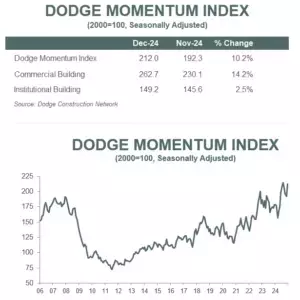

In a significant turn of events, commercial planning experienced a robust resurgence during the final month of 2023. The Dodge Momentum Index (DMI), a key indicator of nonresidential construction activity, witnessed a notable increase of 10.2% in December, reaching 212.0 from the previous month's revised figure of 192.3. This uptick was primarily driven by a substantial rise in data center and warehouse planning, with commercial planning jumping 14.2% and institutional planning seeing a modest improvement of 2.5%. The overall performance of the DMI over the past year is expected to bolster nonresidential construction spending well into 2025.

Details of the Commercial Planning Boom

In the heart of winter, as the calendar turned to December, the commercial sector in Boston saw an unprecedented boost. The re-acceleration of data center and warehouse planning activities played a pivotal role in this growth. According to Sarah Martin, associate director of forecasting at Dodge Construction Network, these sectors were instrumental in driving the recovery. Specifically, the commercial segment surged by 30% compared to the same period last year, while the institutional segment remained stable. Notably, the influence of data centers on the DMI has been particularly significant; excluding these projects, commercial planning would have increased by 8%, and the entire DMI by 5%.

A total of 32 major projects, each valued at $100 million or more, entered the planning phase in December. Among the largest commercial projects were six phases of the $1.6 billion Powerhouse 95 data center in Fredericksburg, Virginia, and four phases of the $1 billion Brambleton Data Center at Tech Park in Ashburn, Virginia. On the institutional side, significant projects included the $226 million OhioHealth Outpatient Cancer Center in Columbus, Ohio, and the $220 million county jail in Peoria, Illinois. These developments underscore the ongoing strength and diversity of the construction market.

The DMI serves as a monthly gauge of the value of nonresidential building projects entering the planning stage, historically leading construction spending by a full year. This forward-looking metric provides valuable insights for industry professionals and investors alike.

From a broader perspective, this surge in commercial planning offers a glimmer of hope for the future of nonresidential construction. It suggests that despite economic uncertainties, there is a strong foundation for sustained growth in the sector. For businesses and communities, this could translate into new opportunities and infrastructure improvements, ultimately fostering economic resilience and development. The momentum observed in December sets a positive tone for the coming year, signaling potential increases in construction activity and investment across various sectors.