Commodities' Ascent: Riding the Wave of Scarcity and Rising Needs

The Economic Pulse: Fueling Commodity Demand

A decade of underinvestment in the raw materials sector, coupled with surging global demand, is creating a compelling narrative for commodity markets. Economic expansion, advancements in artificial intelligence, the global energy transition, and increased defense spending are collectively contributing to a tightening supply-demand balance, setting the stage for elevated prices in the coming year.

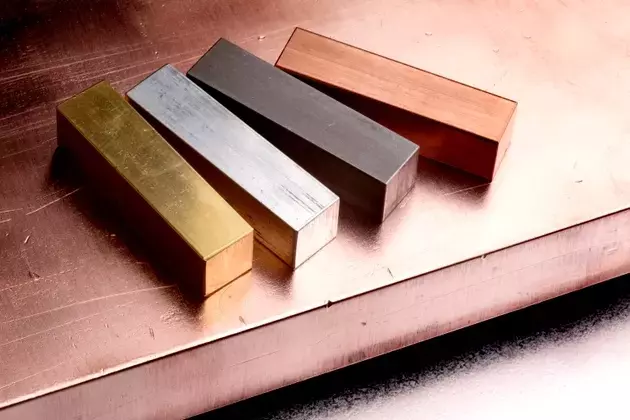

Copper and Gold: A Glimmering Future

Copper, a vital component in modern infrastructure and green technologies, faces a structural deficit. With a scarcity of new mining projects and recent production shortfalls, its price is anticipated to continue its upward trajectory over the next few years. Gold, a traditional safe-haven asset, is also expected to appreciate. However, the path for silver, often a more volatile precious metal, is not as clearly defined.

Oil's Volatile Dance: Supply, Demand, and Geopolitics

The oil market presents a complex picture. While there is a considerable global supply, geopolitical risks introduce significant uncertainty, creating a delicate equilibrium that could lead to price fluctuations. This intricate balance underscores the inherent volatility in energy markets.

Strategic Allocation: Commodities in Your Portfolio

Given the current market landscape, a strategic allocation of 5-10% to commodities can offer several benefits to investors. Such an allocation can enhance portfolio diversification, provide a hedge against inflation, and is projected to deliver superior returns with reduced drawdowns compared to traditional portfolios over the next five to seven years. This suggests that commodities could be a valuable addition to a well-rounded investment strategy.