Unlock Instant Funds: Your Guide to Cash App Compatible Advances

Understanding the Challenge of Cash App Compatibility for Advance Services

Many individuals seeking rapid financial assistance often encounter difficulties when trying to integrate cash advance applications with their Cash App accounts. A significant hurdle arises because numerous cash borrowing platforms rely on Plaid for financial verification and linking, a service that currently does not support Cash App. This incompatibility can lead to frustration for users needing quick access to their funds.

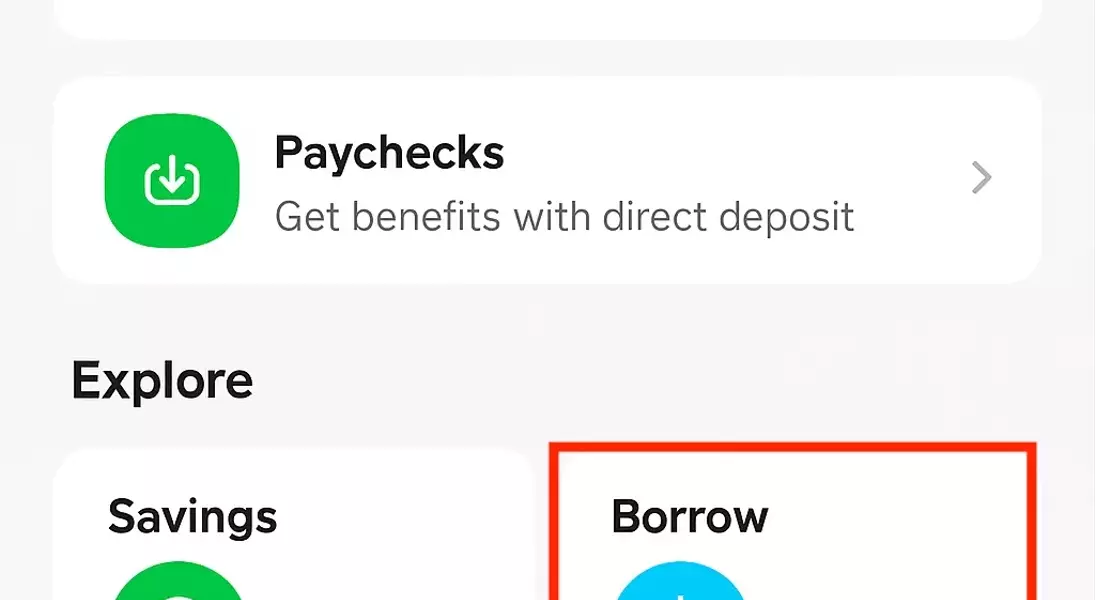

Cash App's Own Borrowing Solution: Cash App Borrow

Cash App features its proprietary advance option, known as Cash App Borrow. While this service is still under development, it offers eligible users a way to borrow between $20 and $400, subject to a 5% flat fee. This feature provides a direct path to accessing funds, but its availability and exact eligibility criteria remain limited as it undergoes a testing phase. Users who qualify will typically find this option within their banking interface on the app.

EarnIn Cash Out: Accessing Earned Wages Directly

EarnIn Cash Out stands out by allowing users to access portions of their earned wages before their regular payday. Initially, users can withdraw between $50 and $250 per pay cycle, with the potential to increase this limit to $750 over time. Standard transfers incur no fees and process within one to two business days. For expedited access, a fee of $3.99 to $5.99 enables funds to be received within minutes.

MoneyLion Instacash: Flexible Advances with Membership Perks

MoneyLion Instacash facilitates advances of up to $1,000, with higher limits generally available to those holding a RoarMoney banking account. This service charges no fees for advance requests, with standard transfers taking one to two business days for RoarMoney account holders and two to five business days for external accounts. A Turbo delivery option is available for those needing immediate access, with fees ranging from $0.49 to $8.99 based on the advance amount and transfer type.

Albert: Diverse Financial Offerings with Instant Advance Options

Albert offers a suite of financial tools, including Instant Advances. While a monthly membership fee may apply to certain services, users can access Instant Advances without an additional monthly charge. Borrowed amounts are typically due within six days. To avoid transfer fees and access higher advance limits, opening an Albert Cash account is recommended. Eligibility usually requires an active bank account with a substantial transaction history linked to Albert.

Possible Finance: Advances with Membership or Single Payment Options

Possible Finance allows users to obtain advances up to $300. Non-members typically qualify for up to $150. The Possible Membership, which includes benefits like fee-free instant delivery and flexible repayment schedules over four installments, is available in specific states. A Single Payment Advance option, which does not require membership, is also being piloted in a few states, with repayment due on the next payday. Non-members face a 10% disbursement fee for express delivery.

Cash Advance Applications Incompatible with Plaid

It is important for Cash App users to be aware that several popular cash advance applications do not support direct integration with Cash App due to their reliance on Plaid for account verification. These include Dave, Brigit, Klover, Chime SpotMe (which exclusively works with Chime checking accounts), and Current. Users whose primary banking is through Cash App should avoid these services if direct linking is their preference.

Effective Strategies for Linking Cash Advance Apps to Cash App

Connecting a cash advance application to Cash App can be accomplished through various methods. Direct linking, if supported by the app, offers the most straightforward integration. Alternatively, many apps permit linking via a Cash App debit card by inputting the card's details. Manual linking is another viable option, utilizing Cash App's provided account and routing numbers. An indirect approach involves depositing funds into a traditional bank account linked to Cash App, then transferring them to Cash App, though this method may introduce delays.

Selecting the Optimal Cash Advance App for Your Needs

When choosing a cash advance app compatible with Cash App, several factors should be considered. Users should assess the app's linking methods (direct, debit card, or manual), the maximum advance amount available, and the fee structure, including interest rates and membership costs. Delivery speed is also crucial; some apps offer expedited transfers for a fee, while standard transfers may take several days. Additionally, evaluating any supplementary features such as credit building tools, budgeting assistance, or flexible repayment options can enhance the overall value. It is advisable to use cash advance services sparingly, reserving them for genuine emergencies to prevent falling into a cycle of debt.

Troubleshooting Common Issues with Cash App and Advance Services

Users frequently encounter challenges when attempting to link cash advance apps with Cash App. If an app fails to link, consider trying to connect using your Cash App debit card details or manually inputting your Cash App account and routing numbers. The incompatibility between Plaid and Cash App is a known issue, often circumvented by these alternative linking methods. Should a transfer to Cash App fail, ensure all account details are correctly entered, and if the problem persists, contact the support teams for both the cash advance app and Cash App. For those without a traditional bank account, utilizing the Cash App debit card for linking is often a solution if the advance app supports it. New users might experience lower initial advance limits, which typically increase over time or with certain memberships, as a history of use is established.