just sporadic efforts; it requires a holistic approach that integrates both traditional and modern marketing techniques. From building robust professional networks to harnessing the power of digital platforms and personalized communication, a comprehensive strategy empowers mortgage specialists to not only attract but also nurture potential clients. This commitment to ongoing engagement and relationship building is what ultimately translates interest into closed deals, reinforcing a professional's expertise and commitment to exceptional service.

Cultivating Connections and Leveraging Digital Reach

Building strong professional referral networks and strategically utilizing digital platforms are fundamental pillars for mortgage professionals seeking to expand their client base. Collaborating with complementary professionals such as real estate agents, financial advisors, and attorneys can create a powerful referral ecosystem. By offering insightful presentations and providing valuable resources, mortgage officers can become trusted partners, leading to a consistent flow of qualified leads. Concurrently, a robust online presence through social media engagement and targeted advertising campaigns allows professionals to reach a wider audience, educate potential clients, and highlight their expertise in a dynamic and accessible manner.

Beyond traditional networking, the digital landscape offers unparalleled opportunities for lead generation. Platforms like Instagram, Facebook, YouTube, and LinkedIn serve as fertile ground for sharing educational content, market insights, client testimonials, and personal anecdotes that humanize the professional. Boosting posts and running targeted advertisements on these channels can significantly amplify reach, drawing in individuals actively seeking mortgage information. Furthermore, investing in purchased leads from reputable sources provides an immediate influx of potential clients, though careful vetting of these sources is essential to ensure lead quality. The combination of cultivating professional relationships and strategically leveraging digital marketing tools creates a powerful synergy, driving both organic and accelerated lead acquisition for mortgage specialists.

Optimizing Operations and Engaging the Community

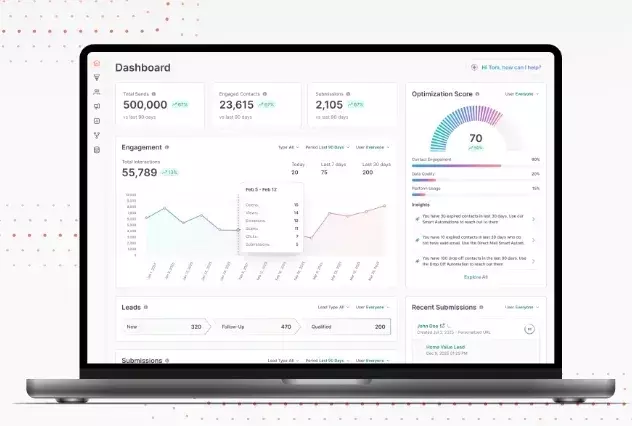

Efficient client relationship management (CRM) and active community involvement are crucial for converting leads and fostering long-term client loyalty in the mortgage sector. A well-organized CRM system, enhanced by AI-driven tools, allows professionals to categorize leads, track interactions, and automate personalized communications, ensuring that hot prospects receive timely attention. Simultaneously, engaging with the local community through events and activities positions mortgage officers as accessible and trustworthy figures, building rapport and generating organic referrals through word-of-mouth. These combined efforts create a comprehensive strategy that not only attracts new clients but also optimizes the entire client journey from initial contact to successful loan closure.

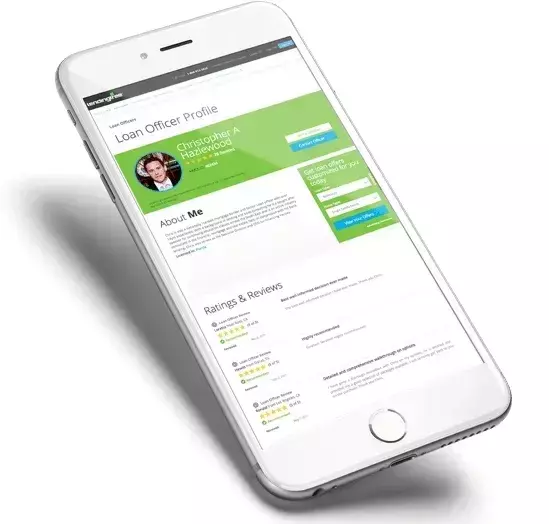

The strategic implementation of an optimized CRM is transformative for lead management, enabling precise segmentation of client data and the automation of tailored email drip campaigns. This ensures that communications are relevant and timely, guiding potential clients through the mortgage process with clear, educational content. Complementing digital strategies, a visible and informative professional website serves as a central hub, offering valuable resources and clear calls to action that convert visitors into leads. Beyond the digital realm, direct mail campaigns targeting specific geographic areas provide a tangible touchpoint, reinforcing brand presence within local communities. Moreover, actively participating in local events, whether sponsoring a sports team or hosting educational seminars, allows mortgage professionals to forge genuine connections, showcasing their commitment to the community. This blend of operational efficiency, digital outreach, and community engagement creates a powerful and sustainable framework for continuous mortgage lead generation and client retention.