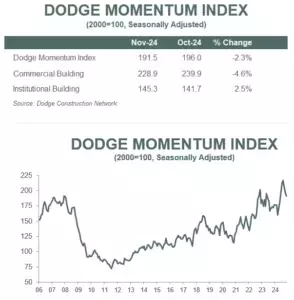

December 6, 2024, brought significant developments in the commercial and institutional sectors. The Dodge Momentum Index (DMI) showed a 2.3% decrease in November to 191.5 (2000=100) from the revised October reading of 196.0. This month witnessed a 4.6% fall in commercial planning and a 2.5% improvement in institutional planning.

Forecasting Insights and Challenges

Throughout 2024, there has been robust growth in nonresidential planning activity. However, labor shortages and high construction costs have hindered the smooth progression of these projects through the planning process. Sarah Martin, the associate director of forecasting at Dodge Construction Network, pointed out that the current backlog might be constraining short-term commercial planning demand. There is also uncertainty regarding new tariff and immigration policies under President-elect Trump's administration, which could potentially cause some hesitation among developers. But overall, easing monetary policy is expected to alleviate the backlog and stimulate more project demand in the coming months.On the commercial side, slower data center, office, warehouse, and retail planning led to a significant decline this month. Conversely, strong growth in education planning contributed to the institutional side's growth. The institutional portion of the DMI has shown positive trends in the last 6 months.In November, the DMI was 12% higher than the year-ago levels. The commercial segment saw a 13% increase from November 2023, while the institutional segment grew by 8% over the same period. It's important to note that if we exclude all data center projects in 2023 and 2024, commercial planning would be down 6% year-on-year, and the entire DMI would be down 1%.A total of 17 projects valued at $100 million or more entered the planning stage in November. Notable commercial projects included the $350 million Bally’s Hotel Tower and Casino in Las Vegas, Nevada, and the $312 million Accokeek Data Center in Stafford, Virginia. Among the institutional projects, the $465 million student dormitory at UC Berkeley, California, and the $323 million Intensive Treatment Tower at Texas Health Presbyterian in Plano, Texas, stood out.The DMI is a crucial monthly measure of the value of nonresidential building projects entering the planning phase, and it leads construction spending for nonresidential buildings by a full year. This provides valuable insights for industry stakeholders and helps in making informed decisions.You May Like