Cherry, a prominent name in keyboard manufacturing, is currently undergoing a period of significant financial strain and strategic re-evaluation. The company has publicly disclosed a substantial net loss amounting to $23 million (equivalent to 20.4 million euros) for the period between January and September 2025. This downturn comes despite a turnover of nearly $82 million (70.7 million euros), indicating a precarious financial position where liabilities outweigh assets. In response, Cherry is actively exploring various strategic options, including the potential divestiture of its Peripherals division, which includes its range of keyboards and mice, or its Digital Health & Solutions division. Adding to these operational shifts, Cherry has announced plans to relocate its mechanical switch manufacturing from Auerbach, Germany, to facilities in China and Slovakia, re-purposing the German site as a dedicated service center. These bold moves are a direct consequence of an increasingly competitive market landscape and the evolving dynamics of the post-pandemic gaming peripheral industry.

Cherry Navigates Financial Turbulences and Operational Transformations

In a candid announcement, Cherry Corporation revealed its ongoing financial struggles, marked by a net loss of $23 million during the first three quarters of 2025. This financial setback, paired with a turnover of approximately $82 million, has placed the company in a challenging position, prompting a comprehensive review of its operational structure and market strategy. Jurjen Jongma, Cherry's Chief Financial Officer, emphasized the necessity of exploring strategic mergers and acquisitions due to the company's low market capitalization and a share price that has dipped below one euro, making other equity-strengthening methods unfeasible.

