CRISPR Therapeutics faces an ongoing challenge with the slower-than-anticipated launch of CASGEVY, a gene therapy product. This situation, coupled with continued cash expenditure, prompts a strategic reassessment, shifting the company's primary focus toward its burgeoning cardiovascular pipeline. Despite a substantial cash reserve, the imperative for groundbreaking advancements in competitive therapeutic areas remains crucial for the company's long-term financial health and market positioning.

CRISPR Therapeutics Navigates Challenges with CASGEVY and Pivots to Cardiovascular Research

In the dynamic realm of biotechnology, CRISPR Therapeutics (CRSP) is currently navigating a period of strategic recalibration. Historically, the company's primary focus has been on CASGEVY, an ex vivo gene therapy co-marketed with Vertex Pharmaceuticals (VRTX), designed for sickle cell disease. However, the initial rollout of CASGEVY has encountered unexpected hurdles, leading to slower revenue recognition due to a cost recoupment agreement with Vertex. Despite these setbacks, there are encouraging signs, with an acceleration in patient infusions and ongoing efforts for geographic market expansion.

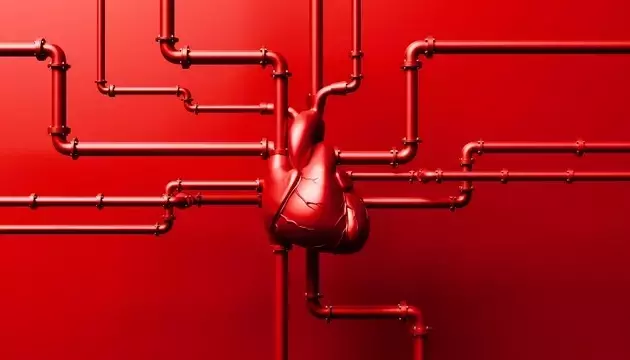

Amidst the lukewarm reception of CASGEVY, CRISPR Therapeutics is strategically pivoting its research and development efforts. The spotlight is now firmly on its cardiovascular pipeline, with particular attention to two promising candidates: CTX310, targeting dyslipidemia, and CTX611, an siRNA therapy for venous thromboembolism (VTE) prophylaxis. The company is keenly anticipating significant data milestones, most notably the Phase 2 TKA data for CTX611, projected for release in 2026. This data is expected to serve as a crucial catalyst, potentially reshaping investor sentiment and the company's future trajectory.

Financially, CRISPR Therapeutics maintains a solid foundation, boasting a cash reserve of $1.98 billion. This capital is projected to sustain operations for approximately three to four years, providing a vital runway for continued research and development. However, the company operates in highly competitive therapeutic landscapes, demanding not just innovation, but also the delivery of truly transformative clinical outcomes. To justify its substantial R&D investments and achieve financial breakeven, CRISPR Therapeutics must demonstrate compelling success with its pipeline assets.

This strategic shift underscores the inherent risks and rewards within the biotech sector. While gene therapies like CASGEVY hold immense promise, their path to market adoption can be fraught with complexities. By diversifying its focus to the cardiovascular pipeline, CRISPR Therapeutics is actively mitigating risks and exploring new avenues for growth and impact. The coming years will be critical in determining whether these new ventures can deliver the breakthrough results needed to solidify its position as a leader in gene editing and therapy.

The journey of CRISPR Therapeutics highlights the unpredictable nature of drug development and market penetration in the biotechnology sector. The initial challenges faced by CASGEVY serve as a stark reminder that even groundbreaking scientific advancements require meticulous strategic planning and adaptability. The company's pivot towards a robust cardiovascular pipeline, backed by significant financial resources, demonstrates a proactive approach to overcoming obstacles and seeking new opportunities. However, the ultimate success hinges on the ability to translate scientific potential into tangible clinical and commercial victories. This situation emphasizes the importance of continuous innovation and strategic flexibility in an industry that demands both scientific rigor and market acumen.