Heart disease remains the leading cause of death in the United States, yet a concerning number of those experiencing heart attacks are unaware of their underlying condition. Cleerly, a pioneering cardiovascular imaging startup, is on a mission to address this critical issue. By analyzing CT scans of the heart, their AI software aims to detect early-stage coronary artery disease, similar to how mammograms and colonoscopies detect breast and colon cancer. Cardiologist James Min, who founded Cleerly in 2017, emphasizes that the majority of those who will die from heart disease and heart attacks will never show any symptoms. At some point, he believes, we must begin screening the world for heart disease. Cleerly grew out of a clinical program Min established in 2003 at New York-Presbyterian Hospital/Weill Cornell Medicine.

Proving the Effectiveness of Cleerly's Screen

Cleerly is currently conducting a large, multi-year clinical trial to demonstrate that their screen can identify heart conditions in people without disease symptoms more accurately than other routine non-invasive methods such as measuring blood pressure and cholesterol levels. If successful in obtaining regulatory approval to screen large populations, this could be a game-changer for the company, significantly expanding its market reach and revenue. Such immense potential has attracted substantial investor interest.Clinical Trial and Investor Support

On Wednesday, Cleerly announced the raising of a $106 million Series C extension round led by Insight Partners and joined by Battery Ventures. This comes just over two years after they raised a $223 million Series C round led by T. Rowe Price and Fidelity. An extension round occurs when a company sells additional shares at the previous round's price. While extension rounds are often seen as a sign of slower growth, Scott Barclay, a managing director at Insight Partners, believes Cleerly is growing fast enough. By allowing Insight to participate in a previous round, Cleerly gains additional capital to fund future growth and multi-site clinical trials.Min's Perspective on Capital and Partnership

Min told TechCrunch that although the company didn't necessarily need additional capital as their other backers were healthcare venture capitalists or crossover firms, they were excited to have Insight Partners, one of the largest enterprise software investors, join their cap table. This partnership brings not only financial resources but also expertise and a broader network.Advantages of Cleerly's CT Scan Analysis

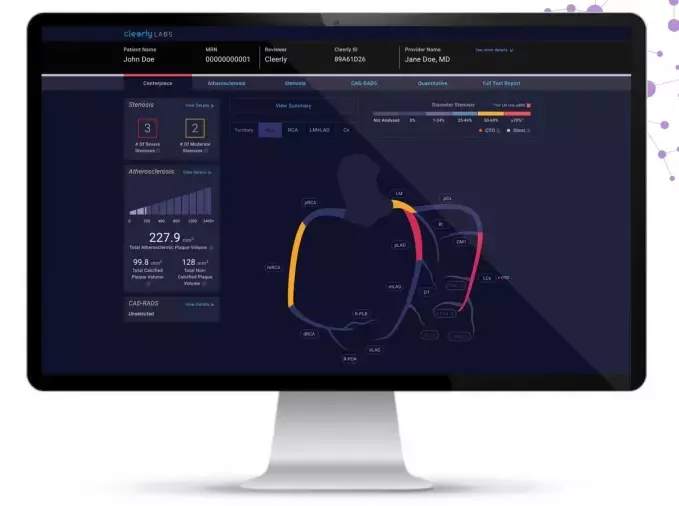

While the company awaits full FDA approval for general heart screening, its algorithms have already been cleared for diagnosing symptomatic patients. In October, Medicare approved coverage for its plaque analysis test, as plaque build-up is a common cause of heart attacks. Cleerly claims that their AI-driven analysis of the CT scan image is less burdensome on the body compared to a stress test or an angiogram. Health insurers and Medicare seem to agree with this claim, as they are willing to cover the test.Commercial Success and Growth Trajectory

The company's software has been commercially available for the past four years, and during this period, Cleerly has achieved a compounded annual growth rate of over 100%. Min added that with most payers now recognizing its diagnostic method for approximately 15 million people who present with heart problems each year, the company is well-positioned to continue its growth trajectory.Competition in the Field

Cleerly isn't alone in the field. Other companies like HeartFlow and Elucid are also working on AI-driven image analysis of heart plaque. However, since they all aim to screen the entire population above a certain age, there is likely room for multiple successful players in this market.You May Like