Unlock the Secrets of Trading with SPY, SPX, and ES

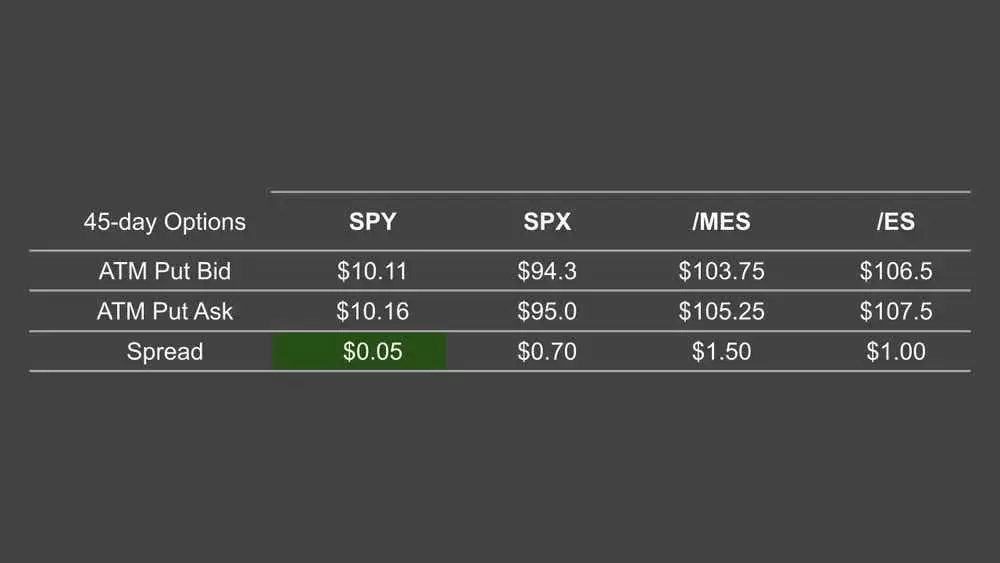

Trading Volume: SPY Takes the Lead

SPY stands out as the clear leader in trading volume. It consistently outperforms the other instruments by a significant margin. Despite being relatively less expensive, SPY holds a higher average daily notional trading value compared to /MES, /ES, and SPX. This high trading volume contributes to tight bid/ask spreads in its options, providing more efficient pricing for retail traders.

For example, over the past 30 days, Nvidia (NVDA), one of the market's most valuable and actively traded stocks, saw a notional value of $42.1 billion exchanged. However, the S&P 500 ETF, SPY, slightly surpassed NVDA with a notional value of $42.8 billion. This shows the popularity and liquidity of SPY in the market.

Tax Benefits: SPX and Futures Take the Advantage

An additional advantage of trading SPX and futures options is the tax benefit. They qualify for special treatment under the Internal Revenue Code, where gains or losses from these contracts can be classified as 60% long-term capital gains and 40% short-term capital gains regardless of the holding period. This provides traders with more flexibility and potential tax savings.

For instance, this unique tax treatment can make a significant difference in the overall profitability of trading these instruments. It allows traders to manage their tax liabilities more effectively and optimize their trading strategies.

