Unprecedented Events Impact Canada's Stock Market

Finance Minister's Resignation and Its Implications

The resignation of Finance Minister Chrystia Freeland came as a surprise to many. Her role in shaping the country's fiscal policies was crucial, and her departure has created uncertainty in the financial sector. The mid-term budget, which was scheduled to be announced shortly after her resignation, now faces an uncertain future. This has led to a lack of clarity regarding the government's economic plans and has likely contributed to the decline in the stock market. Investors are closely watching how the situation will unfold and what impact it will have on their portfolios.Freeland's resignation also raises questions about the stability of the government. Her departure at such a critical time may lead to internal power struggles and delays in decision-making. This could have a negative impact on the implementation of important economic reforms and policies. Market participants are concerned that the lack of leadership and coordination may lead to further volatility in the stock market.

Impact of Fed Rate Decision on Canadian Stocks

The Federal Reserve's rate decision is one of the most closely watched events in the global financial markets. A rate hike or a cut can have a significant impact on stock prices, as it affects borrowing costs and investor sentiment. In Canada, where the economy is closely tied to the United States, the Fed's decision is particularly important. Investors are eagerly awaiting the Fed's announcement to get a better understanding of the future direction of interest rates and how it will affect their investments.If the Fed decides to raise interest rates, it could lead to a decrease in stock prices as borrowing costs increase. This could have a negative impact on companies' earnings and valuations. On the other hand, if the Fed decides to cut rates, it could provide a boost to the stock market as investors become more optimistic about the economy. However, the exact impact of the Fed's decision is difficult to predict, as it depends on a variety of factors such as economic growth, inflation, and global market conditions.

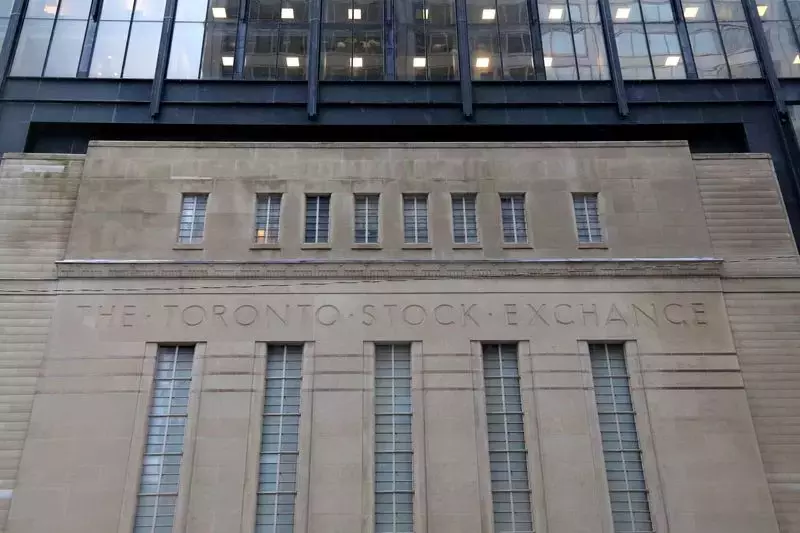

Analysis of Toronto Stock Exchange's Performance

The Toronto Stock Exchange's S&P/TSX composite index is a key barometer of the Canadian stock market. Its performance on Monday reflects the overall sentiment of investors and the economic conditions in the country. The 0.3% decline in the index is a sign of caution among market participants, who are waiting to see how the various events will unfold.Despite the decline, the Toronto Stock Exchange remains an important investment destination for both domestic and international investors. The Canadian economy has shown resilience in the face of global economic challenges, and the stock market has generally performed well in recent years. However, the recent events have highlighted the importance of having a stable and competent government to ensure the long-term growth and stability of the economy.