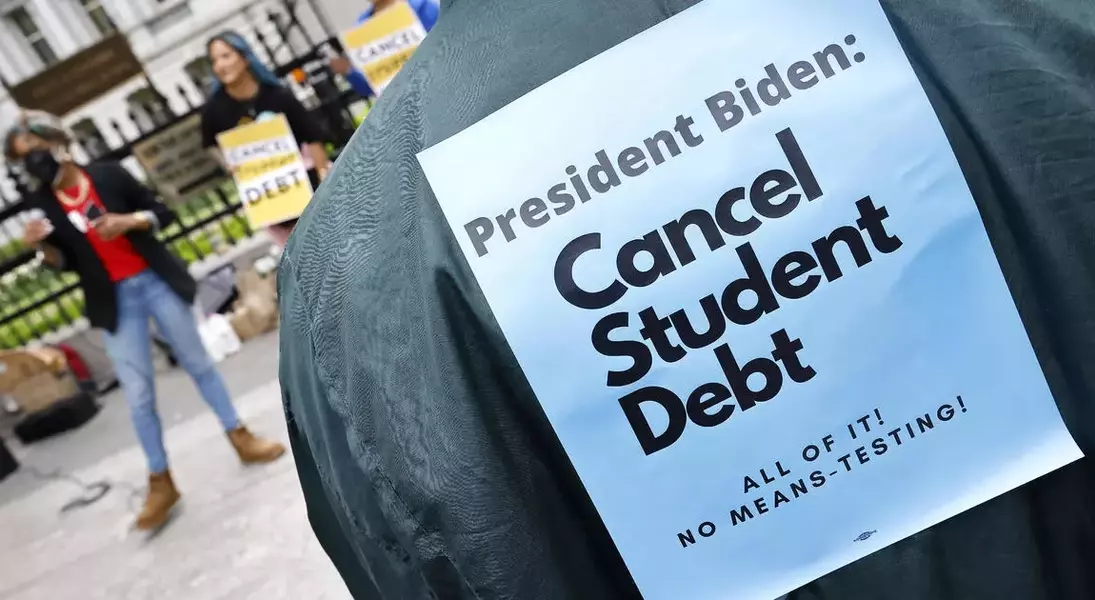

The Biden administration's efforts to provide student debt relief have faced numerous legal challenges, but a new plan aims to offer assistance to millions of borrowers facing financial hardships. The proposed regulations would enable the Department of Education to offer one-time debt forgiveness to those at risk of default, as well as a pathway for borrowers to apply for relief based on various factors. This initiative seeks to address the growing burden of student loans and the impact it has had on the financial well-being of Americans.

Easing the Burden of Student Debt for Millions

Targeted Debt Relief for High-Risk Borrowers

The Biden administration's new plan would provide automatic debt relief to borrowers whom the Education Department determines have an 80% chance of defaulting within two years. This one-time forgiveness is designed to address the alarming rate of student loan defaults, which the Education Secretary described as "more than 1 million" annually. By proactively identifying and assisting these high-risk borrowers, the government aims to prevent the devastating consequences of default, which can have long-lasting impacts on an individual's financial well-being.Application-Based Debt Forgiveness

In addition to the automatic relief, the proposed regulations would also offer a pathway for borrowers to apply for debt forgiveness. The Department of Education would assess 17 factors, including the applicant's overall debt balance, household income, and whether their student loan payments are hindering their ability to afford basic necessities like housing or healthcare. This comprehensive evaluation would ensure that the relief is targeted towards those experiencing the most severe financial hardships, providing a lifeline to those struggling to make ends meet.Addressing the Student Debt Crisis

The student debt crisis in the United States has reached staggering proportions, with Americans holding more than $1.7 trillion in student loans. This overwhelming burden has impaired the ability of borrowers to save, buy a home, and achieve other financial milestones. The Biden administration's new plan represents a significant step towards addressing this crisis, recognizing that the current system has made it "too difficult for borrowers experiencing hardships" to access the relief they desperately need.Overcoming Legal Challenges

The Biden administration's previous efforts to provide widespread student debt relief have faced legal obstacles, with Republican-led states filing lawsuits to block such initiatives. The Supreme Court's 2023 ruling against the administration's plan to erase up to $20,000 in debt for millions of borrowers was a significant setback. However, the new proposal, with its targeted approach and application-based relief, aims to navigate these legal challenges and provide meaningful assistance to those in financial distress.Restoring the Promise of Higher Education

The Education Secretary emphasized that the student loan system should not leave borrowers "buried in a ditch," but rather help them "climb the economic ladder." The proposed regulations seek to restore the promise of higher education, ensuring that the pursuit of knowledge and skills does not become a lifelong burden. By providing relief to those facing the most severe financial hardships, the Biden administration hopes to empower borrowers to achieve their goals and contribute to the broader economic well-being of the nation.You May Like