Crude Oil Futures Fluctuate Amidst Geopolitical Tensions

The global energy market has been closely watching the recent movements in crude oil futures, as prices have been settling down, despite the ongoing tensions in the Middle East. This article delves into the key factors driving the current trends in the oil market and explores the potential implications for various stakeholders.Navigating the Volatile Oil Landscape

Tracking the Price Fluctuations

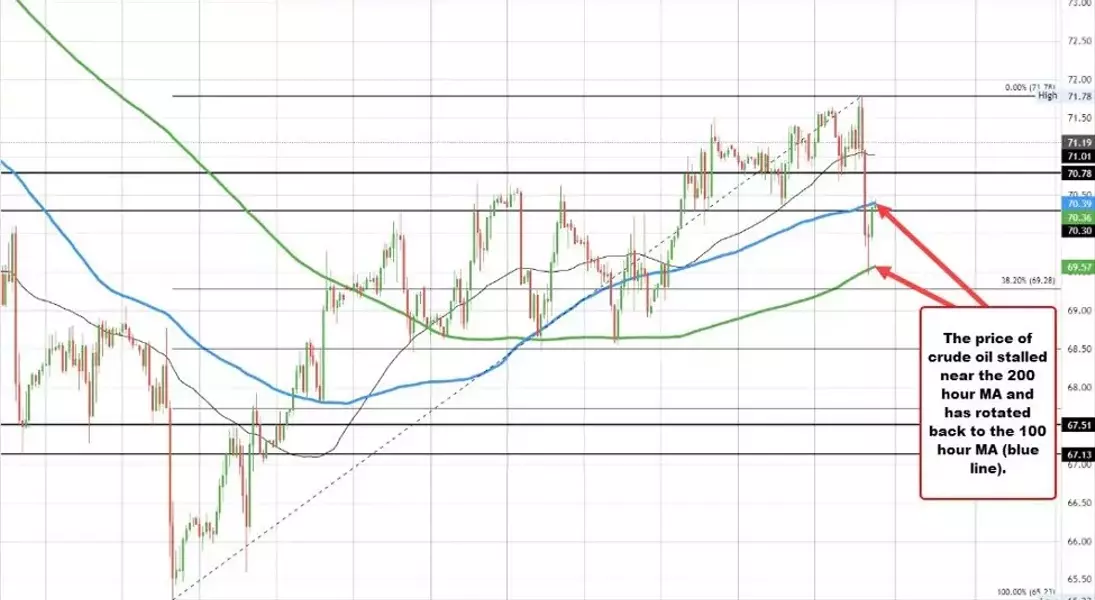

The price of crude oil futures has been on a rollercoaster ride, with the latest settlement showing a decline of $0.63 or 0.89%, closing at $70.37. The day's trading range saw the price dip as low as $69.52 and reach a high of $71.78. Interestingly, the price has found support at its rising 200-hour moving average, a technical indicator that suggests a potential upward trend.However, the price has struggled to break above its 100-hour moving average, which currently stands at $70.39. This resistance level could be a crucial factor in determining the future direction of the market. If the price can successfully breach the 100-hour moving average, it could signal a bullish shift in sentiment. Conversely, a sustained break below the 200-hour moving average could tilt the bias towards a bearish outlook.Geopolitical Tensions and their Impact

The recent price movements in the crude oil futures market have been particularly intriguing, given the ongoing tensions in the Middle East. One would expect the heightened geopolitical risks to drive prices higher, as concerns over supply disruptions typically lead to a risk premium being priced into the market.Yet, the current price action suggests that other factors may be at play, potentially offsetting the impact of the geopolitical tensions. It is possible that the market is factoring in the potential for diplomatic resolutions or the availability of alternative supply sources to mitigate the risk of supply disruptions.Alternatively, the market may be weighing the potential for a slowdown in global economic growth, which could dampen the demand for crude oil and exert downward pressure on prices. The ongoing trade disputes and the potential for a global recession could be contributing to this sentiment.Navigating the Uncertainty

The current state of the crude oil futures market is characterized by a high degree of uncertainty, with various factors pulling the price in different directions. Investors and market participants will need to closely monitor the evolving situation and be prepared to adapt their strategies accordingly.Key factors to watch include the progress of diplomatic efforts to resolve the Middle East tensions, the trajectory of global economic growth, and the technical indicators that could signal a shift in the market's direction. Additionally, the potential for supply disruptions, changes in OPEC production policies, and the impact of geopolitical events on consumer sentiment will all play a crucial role in shaping the future of the oil market.As the market navigates this volatile landscape, it will be essential for stakeholders to stay informed, analyze the data, and make well-informed decisions to manage their exposure and capitalize on the opportunities that may arise.You May Like