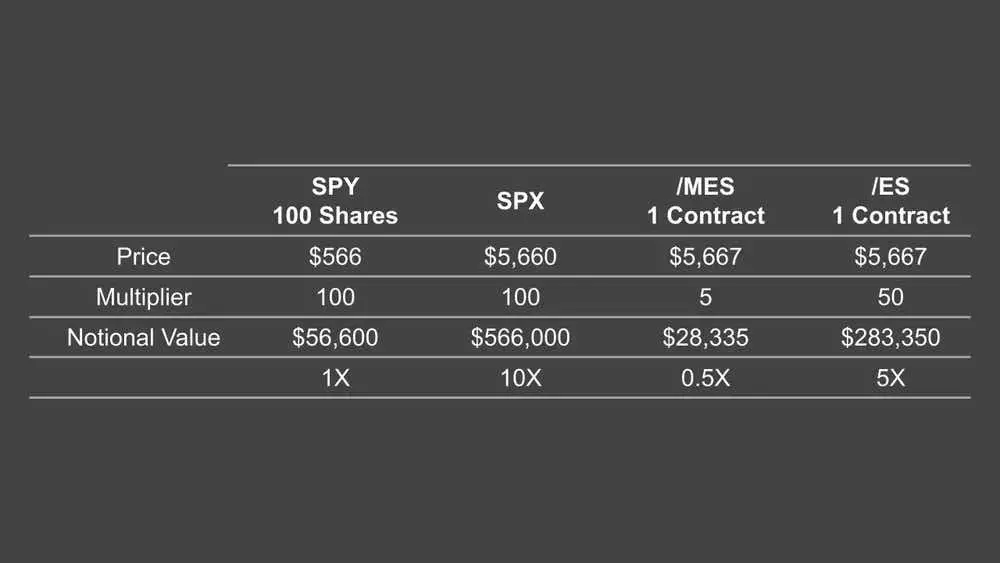

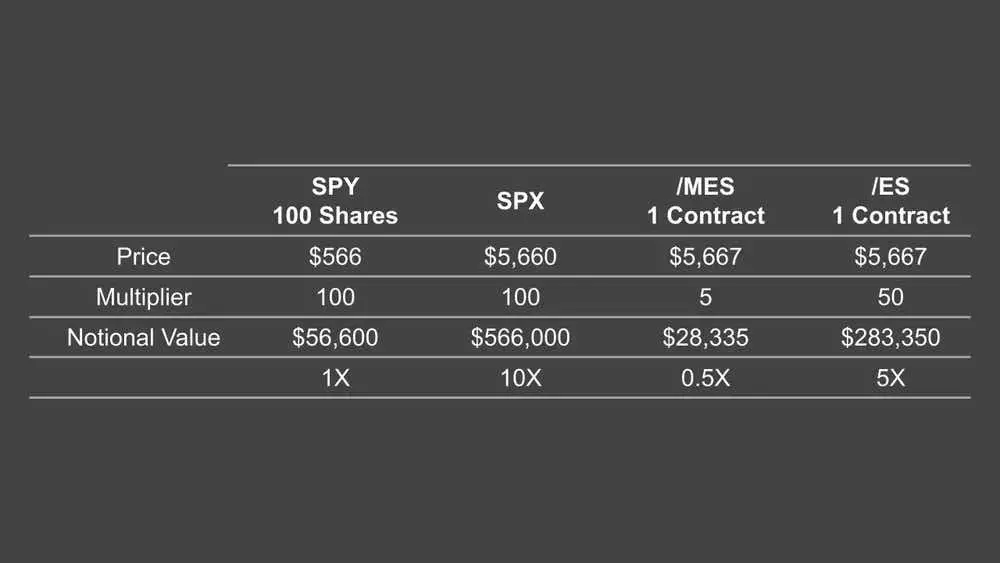

Capital Requirements: SPY vs. SPX and Futures

While trading SPY is relatively more accessible with lower capital requirements, trading SPX requires nearly 10 times more capital or Buying Power Reduction (BPR). However, their credit-to-BPR ratios remain similar because of a common formula used for BPR calculation. Futures products, on the other hand, benefit from a unique ratio and use SPAN margin, leading to a higher potential return on capital (ROC).

For example, this difference in capital requirements can impact the trading strategies of different types of traders. Smaller traders may prefer SPY due to its lower capital requirements, while larger accounts may find SPX and futures more suitable for their trading needs.

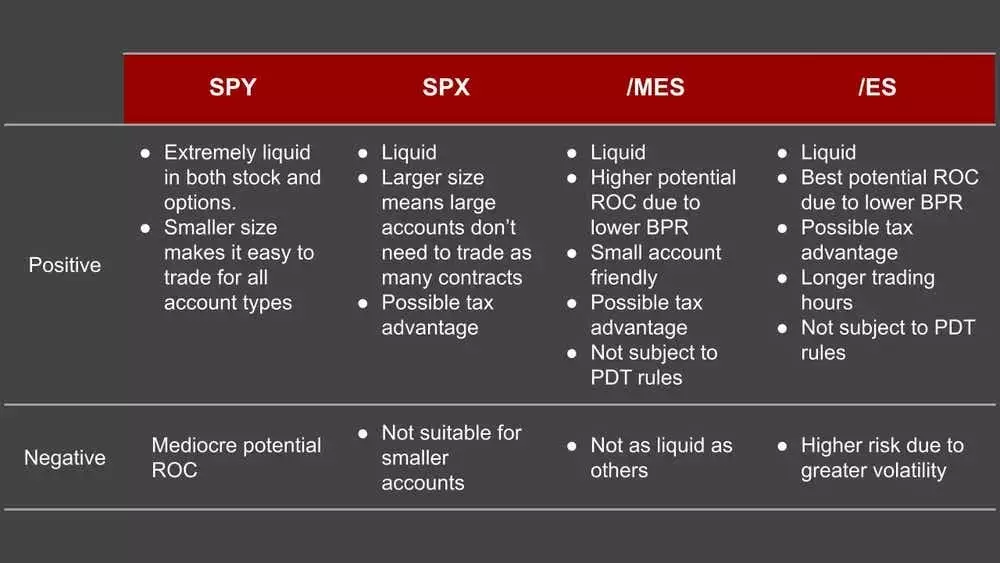

Underlying Assets and Suitability

SPY excels as the most versatile underlying, making it the standout choice overall. It is directly tradable and offers excellent liquidity. SPX and /ES futures are larger products better suited for medium to large accounts, unless options strategies have well-defined wings. Futures products like /ES have a distinct method of calculating BPR, offering greater efficiency with the potential for a higher ROC, though they come with higher volatility.

For instance, different traders have different risk appetites and trading goals. Some may prefer the stability and liquidity of SPY, while others may be willing to take on more risk with larger futures products. Understanding these differences is essential for making informed trading decisions.