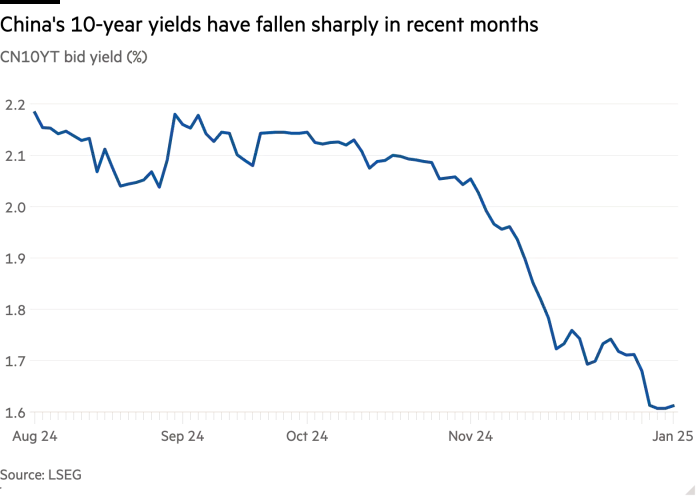

The Chinese bond market is currently exhibiting worrying signs regarding the nation's economic health. The central bank, the People’s Bank of China (PBoC), has been actively addressing deflationary pressures through significant financial measures and stern warnings. Over the past few years, the yield on the country's benchmark 10-year sovereign bonds has dropped sharply from over 2.5% to around 1.6%. This decline has sparked concerns about a prolonged period of deflation and sluggish growth, reminiscent of Japan's economic challenges. The PBoC has repeatedly voiced its apprehensions about regional banks purchasing government bonds, which has driven borrowing costs down. In response, the central bank has taken several actions, including naming and shaming specific banks for manipulating bond prices and ceasing its treasury purchase program after five months. Despite these interventions, analysts believe the risk of a systemic financial event remains low due to the proactive support provided by regulators.

Since early last year, China's benchmark 10-year sovereign bond yields have experienced a notable decline, dropping from more than 2.5% to approximately 1.6%. This decrease has raised alarms among economists and policymakers, who fear a potential "Japanification" scenario where the economy faces long-term deflation and slow growth. The PBoC has expressed deep concern over the trend of regional banks buying up government bonds, which has led to plummeting borrowing costs. In April, the central bank issued a warning that continued purchases could lead to bank runs similar to those seen at Silicon Valley Bank. Later in August, four rural commercial banks were publicly criticized for manipulating sovereign bond prices in the secondary market. These actions were intended as a deterrent to other banks engaging in similar practices. Moreover, insiders close to the PBoC revealed plans to issue billions of dollars in fresh government debt and special bonds, which they feared could burst an existing market bubble.

Earlier this month, the PBoC announced it would indefinitely halt its treasury purchase program after five months of intense activity. During this period, the central bank had bought a net $1 trillion worth of bonds, causing yields to rise slightly. Analysts suggest that the risk of a systemic financial crisis stemming from these bond purchases is minimal. Unlike Silicon Valley Bank, which suffered from holding an unusually large proportion of assets in US Treasury bonds without interest rate hedges, Chinese financial institutions are closely monitored and supported by regulators. May Yan, head of Asia financials at UBS investment bank, noted that authorities would intervene promptly if any signs of instability emerged. Additionally, concerns about a massive bond issuance leading to a spike in yields have been dismissed by some economists. They argue that such a large issuance would only occur in response to high private savings, which would naturally seek stable investments like bonds.

Global investors remain largely unfazed by the PBoC's warnings and continue to hold Chinese government bonds. Marcelo Assalin, head of William Blair Investment Management’s emerging markets debt team, highlighted that Chinese bonds were standout performers in local emerging markets in 2024, with falling yields rewarding investors despite global trends. Mark Evans, an emerging markets fixed income portfolio manager at Ninety One, also maintains an overweight position in Chinese bonds, citing attractive real rates. However, investors do not anticipate yields declining to 0%, as seen in Japan, given expectations of more aggressive and effective government stimulus measures in 2025. This approach aims to stabilize yields and mitigate deflationary risks, ensuring the bond market remains a viable investment option.