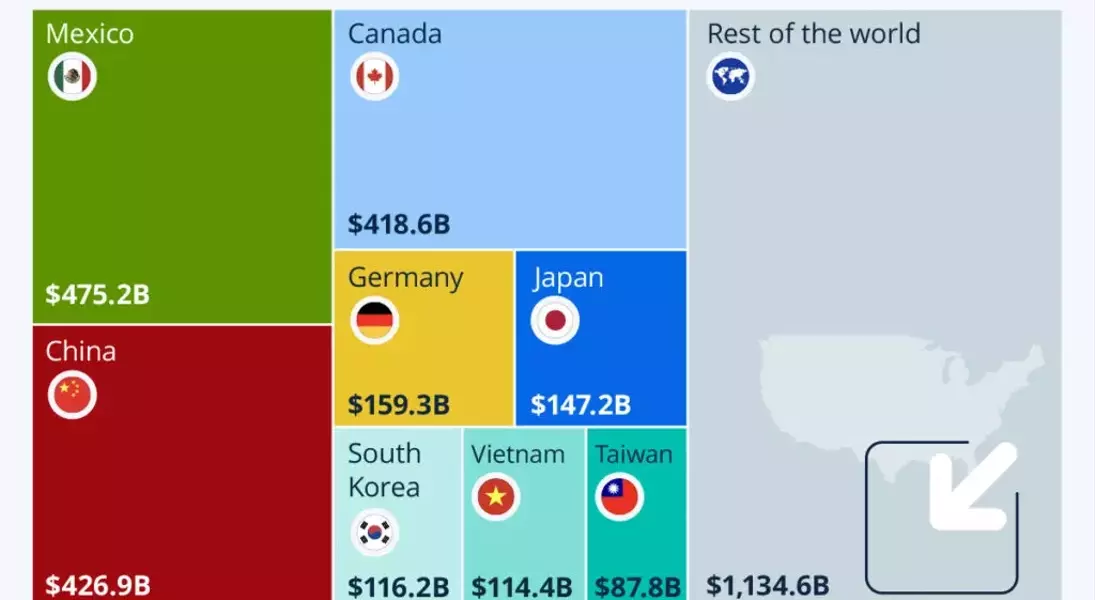

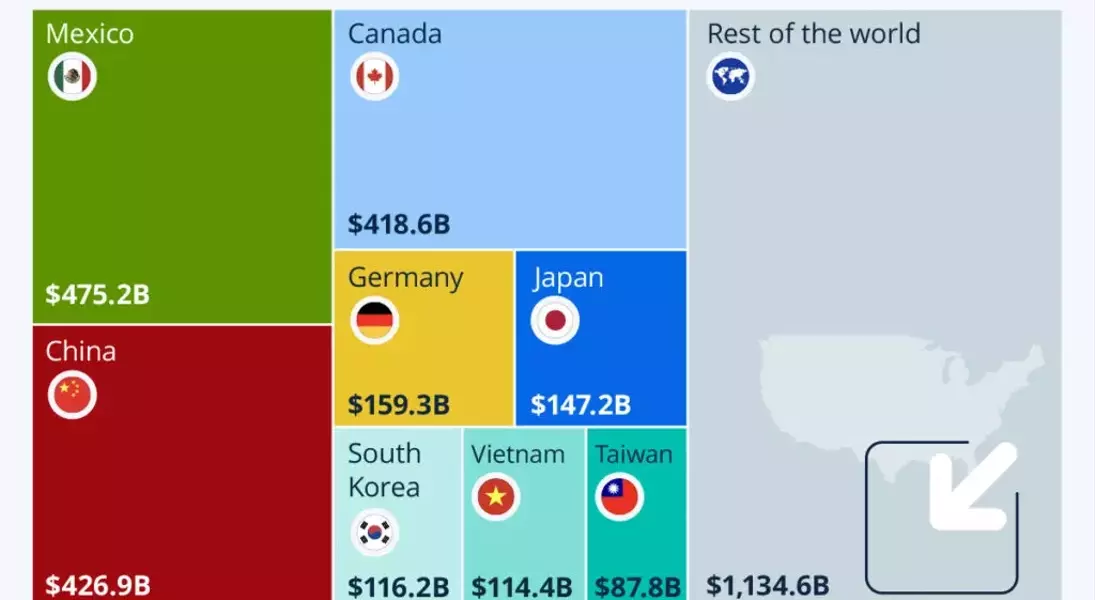

The construction sector is bracing for potential disruptions as the incoming administration contemplates imposing significant tariffs on key suppliers. President-elect Donald Trump has indicated plans to introduce tariffs on goods from Mexico, Canada, and China, which could lead to increased material costs and supply chain challenges. Experts warn that these measures may cause uncertainty in managing materials prices, particularly for industries heavily reliant on imports.

Potential Tariff Impact on Construction Material Costs

Industry analysts predict that the proposed tariffs could significantly affect the cost of construction materials. With the U.S. importing a substantial amount of goods from Mexico, Canada, and China, contractors are concerned about rising prices and supply chain disruptions. Economists suggest that while domestic producers might benefit, the overall industry could face higher material costs, impacting project budgets and timelines.

Tariffs on steel, aluminum, softwood lumber, concrete, glass, and asphalt binder could lead to price hikes. For instance, previous tariffs on steel and aluminum under the Trump administration resulted in domestic producers raising prices and contractors experiencing supply chain issues. The knock-on effects could be damaging to construction firms and reduce demand for construction projects. Additionally, retaliatory tariffs from other countries could further complicate matters, leading to broader economic repercussions.

Strategies for Mitigating Tariff Risks

Contractors and developers are exploring strategies to mitigate the risks associated with potential tariffs. Diversifying supply chains and emphasizing U.S. production could help offset some of the impacts. Some firms are considering purchasing materials ahead of time or waiting for market stabilization before proceeding with projects. Contractual adjustments to allocate tariff liability risk between contractors and clients are also being evaluated.

Experts advise close monitoring of material pricing and policy developments. Raw materials like aluminum and steel are expected to be primary targets for tariffs. Canadian softwood lumber suppliers, who have made recent progress, may face setbacks. Projects further downstream, such as those using steel products from Mexico with inputs from China, could also be affected. Acts like the Infrastructure Investment and Jobs Act may see tighter restrictions favoring domestic suppliers, benefiting local manufacturers. Construction firms must act swiftly to adapt to these changes, as the new administration is poised to implement policies quickly with minimal oversight.