Charting a New Course: CFTC's Landmark Guidance for Voluntary Carbon Credit Derivatives

The Commodity Futures Trading Commission (CFTC) has taken a significant step in shaping the future of the voluntary carbon credit (VCC) market. Its recently finalized guidance aims to establish quality standards for futures contracts that settle via physical delivery of VCCs, marking a pivotal moment in the regulation of this rapidly evolving sector.Unlocking Transparency and Integrity in the VCC Derivatives Market

Defining the Voluntary Carbon Credit Landscape

The CFTC defines VCCs as "a tradeable intangible instrument that is issued by a carbon crediting program [that] represent[s] a [greenhouse gas] (GHG) emissions reduction to, or removal from, the atmosphere equivalent to one metric ton of carbon dioxide." These VCCs have become the foundation for a growing number of futures contracts listed on CFTC-regulated exchanges, with three actively traded contracts currently in the market.Addressing Concerns and Establishing Standards

The CFTC's Final Guidance is a direct response to the common critiques surrounding the quality and integrity of the voluntary carbon market. By outlining a comprehensive set of factors for CFTC-regulated exchanges to consider, the guidance aims to ensure that only VCC derivatives with robust underlying characteristics are listed on these exchanges.Strengthening the Foundations of VCC Derivatives

The Final Guidance requires exchanges to evaluate the VCC crediting programs based on key attributes, including transparency, additionality, permanence, robust quantification, governance, tracking, and prevention of double-counting. Exchanges must also consider the inspection provisions, including third-party validation and verification, as well as ongoing monitoring of the derivative's terms and conditions.Indirect Regulation: Leveraging Exchange Oversight

The CFTC's authority to directly impose standards on the VCC market is limited, but the Final Guidance represents a strategic approach to indirectly influence the market. By placing the onus on CFTC-regulated exchanges to conduct thorough due diligence on the VCC crediting programs, the CFTC is effectively extending its regulatory reach and driving the voluntary carbon market towards higher standards.Aligning with Broader Regulatory Efforts

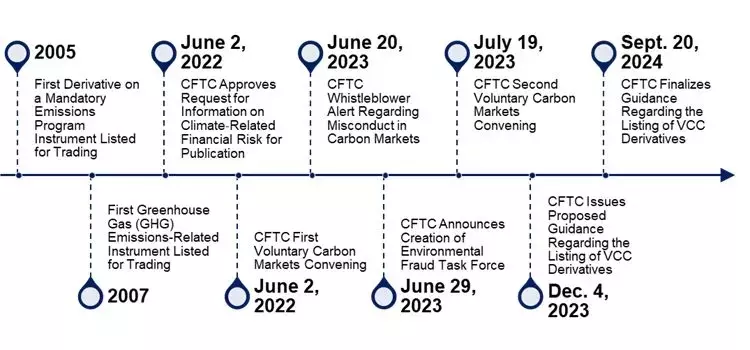

The Final Guidance is part of a broader regulatory push by the CFTC to address concerns in the carbon markets. This includes the agency's previous Whistleblower Alert and the creation of the Environmental Fraud Task Force, which signal a heightened focus on monitoring and enforcing against potential misconduct, such as greenwashing.Prioritizing Quality and Integrity in a Shifting Landscape

The timing of the CFTC's Final Guidance, prior to a potential change in administration, underscores the agency's commitment to establishing robust standards for VCC derivatives. This move aligns with the Biden-Harris administration's principles for high-integrity voluntary carbon markets, indicating a shared goal of fostering a transparent and trustworthy VCC ecosystem.Navigating the Future of VCC Derivatives

The CFTC's Final Guidance represents a significant milestone in the regulation of the VCC derivatives market. By setting clear expectations for exchanges and indirectly shaping the voluntary carbon market, the CFTC is paving the way for a more standardized, transparent, and high-quality VCC ecosystem. As the VCC market continues to evolve, this guidance will serve as a crucial framework for ensuring the integrity and credibility of VCC derivatives.You May Like