Clearway Energy (CWEN) is strategically positioned for considerable expansion, with an ambitious target of achieving a 7-8% compound annual growth rate in Cash Available For Distribution (CAFD) by 2030. This positive forecast is underpinned by a significant increase in demand for power, largely driven by the burgeoning artificial intelligence industry, and a notable rise in Power Purchase Agreement (PPA) pricing. The company's future is further secured by a strong pipeline of development projects, including high-yield wind repowering initiatives and strategic asset transfers from its parent organization. The prevailing market conditions, marked by elevated PPA rates and a limited capacity for new power infrastructure development, enhance CWEN's long-term organic growth potential, making it an appealing investment choice, particularly its CWEN.A shares, which are currently trading at a discount.

Clearway Energy's trajectory for expansion since August 2023 has been shaped by three critical developments: a substantial rise in stock value, with CWEN.A shares now trading at a 16.3x CAFD multiple; an pervasive increase in the demand for additional power infrastructure; and a nearly twofold increase in Power Purchase Agreement (PPA) pricing, which positively influences both initial yields and long-term organic growth. These shifts collectively reinforce the belief that Clearway Energy is well-equipped to meet its recently announced ambitious growth targets, thereby justifying the current, higher valuation multiple.

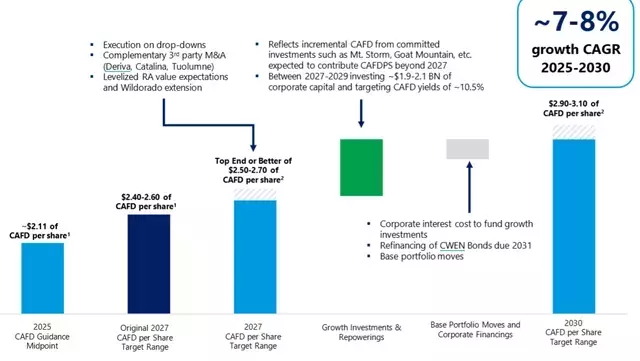

The company's long-term guidance projects a CAFD ranging from $2.90 to $3.10 by 2030, which signifies an impressive 7%-8% compound annual growth rate. Such a rapid pace of growth is uncommon for a yield-co, which typically focuses on stable cash flows to support large, consistent dividends, leaving minimal retained earnings for further investments. However, the unique market environment, characterized by an exceptionally high demand for energy and Clearway Energy's proven expertise in developing large-scale energy assets, enables this accelerated growth. This context necessitates a closer examination of the feasibility of Clearway Energy's growth aspirations and the potential returns for investors if these objectives are met.

The current energy landscape is defined by widespread demand and a limited number of suppliers. For decades, stagnant power demand in the United States led to a decline in new power source development capabilities. Consequently, few entities maintained active development pipelines, and existing construction plans faced delays due to complex regulatory processes. The emergence of artificial intelligence has dramatically altered this trend, creating an urgent need for a rapid increase in energy capacity. Both regulators and power suppliers were largely unprepared for this sudden surge, leaving a significant gap that companies with innovative solutions are now striving to fill. The situation dictates the construction of any viable power source, regardless of type, wherever possible.

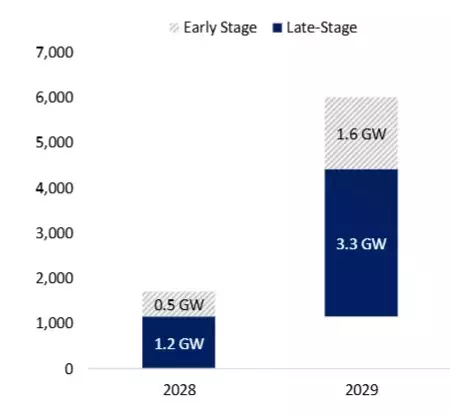

Clearway Energy is uniquely positioned to address this growing energy crisis. The company has consistently maintained a developer-oriented approach, making it particularly well-suited to tackle the increasing energy requirements. Its parent company manages a substantial pipeline of over 11 gigawatts, a significant portion of which is slated to be transferred to Clearway Energy, promising strong CAFD yields. This established pipeline is already delivering results, with several projects recently completed or nearing completion. This initial phase of development is expected to boost CAFD to $2.50-$2.70, a highly visible and largely de-risked increase due to existing contracts and ongoing progress. While projects scheduled for 2028-2030 are in earlier stages, they also exhibit reasonable visibility, targeting CAFD yields of approximately 10.5%.

The current market also sees wind power challenges mitigated by repowering projects. The discontinuation of most green energy tax credits has diminished the financial viability of new wind projects. Additionally, supply chain bottlenecks and the withdrawal of key producers like GE Vernova from the wind sector, due to its low profitability, have made new wind projects less appealing. In contrast, the repowering of existing wind facilities offers a more attractive alternative. This involves refurbishing and upgrading older or defunct wind plants, leveraging existing infrastructure such as transmission assets. By utilizing established infrastructure, repowering projects are both quicker to complete and offer higher returns due to reduced costs. Clearway Energy's repowering initiatives are yielding double-digit returns, specifically 10%-12% CAFD, with 863 megawatts of repowering already secured by Power Purchase Agreements. The heightened demand for power has enabled Clearway Energy to capitalize on its development expertise. Elevated power prices have created sufficiently high yields, rendering these developments substantially accretive beyond Clearway Energy's capital costs. The nuances of PPA pricing warrant further discussion.

