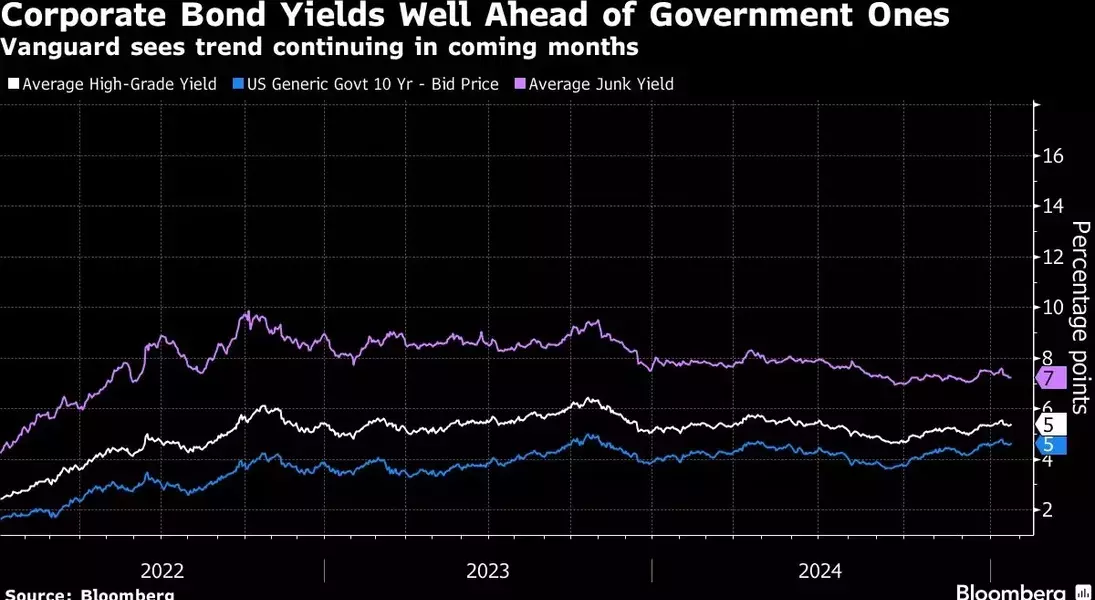

In a recent analysis, Vanguard Group Inc., one of the world's leading asset managers, has forecasted that corporate bonds will likely surpass Treasury bonds for the seventh consecutive year. This prediction is underpinned by the current market stabilization and elevated interest rates, which are enhancing returns for investors. According to Vanguard’s fixed-income team, led by Sara Devereux, today's bond yields offer attractive opportunities compared to those seen since the 2008 financial crisis. The firm emphasizes that while uncertainty remains due to factors like fiscal policy and Federal Reserve actions, the overall environment remains favorable for fixed income investments.

Market Dynamics Favor Corporate Bonds in a Shifting Economic Landscape

In the evolving economic terrain, US corporate bonds present higher starting yields compared to government bonds across various sectors. This advantage positions them well to deliver steady income streams, potentially outperforming other investment options. Vanguard, managing an impressive $122 billion through its BND exchange-traded fund, anticipates significant inflows into debt markets. The firm highlights several strategic preferences: it favors industrial sector bonds rated at the lower end of investment-grade and prefers shorter-maturity bonds. Additionally, Vanguard maintains a cautious stance on high-yield bonds, noting limited room for absorbing negative surprises as spreads tighten historically.

The incoming administration adds a layer of unpredictability, influencing growth, inflation, and monetary policy outcomes. However, Vanguard believes that this volatility could create new opportunities for savvy investors. The firm argues that uneven economic conditions can lead to market dislocations, which skilled investors can capitalize on through strategic security selection. Despite uncertainties, the potential for generating alpha remains strong if credit fundamentals remain robust.

From a journalist's perspective, this outlook underscores the importance of adaptability in investment strategies. Investors must stay informed about macroeconomic trends and be prepared to pivot their portfolios in response to changing market conditions. The insights provided by Vanguard suggest that while challenges persist, there are ample opportunities for those who can navigate the complexities of the fixed income market with precision and foresight.