In 2025, small-cap investors experienced a testing period marked by market volatility and a speculative trend that often sidelined fundamentally strong companies. Despite these challenges, the consistent application of a disciplined, quality-focused investment strategy is anticipated to yield substantial long-term benefits. The market's tendency to sometimes favor speculation over solid fundamentals underscores the importance of patience and a steadfast commitment to intrinsic value. This approach, likened to the slow, deliberate growth of an avocado orchard, positions investors to capitalize when market sentiment inevitably realigns with underlying company strength, promising significant outperformance in the years to come.

This steadfast investment philosophy extends beyond market cycles, becoming a cornerstone for firms like Riverwater. As the company celebrates a decade of growth and achieves significant milestones in asset management, it reinforces the value of building strong foundations and adhering to core principles. The journey of an emerging manager, from proving track record to establishing robust infrastructure, mirrors the long-term cultivation of value. This enduring commitment to responsible and value-driven investing, even through uncomfortable periods, is poised to reward clients who entrust their capital with a vision for sustained prosperity and impactful societal contributions.

The Enduring Value of Patience in Small-Cap Investing

The year 2025 presented a unique crucible for investors dedicated to high-quality small-cap companies. Despite an initial burst of optimism following the November 2024 election, which saw the Russell 2000 index reach unprecedented levels, the market quickly pivoted towards speculative assets, largely overlooking companies with robust fundamentals. This shift created an environment where firms emphasizing profitability, strong management, and sensible valuations faced headwinds, leading to periods of underperformance. The analogy to planting an avocado orchard perfectly captures this reality: just as a farmer commits to a long-term process without immediate gratification, quality-focused investors must endure discomfort, understanding that the seeds sown today are for future harvests. History consistently demonstrates that such periods of market irrationality often precede significant opportunities for disciplined investors, affirming that patience is not merely a passive waiting game but an active, strategic choice essential for long-term success.

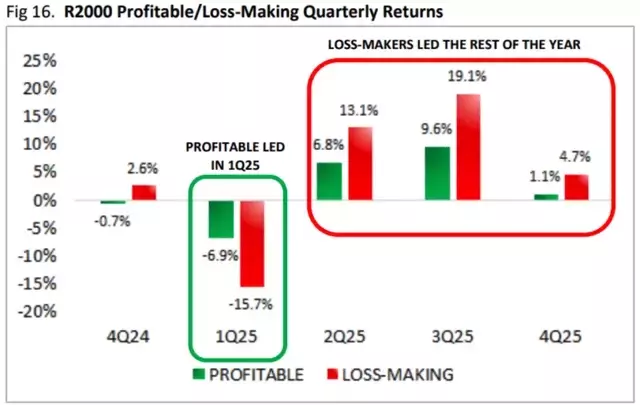

The market's "whiplash" in 2025, characterized by rapid shifts from tariff announcements to sharp downturns and subsequent recoveries, highlighted the unpredictable nature of external factors. Small-cap stocks, in particular, experienced a bear market dip before a surprising recovery, with lower-quality companies often leading the rally. This phenomenon is a familiar one, reminiscent of past speculative bubbles where market momentum temporarily overshadowed intrinsic value. However, such deviations from fundamental performance are typically transient. The prevailing valuation discount of small-caps relative to large-caps, last observed before the tech bubble, further suggests an impending shift. For investors committed to quality, this environment is not a cause for despair but a strategic vantage point, providing an opportunity to acquire undervalued assets that possess the resilient management, strong balance sheets, and competitive advantages necessary for substantial long-term compounding, especially when market recognition for these attributes returns.

Strategic Resilience: Limoneira's Avocado Expansion and Market Outlook

Limoneira (LMNR), a venerable California agribusiness with a 132-year history, stands as a prime example of the long-term, patient capital allocation strategy advocated by Riverwater Partners. Their multi-year investment in expanding avocado acreage, planting 1,500 acres with many trees still maturing, illustrates a foresight that transcends immediate market fluctuations. The biological imperative of avocado trees, requiring years to bear fruit and reach full production, mirrors the extended timeline often needed for strategic investments to yield their full potential. This deliberate expansion, undertaken long before the emergence of current supply chain vulnerabilities and trade policy uncertainties affecting Mexican avocado imports, now appears particularly prescient. Limoneira's domestic orchards are poised to capitalize on a critical window when Mexican supply is low, demonstrating how strategic, patient capital deployment can build an inimitable competitive advantage, regardless of short-term stock performance or policy shifts.

Despite Limoneira's stock experiencing declines in the past year, reflecting broader market trends that have challenged quality-focused small-cap investors, its underlying strategy highlights a crucial aspect of resilient investing. The company’s restructuring to prioritize avocado production, a move driven by avocados' significantly higher profit per acre compared to lemons, underlines a clear, long-term vision for enhancing shareholder value. This strategic pivot, coupled with the inherent difficulties competitors would face in replicating such an extensive, time-intensive agricultural investment, solidifies Limoneira's long-term competitive positioning. This approach aligns with a broader market outlook that anticipates a shift back towards rewarding fundamental strength. As Riverwater Partners looks ahead to 2026, the current market conditions, characterized by compelling small-cap valuations and the cyclical nature of speculative trends, are seen as a setup for future outperformance, where companies like Limoneira, built on patient, strategic investments, are well-positioned for substantial gains.