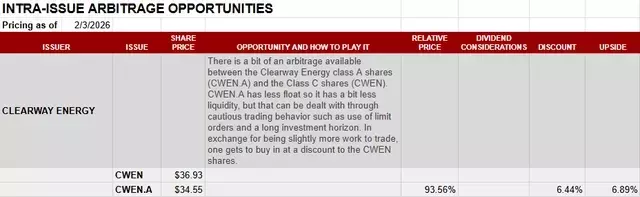

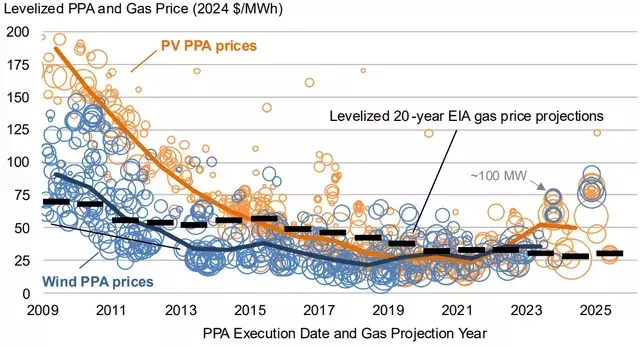

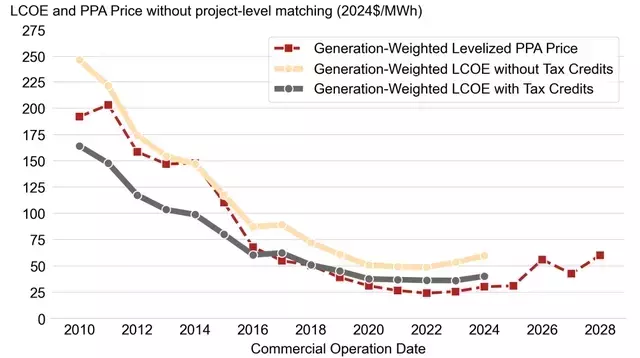

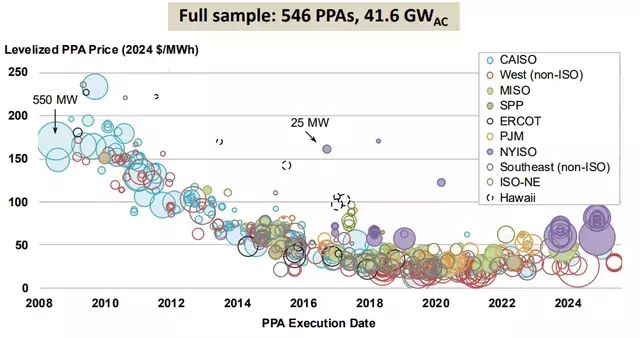

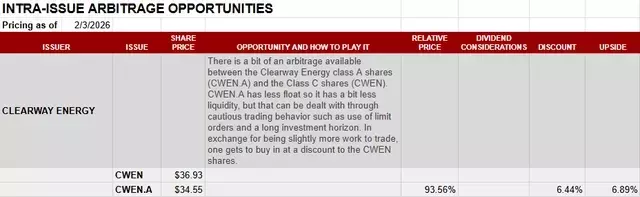

PPA pricing varies considerably by region, although Clearway Energy's nationwide operations tend to balance these fluctuations. Historically, green energy PPA prices declined significantly, with wind PPAs around $80 per MWh and solar PPAs about $175 per MWh in 2009. This decrease was primarily due to technological advancements and substantial tax credits. The tax credits, known upfront, were factored into PPA prices, leading to a bottoming out in 2022. However, since 2022, two critical changes have occurred: most future tax credits have been eliminated, and power demand has increased substantially. These factors have driven PPA prices significantly upward. Data from Berkeley Labs confirms this upswing, showing actual signed PPAs reflecting increased prices in 2024, with projections for 2025-2026 indicating prices around $70/MWh for solar and wind. These higher PPA prices directly enable Clearway Energy to achieve high CAFD yields on its development projects. An often-overlooked secondary impact is the boost to organic growth. Historically, yield-cos struggled with organic growth as expiring PPAs, particularly those signed during high-price periods like 2009, faced significant revenue reductions upon renewal. This led to yield-cos being perceived as finite-life entities. However, with PPA prices now rising, the organic growth outlook is much more favorable. PPAs with a vintage of 2016 or newer now have a strong potential for price increases upon renewal. This positive shift in organic growth means that Clearway Energy's substantial external growth from new construction will translate into long-term bottom-line gains, rather than being offset by unfavorable contract rollovers. This improved organic growth potential, driven by stronger PPA pricing, justifies a higher valuation multiple. Yield-cos like Clearway Energy are no longer constrained by finite lifespans; they can now achieve sustainable, long-term growth. Clearway Energy's ambition to maintain CAFD/share growth at over 5% beyond 2030 now appears entirely plausible. Given this long-term growth potential, a 16x CAFD multiple is not only reasonable but, in my assessment, somewhat conservative. Clearway Energy maintains a dual share class structure, with both CWEN and CWEN.A publicly traded. Currently, CWEN.A trades at a discount exceeding 6% while offering identical dividend and cash flow rights. The lower price of CWEN.A is primarily due to its smaller issue size and reduced liquidity. This can be managed through patient trading and the use of limit orders. We closely monitor such intra-issue arbitrage opportunities, and given the current significant spread, CWEN.A appears to be a more advantageous investment. The price discrepancy between the two share classes is expected to narrow over time.

The robust market conditions, driven by a surge in demand and a scarcity of new power development, position Clearway Energy for sustained and accelerated growth. The company’s strategic focus on high-yield repowering projects and a substantial development pipeline, combined with favorable PPA pricing trends, indicate a strong financial future. This environment transforms the conventional outlook for yield-cos, enabling Clearway Energy to achieve long-term, repeatable growth beyond 2030, justifying its current valuation and offering an attractive investment proposition, particularly through its discounted CWEN.A shares.