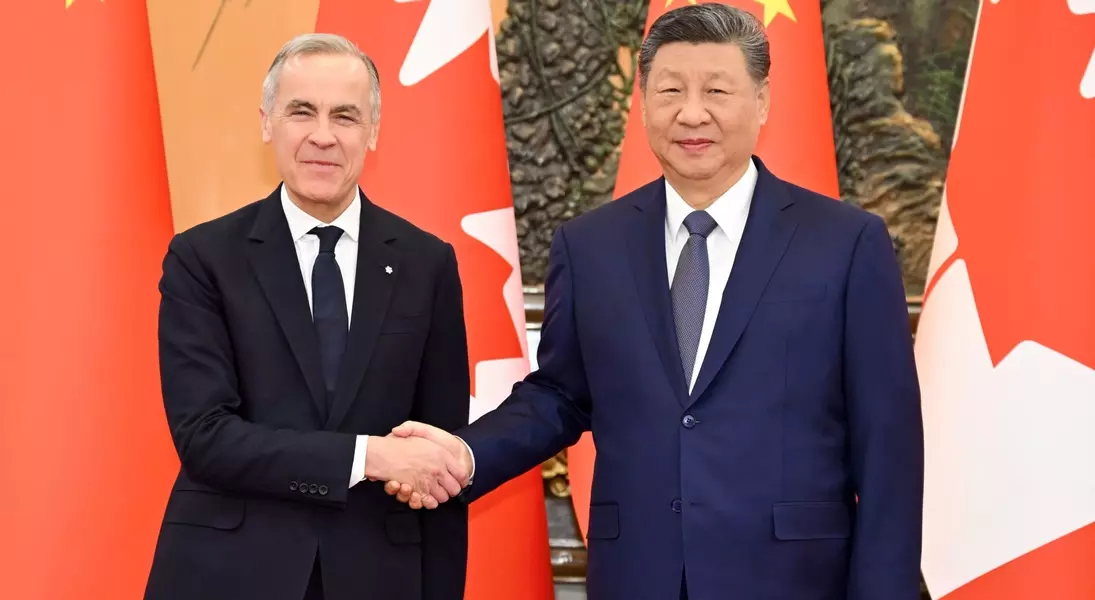

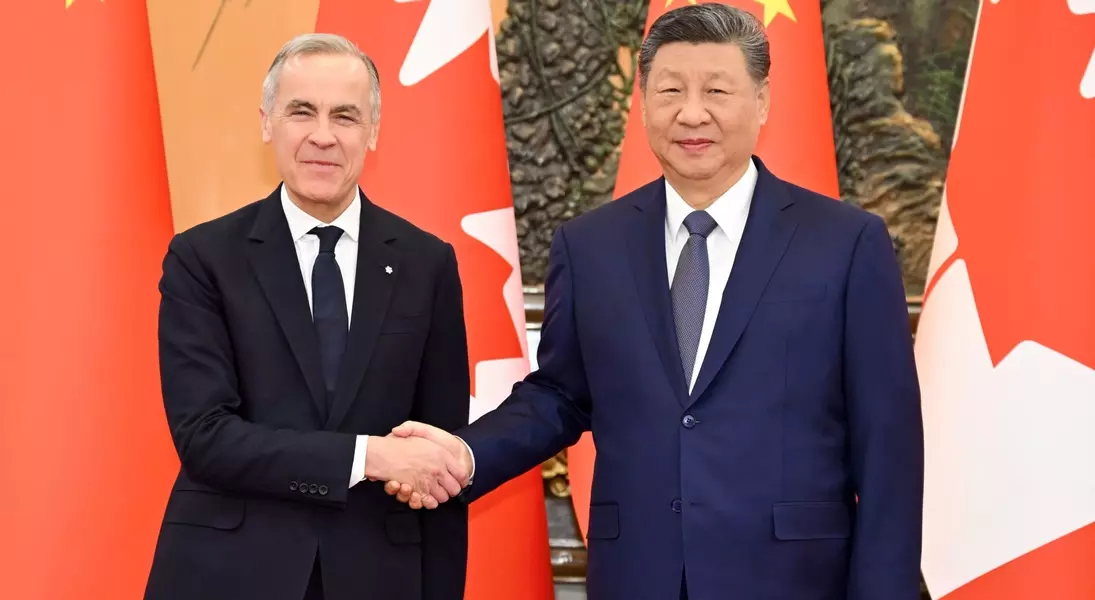

A new economic alliance has been forged between Canada and China, ushering in a significant recalibration of trade policies. Canadian Prime Minister Mark Carney, during a state visit to Beijing, unveiled a strategic partnership that dramatically reduces tariffs on Chinese electric vehicles entering Canada and, reciprocally, on Canadian canola products shipped to China. This bilateral agreement, announced on January 16, 2026, aims to revitalize trade in these key sectors, potentially creating new economic opportunities while also drawing scrutiny and debate among Canadian political leaders regarding its long-term implications for domestic industries and national security.

Under the terms of this new pact, Canada will permit the import of up to 49,000 Chinese-made electric vehicles annually, applying a significantly lower 'most-favored-nation tariff rate' of 6.1%. This represents a sharp decline from the previous 100% tariff that had been in place since 2024, a measure initially implemented at the behest of the United States. In exchange, China has agreed to substantially reduce its tariffs on Canadian canola seed, lowering it from nearly 85% to approximately 15%, and completely eliminating the 100% tariff on Canadian canola meal. This move is expected to provide substantial relief to Canadian farmers, as the canola industry is a major contributor to the nation's economy, generating an estimated C$43.7 billion (approximately US$31.38 billion) in economic activity each year. The Prime Minister's office projects that this influx of Chinese EVs will account for less than 3% of the Canadian new vehicle market, with a focus on more affordable models priced under C$35,000, offering consumers more budget-friendly electric vehicle options.

Despite the potential economic benefits, the agreement has not been universally embraced within Canada. While Saskatchewan Premier Scott Moe lauded the deal as a positive development for both Canada and his province, a significant canola-producing region, other prominent figures have expressed reservations. Ontario Premier Doug Ford, whose province is a hub for major automotive manufacturers like Ford, General Motors, Stellantis, Honda, and Toyota, voiced strong criticism. Ford argued that the Prime Minister should have engaged in consultations with domestic automakers before finalizing such a far-reaching agreement. He suggested that allowing Chinese EVs with lower tariffs than those imposed by Canada's largest trading partner, the U.S., could adversely affect Canadian auto manufacturers and their extensive supply chains. Furthermore, Ford raised concerns about national security, questioning the data privacy and cybersecurity implications of Chinese vehicle technology and their potential integration with Canadian digital infrastructure.

The current landscape of the global electric vehicle market underscores the timing of this agreement. Recent sales figures from 2025 indicated that Chinese manufacturer BYD surpassed Tesla as the world's leading EV seller, demonstrating the growing competitiveness and global reach of Chinese automotive companies. BYD's success, particularly with its low-priced Seagull model, highlights the segment of the market that Canada's new policy aims to tap into. This strategic partnership with China also aligns with a broader trend, as the European Union recently reached a similar understanding with China to adjust tariffs on imported electric vehicles, signaling a shifting global trade dynamic in the rapidly evolving EV sector. The impact of this Canadian policy on the North American auto industry and the potential for Chinese EV manufacturers to establish a production presence in Canada will be closely monitored.