The 2024 U.S. presidential election was a pivotal moment, with significant implications for the energy sector. As the results unfolded, the futures markets for crude oil and natural gas became a focal point, as traders and analysts sought to gauge the potential impact of the new administration's policies. This article delves into the intriguing insights revealed by these futures prices, shedding light on the market's expectations and the challenges facing the incoming president's energy agenda.

Uncovering the Futures Market's Perspective on the Election Outcome

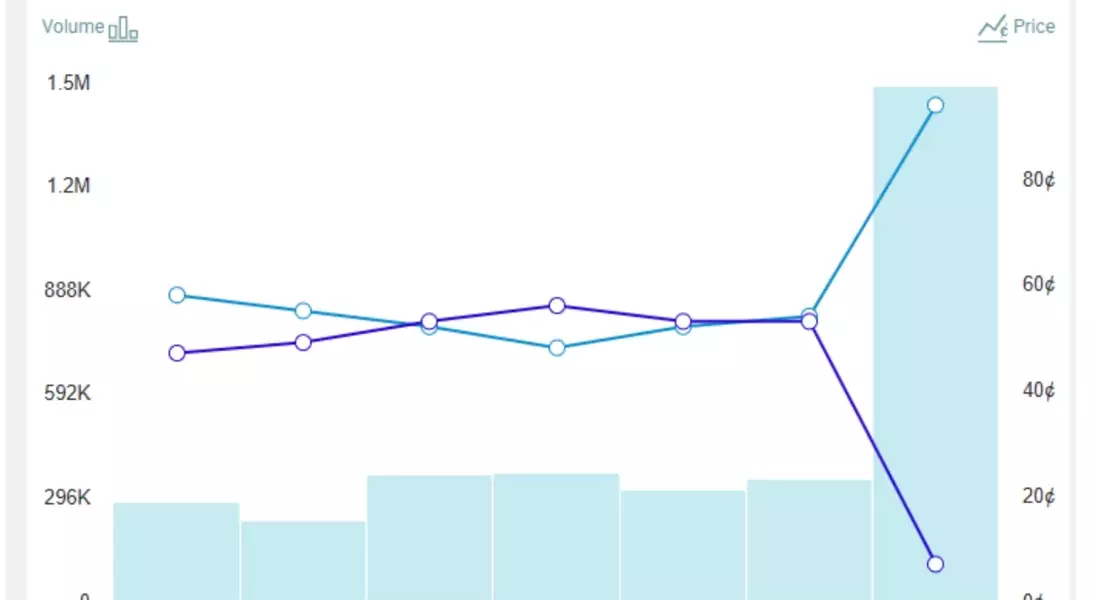

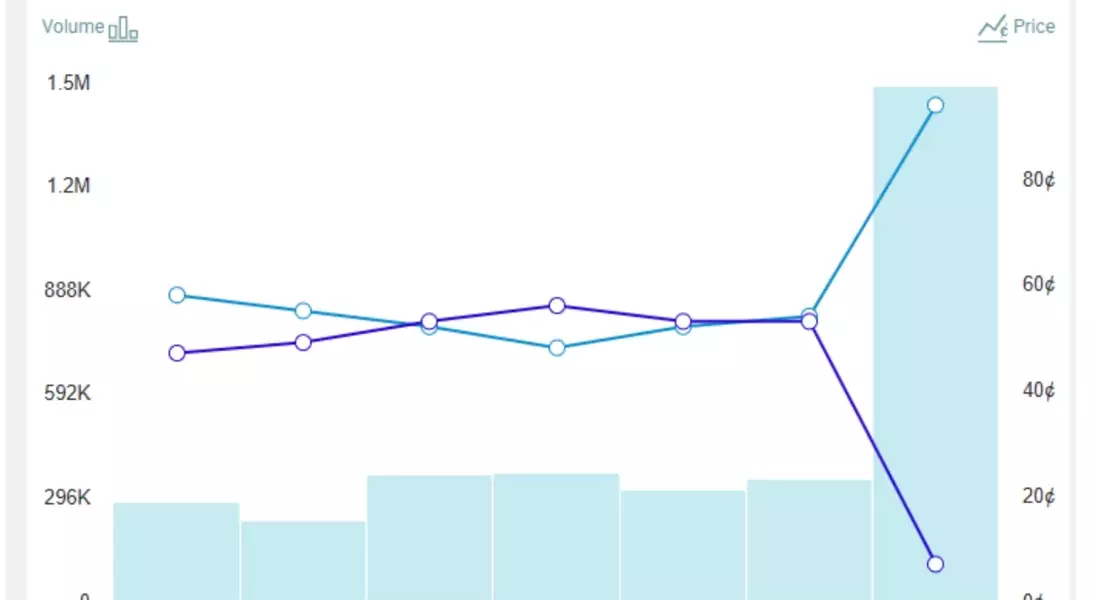

Crude Oil Futures: Unfazed by the Election Results

Contrary to the bold claims made by the former president during the campaign, the futures market for crude oil delivery in June 2025 showed little to no reaction to the election outcome. The price remained largely unchanged on November 5th and 6th, the days when the election results became clear. This pattern held true for other contract months as well, with futures prices for December 2025 and June 2026 also exhibiting stability.The resilience of crude oil futures prices suggests that the market was skeptical about the former president's ability to significantly influence U.S. oil production. Even his ambitious promise to quadruple or quintuple domestic oil output was met with skepticism, as futures prices remained firmly grounded in the realities of the market.Natural Gas Futures: Unfazed by the Election Outcome

The natural gas futures market, centered around the Henry Hub pricing hub in Louisiana, also displayed a lack of reaction to the election results. Prices for June 2025 delivery, as well as those for December 2025 and June 2026, remained largely unchanged on November 5th and 6th.This stability in natural gas futures is particularly noteworthy, as the U.S. natural gas market is not a global one. Had the election outcome signaled expectations of increased U.S. natural gas production, one would have expected to see a corresponding drop in futures prices. However, the data suggests that the market did not anticipate any significant changes in the country's natural gas supply and demand dynamics.Interpreting the Futures Market's Perspective

The unwavering futures prices for both crude oil and natural gas indicate that the market participants did not believe the former president's bold claims about his ability to transform the U.S. energy landscape. Despite the rhetoric, the futures markets suggest that the new administration's policies were unlikely to have a dramatic impact on the country's oil and gas production in the near term.This finding aligns with the views of economists and industry experts, who have long argued that the president's ability to directly influence energy production is limited. The U.S. has already become the world's largest oil and gas producer, and this trend is unlikely to change significantly in the next few years, regardless of who occupies the White House.The Challenges Ahead for the New Administration

While the futures markets may have shrugged off the former president's energy promises, the new administration still faces a complex set of challenges in the energy sector. The Biden administration's pause on approvals for new LNG export facilities, for instance, has created uncertainty in the natural gas market, with potential implications for the country's energy exports and global energy dynamics.Moreover, the U.S. oil and gas industry is already operating in a challenging environment, with many producers struggling to turn a profit even at current price levels. This underscores the inherent limitations of what a president can do to significantly boost domestic energy production, especially when market forces are already exerting significant pressure.As the new administration takes office, it will need to navigate these complex realities, balancing its energy and environmental policy goals with the practical constraints of the market. The futures markets have provided a clear signal that bold promises alone are not enough to sway the energy sector, and that a more nuanced and pragmatic approach will be required to address the challenges ahead.You May Like