Resilient Stocks Defy Economic Headwinds

Despite a deluge of important economic data, stocks have proved remarkably resilient this week, defying expectations and showcasing the market's ability to weather turbulent times. Investors are now turning their attention to the upcoming Federal Reserve interest rate decision, as they navigate the ever-evolving economic landscape.Navigating the Shifting Tides of the Market

Weathering the Economic Storm

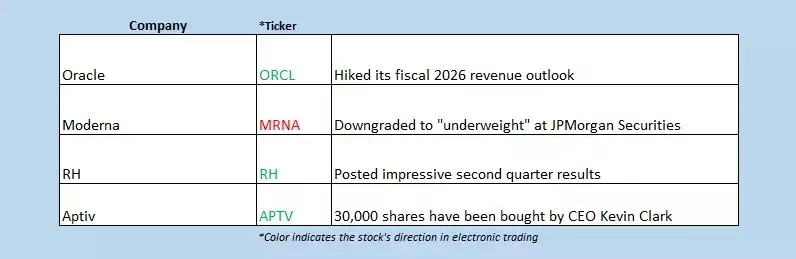

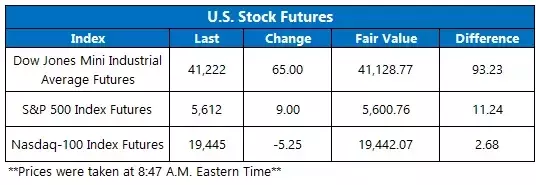

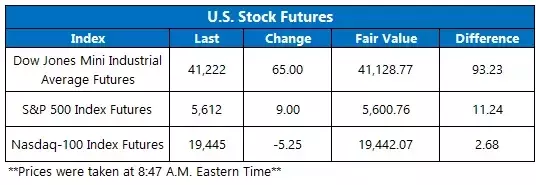

The markets have demonstrated remarkable resilience in the face of a barrage of economic data this week. Futures on the Dow Jones Industrial Average (DJIA) are up 65 points ahead of the bell, while the S&P 500 Index (SPX) and Nasdaq-100 Index (NDX) futures hover around fair value. Barring any dramatic turn of events, all three major indexes are poised to build on their sizable weekly gains.The key inflation data has been digested, and investors are now eagerly awaiting the Federal Reserve's upcoming interest rate decision. In the meantime, import prices have fallen 0.3% in August, providing a glimmer of hope for easing inflationary pressures.Navigating the Volatility

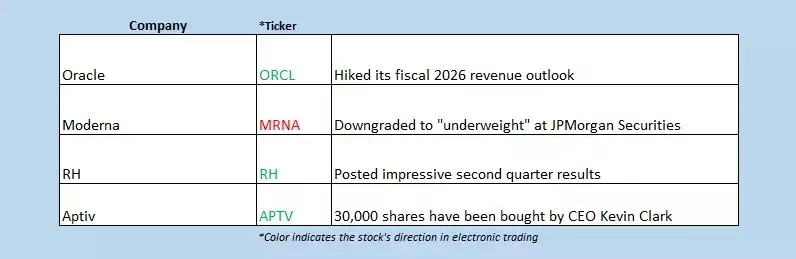

The Cboe Options Exchange (CBOE) saw a flurry of activity on Thursday, with over 1.8 million call contracts and more than 1 million put contracts exchanged. The single-session equity put/call ratio fell to 0.57, while the 21-day moving average remained at 0.65, indicating a shift in investor sentiment.Amidst the market volatility, individual stocks have also been making headlines. Boeing Co (NYSE:BA) stock is down 4.4% premarket, after the airline manufacturer's factory workers rejected the new labor contract and went on strike. Year to date, the equity is down a staggering 37.6%.AstraZeneca plc (NASDAQ:AZN) stock, on the other hand, is off 1.8% before the bell, following a downgrade by Deutsche Bank from "hold" to "sell." Despite this setback, the equity is still up 17.3% year to date, though it is on track for its biggest weekly decline since July 2023.Navigating the Earnings Landscape

The earnings season has also been a focal point for investors, with Adobe Inc (NASDAQ:ADBE) being the latest company to report. Shares of the software giant are down 8.8% in electronic trading, as the company's disappointing current-quarter guidance overshadowed its upbeat fiscal third-quarter results. Heading into today, ADBE is down 1.7% in 2024.As the market navigates these shifting tides, investors are keeping a close eye on the upcoming events, including the Federal Reserve's interest rate decision, which is set to be a key driver of market sentiment in the coming week.Exploring the Global Landscape

The resilience of the US markets is not an isolated phenomenon, as the global markets have also been grappling with their own set of challenges. In Asia, the markets have had a mixed performance, with the Nikkei in Japan shedding 0.7%, while the Kospi in South Korea finished up 0.1% and the Hang Seng in Hong Kong added 0.8%.The European markets have also been closely watching the developments, with the European Central Bank's (ECB) decision to slash inflation rates yesterday still in focus. The major indexes in Europe are higher in response, with London's FTSE 100 up 0.3%, France's CAC 40 also up, and Germany's DAX 0.6% higher.The global economic landscape is constantly evolving, and investors must navigate these shifting tides with a keen eye and a steady hand. As the markets continue to demonstrate their resilience, the coming weeks and months will undoubtedly bring new challenges and opportunities, requiring investors to stay vigilant and adaptable.