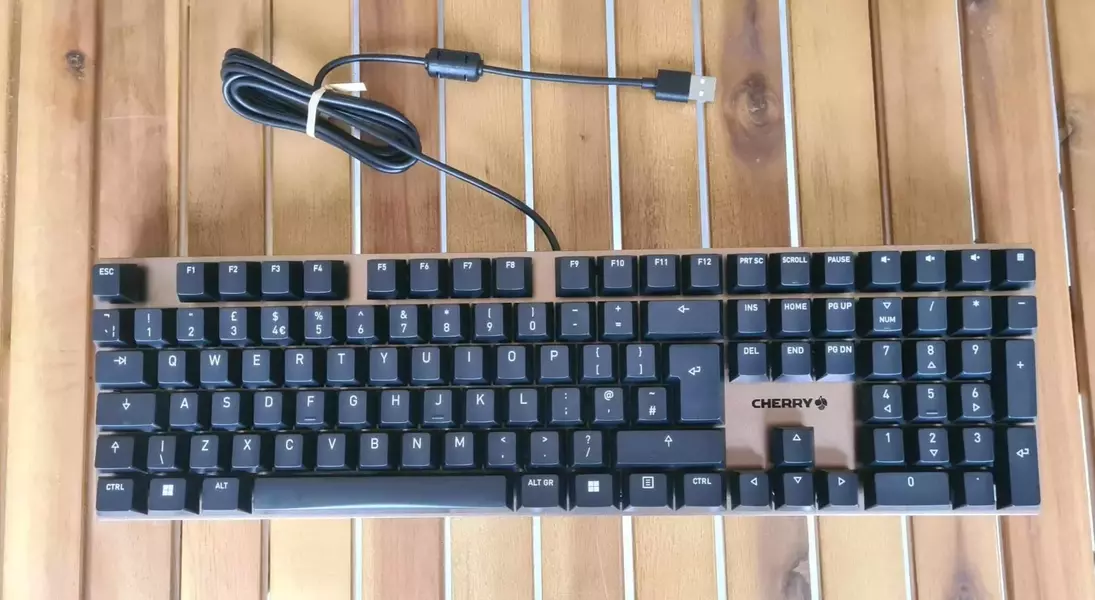

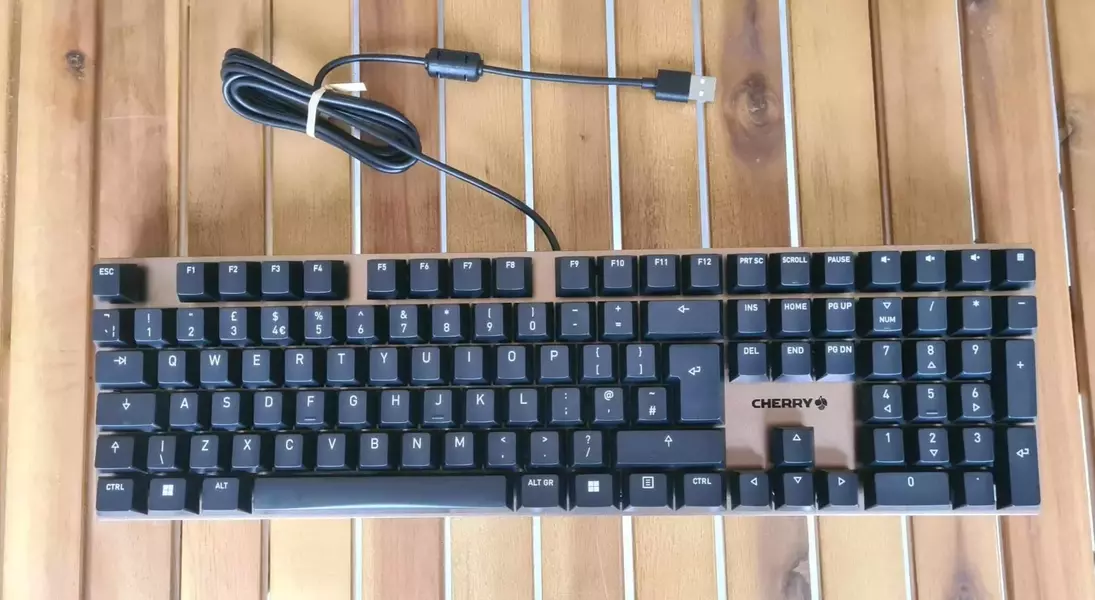

A critical aspect of Cherry's strategic overhaul involves its Peripherals division. This segment, encompassing both gaming and office input devices, faces an uncertain future. The company is considering either selling this division entirely or divesting its Digital Health & Solutions segment. Notably, this comes after Cherry's 2022 acquisition of gaming peripheral company Xtrfy, an investment that now appears to be part of the potential sale. Should the Peripherals division be sold, the future identity and offerings of its keyboard line remain a topic of speculation, though continued production under new ownership is anticipated.

Furthermore, Cherry is undertaking significant changes within its Components division, which oversees the production of its highly acclaimed mechanical switches. While this division is not slated for sale, it faces its own set of challenges. Udo Streller, Cherry's Chief Operating Officer, confirmed the closure of the switch production facility in Auerbach, Germany. Manufacturing operations will now be outsourced to specialized plants in China and Slovakia, with the Auerbach site transitioning into a dedicated service and competence center for the company. This decision is partly attributed to the expiration of Cherry's patent on its iconic MX switch design in 2014, which opened the door for increased competition and innovation from other manufacturers, including the integration of factory-lubricated switches and the emergence of advanced Hall effect technology.

The confluence of intense market competition, the expiration of key patents, and a perceived slow response to emerging technologies like Hall effect switches in the post-pandemic era has exerted considerable pressure on Cherry. The company's future trajectory, particularly concerning its product lines and market positioning, remains fluid as it adapts to these multifaceted challenges through strategic divestments and operational realignments.

This restructuring period for Cherry highlights the relentless pace of innovation and competition within the technology sector. It serves as a potent reminder that even established leaders must continuously adapt to shifting market dynamics, patent expirations, and consumer preferences. The decision to outsource production and potentially divest key divisions, while difficult, demonstrates a pragmatic approach to ensuring long-term viability. For consumers, the outcome could bring new iterations of beloved products or entirely new offerings from different entities. Ultimately, Cherry's journey underscores the critical importance of agility and foresight in navigating the complexities of a rapidly evolving global market.